United States Credentialing Software and Services In Healthcare Market Size, Share, And COVID-19 Impact Analysis, By Component (Software, Services), By Functionality (Functionality Credentialing Enrollment and Provider Information Management), By End-Use (Hospitals and Clinics, Healthcare Payers, and Other), and United States Credentialing Software and Services In Healthcare Market Insights, Industry Trend, Forecasts To 2035

Industry: HealthcareUnited States Credentialing Software and Services in Healthcare Market Insights Forecasts to 2035

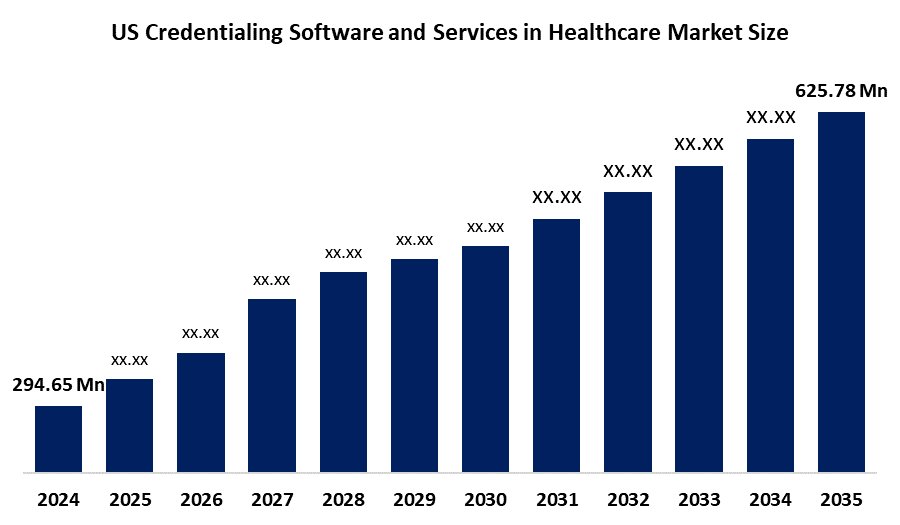

- The United States Credentialing Software and Services in Healthcare Market Size Was Estimated at USD 294.65 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.09% from 2025 to 2035

- The United States Credentialing Software and Services in The Healthcare Market Size is Expected to Reach USD 625.78 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Credentialing Software and Services in Healthcare Market Size is anticipated to reach USD 625.78 Million by 2035, growing at a CAGR of 7.09% from 2025 to 2035. The United States credentialing software and services in healthcare market are being driven by a growing demand for efficient, automated verification of healthcare provider qualifications to ensure regulatory compliance and patient safety.

Market Overview

Credentialing software and services in healthcare refer to digital platforms and managed solutions designed to verify, manage, and maintain the professional qualifications, licenses, certifications, and background information of healthcare providers. The process ensures that physicians, nurses, and allied health professionals meet regulatory, organizational, and payer requirements before delivering care or participating in insurance networks. These solutions streamline what has traditionally been a labor-intensive process, minimizing compliance risks and improving operational efficiency for hospitals, clinics, insurers, and medical groups. In today’s healthcare environment, credentialing plays a critical role in safeguarding patient safety, meeting accreditation standards, and enabling smooth provider-payer relationships. Credentialing software automates tasks such as primary source verification, license monitoring, and document management, reducing errors and administrative burden. Service providers often complement these platforms with dedicated expertise in regulatory compliance, ensuring that healthcare organizations remain aligned with standards set by bodies such as The Joint Commission (TJC), NCQA, CMS, and state medical boards. Overall, credentialing software and services in healthcare have become indispensable in modern healthcare administration. They not only reduce risks of penalties, malpractice claims, or payer denials but also enhance transparency and trust within the healthcare ecosystem.

Report Coverage

This research report categorizes the United States credentialing software and services in healthcare market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States credentialing software and services in healthcare market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States credentialing software and services in healthcare market.

United States Credentialing Software and Services in Healthcare Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 294.65 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.09% |

| 2035 Value Projection: | USD 625.78 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Component, By Functionality and By End-Use |

| Companies covered:: | symplr, HealthStream, Inc., Simplify Healthcare Technology, Global Healthcare Exchange, LLC., Bizmatics, Inc. (Constellation Software Inc.), Naviant, OSP Labs, Wybtrak, Inc., Applied Statistics & Management, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

The United States credentialing software and services market includes rising regulatory compliance requirements, increasing complexity of healthcare networks, and demand for faster provider onboarding. Growth of telehealth and value-based care models further accelerates adoption. Additionally, automation, AI integration, and cloud-based platforms enhance efficiency, reduce errors, and improve payer-provider alignment, fueling market expansion.

Restraining Factor

The United States credentialing software and services market faces restraints due to high implementation costs, integration challenges with legacy systems, and data security concerns. Resistance to digital transformation and complex regulatory variations across states further hinder seamless adoption and scalability.

Market Segmentation

The United States credentialing software and services in healthcare market share is classified into component, functionality, and end-use.

- The software segment held the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period

The United States credentialing software and services in healthcare market are segmented by component into software and services. Among these, the software segment held the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is due to its healthcare credentialing software enables healthcare organizations and insurance companies to effectively store and manage the records of healthcare providers while ensuring that they possess the required certifications and licenses to practice. Deploying credentialing software solutions accelerates the provider enrollment process and improves its precision.

- The credentialing and enrollment segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United States credentialing software and services in healthcare market are segmented by functionality into credentialing and enrollment, and provider information management. Among these, the credentialing and enrollment segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. Credentialing and enrollment function as a substantial checks and balances system that effectively ensures the maintenance of high quality and standards in the Healthcare system. In addition, it offers advantages, such as helping reduce medical blunders and malpractice, facilitating insurance reimbursements, assisting in retaining staffing levels, and more.

- The hospitals and clinics segment held the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The United States credentialing software and services in healthcare market are segmented by end-use into hospitals and clinics, healthcare payers, and others. Among these, the hospitals and clinics segment held the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. he credentialing process is mandatory for all physicians who intend to provide patient care within a hospital setting, regardless of whether they are employed or working as independent practitioners. The automated process helps hospitals with quick billing & reimbursement, compliance, quality of care, productivity & efficiency, and payment & reimbursement.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States credentialing software and services in healthcare market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- symplr

- HealthStream, Inc.

- Simplify Healthcare Technology

- Global Healthcare Exchange, LLC.

- Bizmatics, Inc. (Constellation Software Inc.)

- Naviant

- OSP Labs

- Wybtrak, Inc.

- Applied Statistics & Management, Inc.

- Others

Recent Development

- In March 2025, DISA Global Solutions partnered with Symplr to deliver an integrated, automated solution for workforce compliance, credentialing, and background screening. This collaboration aims to enhance operational efficiency and risk management for organizations in highly regulated industries by combining DISA’s compliance services with Symplr’s healthcare operations technology.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Credentialing Software and Services in Healthcare market based on the following segments:

United States Credentialing Software and Services in The Healthcare Market, By Process

- Software

- Services

United States Credentialing Software and Services in The Healthcare Market, By Functionality

- Credentialing and Enrollment

- Provider Information Management

United States Credentialing Software and Services in The Healthcare Market, By End-Use

- Hospitals And Clinics

- Healthcare Payers

- Others

Frequently Asked Questions (FAQ)

-

Q: What is credentialing software and services in healthcare?A: Credentialing software and services are digital platforms and managed solutions that verify, manage, and maintain healthcare providers’ qualifications, licenses, and certifications to ensure compliance, patient safety, and streamlined provider-payer relationships.

-

Q: What was the size of the U.S. credentialing software and services in the healthcare market in 2024?A: The market size was estimated at USD 294.65 million in 2024.

-

Q: What is the forecasted growth rate of the market?A: The market is expected to grow at a CAGR of 7.09% between 2025 and 2035.

-

Q: What will be the market size by 2035?A: The market is projected to reach USD 625.78 million by 2035.

-

Q: What are the key driving factors for market growth in the U.S.?A: Drivers include rising regulatory compliance requirements, growing healthcare network complexity, demand for faster provider onboarding, expansion of telehealth, and adoption of AI- and cloud-based credentialing solutions.

-

Q: What are the major restraining factors?A: High implementation costs, integration challenges with legacy systems, data security concerns, resistance to digital transformation, and varying state-level regulations act as restraints.

-

Q: Which component segment held the largest market share in 2024?A: The software segment dominated in 2024, driven by demand for automated credentialing and efficient provider record management.

-

Q: Which functionality segment leads the U.S. market?A: The credentialing and enrollment segment dominated in 2024, ensuring compliance, reducing medical errors, and supporting insurance reimbursements.

-

Q: Who are the key players in the U.S. credentialing software and services market?A: Major players include symplr, HealthStream, Simplify Healthcare Technology, Global Healthcare Exchange, Bizmatics, Naviant, OSP Labs, Wybtrak, and Applied Statistics & Management.

-

Q: What is the forecast for the United States credentialing software and services in healthcare market?A: The U.S. market is projected to grow from USD 294.65 million in 2024 to USD 625.78 million by 2035, at a CAGR of 7.09% during 2025–2035.

Need help to buy this report?