United States Cold Storage Market Size, Share, By Service (Refrigerated Warehouse, Private & Semi-Private, Public, And Cold Room), By Equipment (Blast Freezer, Walk-In Cooler & Freezer, Deep Freezer, And Others), By Temperature (Chilled, Frozen, And Deep-Frozen), By Application (Food & Beverages, Pharmaceuticals, And Others), And United States Cold Storage Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Cold Storage Market Size Insights Forecasts to 2035

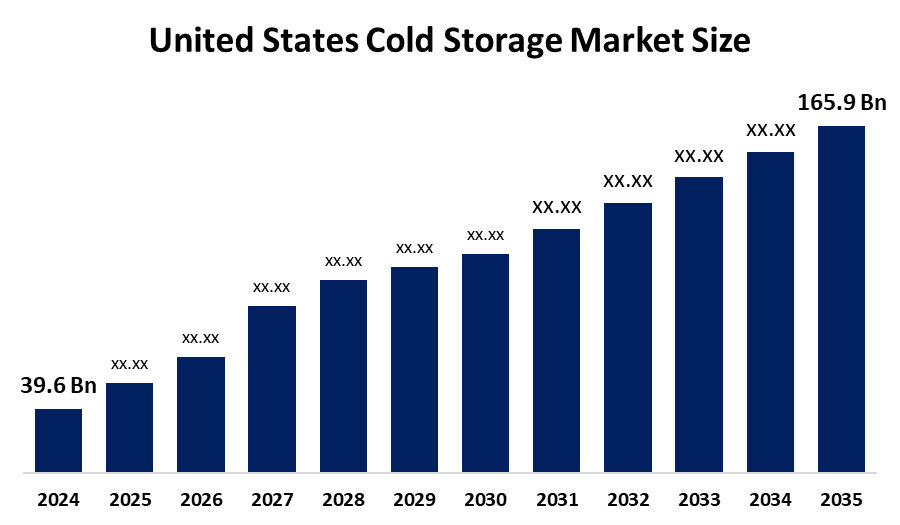

- United States Cold Storage Market Size 2024: USD 39.6 Bn

- United States Cold Storage Market Size 2035: USD 165.9 Bn

- United States Cold Storage Market Size CAGR: 13.91%

- United States Cold Storage Market Size Segments: Service, Equipment, Temperature, and Application

Get more details on this report -

The U.S. cold storage market consists of a collection of temperature-controlled warehouses and associated logistics services that keep different products frozen or refrigerated until reaching consumers. Cold storage facilities store and distribute frozen foods, chilled food, and temperature-sensitive pharmaceuticals and other products. Cold storage warehouses, blast freezers, and other types of cold chain logistics networks play an important role in making it possible for many different types of products to be safe from spoilage due to inadequate thermal regulation or a lack of timely delivery. Growth in consumer demand for frozen and chilled food products, rapidly changing lifestyles that require the convenience of healthy eating options as well as an expanding number of e-commerce companies and consumers utilizing online shopping to fulfil grocery needs is driving growth in the U.S. cold storage market.

The cold storage in United States are backed by government support, including the United States Department of Agriculture, collects data on cold storage facilities, storage capacity, agricultural products, and regulates the standards of general refrigeration and other refrigeration technologies used in support of U.S. agriculture. The USDA report shows an estimate of 3.70 billion cubic feet of total gross capacity of cold storage facilities. There are approximately 900 refrigerated warehouses throughout the country with 615 million of cooler capacity and over 2.413 billion cubic feet of freezer capacity. The data from the USDA shows the official measurement of the characteristics and scale of the cold storage infrastructure in the United States, and illustrates and supports the U.S. agricultural food supply chain and perishable market sectors with vast amounts of cold storage capability.

As technology advances, United States cold storage providers are now using automated system & storage retrieval using automated technologies to increase operational throughput Internet of Things (IoT) sensors support real-time temperature & condition monitoring for general purpose manufacturing & warehousing increasing traceability, compliance and improve quality control blockchain technology for secure supply chain transparency. Smart energy-efficient refrigerators and sustainability-focused innovations decrease both energy use and environmental impact.

United States Cold Storage Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 39.6 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 13.91% |

| 2035 Value Projection: | 165.9 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Equipment, By Temperature |

| Companies covered:: | Lineage Logistics, Americold Logistics, United States Cold Storage, Burris Logistics, NewCold, AGRO Merchants Group, Henningsen Cold Storage Co., Interstate Warehousing Inc., RLS Logistics, Vertical Cold Storaget, Arcadia Cold Storage & Logistics, Penske Logistics, NFI Industries, Tippmann Group LLC, FreezPak Logistics, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the United States Cold Storage Market Size:

The United States Cold Storage Market Size is driven by the consumer demand for frozen and chilled foods, urbanization and changes in lifestyle, increase of consumers favouring the convenience of healthy eating, increasing online purchasing through e-commerce, developing an efficient cold storage system, enabling fast delivery of perishable products, growing need for temperature-controlled storage, and government initiatives supporting the development of infrastructures and technology improvements.

The United States Cold Storage Market Size is restrained by the high costs for building cold storage facilities, operating costs especially for energy, maintaining compliance with strict regulations adds complexity, skilled labour shortage limit efficient operations, and aging infrastructure issues.

The future of United States Cold Storage Market Size is bright and promising, with versatile opportunities emerging from the continued development of online grocery retailing and direct delivery of perishable products to consumers will increase the need for large and small cold storage facilities in urban locations. The use of automation, robotics and AI is expected to improve efficiency and reduce costs while the focus on sustainability provides opportunities for energy-efficient and environmentally friendly cold storage solutions. The evolution of supply chain traceability through the application of digital technologies can provide industry players with new value propositions while enhancing their ability to compete on an international basis in the perishable goods sector.

Market Segmentation

The United States Cold Storage Market Size share is classified into service, equipment, temperature, and application.

By Service:

The United States Cold Storage Market Size is divided by service into refrigerated warehouse, private & semi-private, public, and cold room. Among these, the refrigerated warehouse segment held the largest revenue market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Cost effectiveness, flexibility for businesses needing on-demand space, and ability to offer specialized services without high upfront investment, and high demand from food & beverages and pharmaceutical end use all contribute to the refrigerated warehouse segment's dominance and higher spending on cold storage when compared to other service.

By Equipment:

The United States Cold Storage Market Size is divided by equipment into blast freezer, walk-in cooler & freezer, deep freezer, and others. Among these, the walk-in cooler & freezer segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The walk-in cooler & freezer segment dominates because of vast use in food service, retail, and general food preservation, found in virtually every restaurant, and versatile in nature to handle beverages, dairy products, meats, seafood, and prepared meals.

By Temperature:

The United States Cold Storage Market Size is divided by temperature into chilled, frozen, and deep frozen. Among these, the frozen segment held the largest market share in 2024 and is predicted to grow at a significant CAGR during the forecast period. Consumer demand for long shelf life products, and convenient ready-to-eat meals, urbanization and lifestyle changes, and advancement in freezing technology that preserve quality and nutrition all contribute to the frozen segment's dominance and higher spending on cold storage when compared to other temperature.

By Application:

The United States Cold Storage Market Size is divided by application into food & beverages, pharmaceuticals, and others. Among these, the food & beverages segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The food & beverages segment dominates because of massive volume of perishable goods needing preservation, consumer demand for fresh and convenience foods, growth in e-commerce, strict food safety regulations, and robust cold chain infrastructure to prevent spoilage and maintain quality.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United States Cold Storage Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United States Cold Storage Market Size:

- Lineage Logistics

- Americold Logistics

- United States Cold Storage

- Burris Logistics

- NewCold

- AGRO Merchants Group

- Henningsen Cold Storage Co.

- Interstate Warehousing Inc.

- RLS Logistics

- Vertical Cold Storaget

- Arcadia Cold Storage & Logistics

- Penske Logistics

- NFI Industries

- Tippmann Group LLC

- FreezPak Logistics

- Others

Recent Developments in United States Cold Storage Market Size:

In April 2025, Lineage Logistics acquired Northeast Cold Storage, increasing capacity and pharmaceutical capabilities. Agile Cold Storage launched its first United States facility in Joliet, a semi-automated, multi-temperature plant.

In March 2025, Americold opened a fully automated deep-freeze facility in Dallas powered by renewable energy and AI Americold also acquired a large facility in Houston.

In May 2024, Americold launched an automated cold storage facility in Russellville, Arkansas. Paxafe raised $9 million for its AI-driven cold chain logistics platform. CJ logistics America announced the opening of the new facility in new country, Kansas.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the US, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Cold Storage Market Size based on the below-mentioned segments:

United States Cold Storage Market Size, By Service

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

United States Cold Storage Market Size, By Equipment

- Blast Freezer

- Walk-In Cooler & Freezer

- Deep Freezer

- Others

United States Cold Storage Market Size, By Temperature

- Chilled

- Frozen

- Deep Frozen

United States Cold Storage Market Size, By Application

- Food & Beverages

- Pharmaceuticals

- Others

Frequently Asked Questions (FAQ)

-

What is the United States Cold Storage Market Size size?United States Cold Storage Market Size is expected to grow from USD 39.6 billion in 2024 to USD 165.9 billion by 2035, growing at a CAGR of 13.91% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the growing United States consumer demand for frozen and chilled foods, urbanization and lifestyle changes, preference for convenient and healthy eating options, demand for e-commerce and online grocery, efficient cold storage infrastructure to support fast delivery of perishables, rising demand for temperature-controlled storage across food and pharmaceuticals, supported by government infrastructure initiatives, and ongoing technological innovation.

-

What factors restrain the United States Cold Storage Market Size?Constraints include the high costs for building cold storage facilities, operating costs especially for energy, maintaining compliance with strict regulations adds complexity, skilled labour shortage limit efficient operations, and aging infrastructure issues.

-

How is the market segmented by service?The market is segmented into refrigerated warehouse, private & semi private, public, and cold room.

-

Who are the key players in the United States Cold Storage Market Size?Key companies include Lineage Logistics, Americold Logistics, United States Cold Storage, Burris Logistics, NewCold, AGRO Merchants Group, Henningsen Cold Storage Co., Interstate Warehousing Inc., RLS Logistics, Vertical Cold Storaget, Arcadia Cold Storage & Logistics, Penske Logistics, NFI Industries, Tippmann Group LLC, FreezPak Logistics, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?