United States Clinical Trials Management System Market Size, Share, And COVID-19 Impact Analysis, By Type (Enterprise and On-Site), By Delivery (Web-Based, Cloud-Based, and On-premise), End User (Pharmaceutical and Biotechnology Firms, CROs, and Medical Device Firms), and United States Clinical Trials Management System Market Insights, Industry Trend, Forecasts To 2035

Industry: HealthcareUnited States Clinical Trials Management System Market Insights Forecasts to 2035

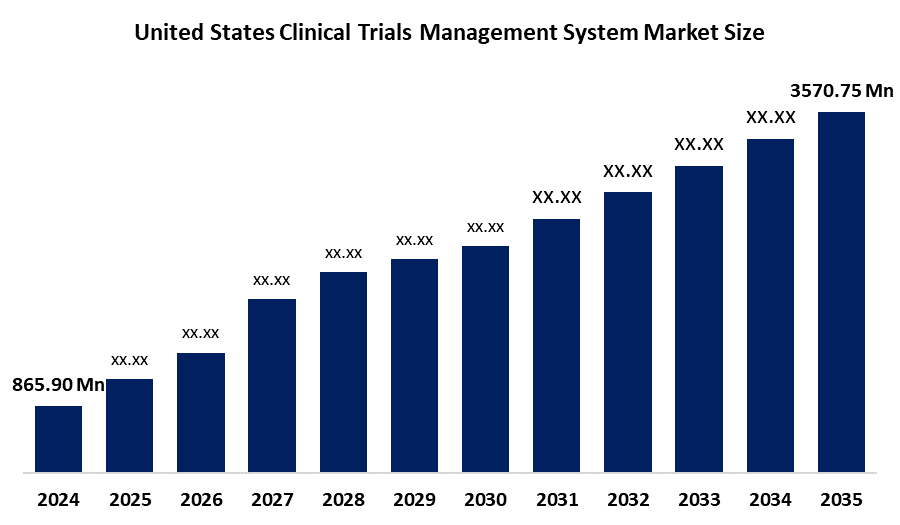

- The United States Clinical Trials Management System Market Size Was Estimated at USD 865.90 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.75% from 2025 to 2035

- The United States Clinical Trials Management System Market Size is Expected to Reach USD 3570.75 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Clinical Trials Management System Market Size is anticipated to reach USD 3570.75 Million by 2035, growing at a CAGR of 13.75% from 2025 to 2035. The United States clinical trials management system market is being driven by the rapid growth of healthcare IT, a preference for decentralized clinical trials, initiatives by key industry players, and a rising number of clinical studies are expected to fuel market growth.

Market Overview

A clinical testing management system (CTMS) is a specialized software solution for planning, tracking, managing, and optimizing the complicated activities involved in clinical trials. It serves as a consolidated platform for effectively overseeing diagnostic testing activities such as study planning, patient recruiting, regulatory compliance, site management, data tracking, and financial management. A diagnostic testing management system collects critical data and automates workflow operations such as study planning, site management, patient recruiting and enrollment, budgeting, monitoring, and reporting. By giving real-time access to test information, the clinical testing management system is able to monitor the progress of the study to stakeholders, track milestones, and adhere to guidelines for clinical practice (GCP), FDA regulations, and additional regional legal obligations. Through government investments and initiatives, biotechnology and pharmaceutical businesses are carrying out medical research. In order to improve testing efficiency, guarantee patient safety, and promote data-driven initiatives for clinical advancement, clinical testing management systems are crucial. Through the reduction of manual administrative tasks, the elimination of excesses, and the enhancement of cross-functional collaboration, these technologies allow sponsors and CROs to expedite testing schedules while upholding superior quality standards.

Report Coverage

This research report categorizes the United States clinical trials management system market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States clinical trials management system market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States clinical trials management system market.

Driving Factor

The United States clinical trials management system market is driven by the volume and complexity of clinical trials, the growing need for quick medication development, and the strict criteria for regulatory compliance. Adopting digital solutions and integrating them with EHRS and EDC systems results in more pharmaceutical businesses, CROS, and research institutes, as well as increased cost reduction, data accuracy, and real-time insight.

Restraining Factor

The United States clinical trial management system (CTMS) market faces restraints due to opposition to digital changes, high installation and maintenance costs, difficulties integrating with legacy systems, and data protection issues. Adoption is further hampered by a shortage of qualified workers and complex regulations.

Market Segmentation

The United States clinical trials management system market share is classified into type, delivery, and end-user.

- The enterprise segment led the market with the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United States clinical trials management system market is segmented by type into enterprise and on-site. Among these, the enterprise segment led the market with the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is due to providing scalable solutions, strong reporting tools, enhanced billing compliance, expedited regulatory process management, and extensive risk and deviation visibility. Organizations may manage a variety of difficult activities with a single software platform thanks to enterprise software solutions, which are made to integrate many features or application packages.

- The web & cloud-based segment accounted for the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United States Clinical Trials Management System market is segmented by delivery into web-based, cloud-based, and on-premise. Among these, the web & cloud-based segment accounted for the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is due to these solutions facilitating clinical trial data management through third-party providers, offering scalable hosting options. In addition, cloud-based technologies offer the advantage of seamless data accessibility from various devices, including laptops, mobiles, workstations, and tablets, via CTMS software.

- The CRO segment accounted for the largest revenue share in 2024 and is anticipated to grow a significant share during the predicted timeframe.

The United States Clinical Trials Management System market is segmented by services into Clinical Trials Management System service, imaging service, and laboratory service. Among these, the CRO segment accounted for the largest revenue share in 2024 and is anticipated to grow a significant share during the predicted timeframe. This is due to the rising number of partnerships, the outsourcing of clinical trials to contract research organizations, and the increasing prevalence of decentralized trials.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States clinical trials management system market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IQVIA, Inc.

- Medidata (Dassault Systèmes)

- Oracle

- DATATRAK International, Inc.

- Clario

- SimpleTrials

- Veeva Systems

- Wipro Limited

- MedRhythms

- Others

Recent Development

In April 2025, SiteVault CTMS, a cloud-based clinical trial management system for research facilities, was unveiled by Veeva Systems. It enables thorough trial administration and smooth data transmission with sponsors when integrated with SiteVault eISF and eConsent.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Clinical Trials Management System market based on the below-mentioned segments:

United States Clinical Trials Management System Market, By Type

- Enterprise

- On-Site

United States Clinical Trials Management System Market, By Delivery

- Web-Based

- Cloud-Based

- On-premise

United States Clinical Trials Management System Market, By End-User

- Pharmaceutical and Biotechnology Firms

- CROs

- Medical Device Firms

Frequently Asked Questions (FAQ)

-

Q: What is a clinical trials management system (CTMS)?A: A CTMS is specialized software that helps plan, track, manage, and optimize clinical trials. It centralizes activities such as study planning, patient recruitment, site management, regulatory compliance, data tracking, and financial management.

-

Q: What was the U.S. CTMS market size in 2024?A: The market was estimated at USD 865.90 million in 2024.

-

Q: What is the forecasted growth of the U.S. CTMS market?A: The market is expected to grow at a CAGR of 13.75% from 2025 to 2035, reaching USD 3,570.75 million by 2035.

-

Q: What factors are driving the CTMS market in the U.S.?A: Growth is driven by increasing clinical trial complexity, demand for faster drug development, adoption of digital solutions, integration with EHR and EDC systems, cost reduction, and real-time data insights.

-

Q: What are the key restraining factors?A: High installation and maintenance costs, integration challenges with legacy systems, data privacy concerns, shortage of skilled personnel, resistance to digital adoption, and complex regulations.

-

Q: Which CTMS type segment leads the U.S. clinical trials management system market?A: The enterprise segment led in 2024, due to scalability, enhanced reporting, regulatory process management, and visibility into risk and deviations.

-

Q: Which delivery model dominates the U.S. clinical trials management system market?A: Web & cloud-based CTMS accounted for the largest share, offering scalable hosting, remote access, and seamless data exchange across devices.

-

Q: Which end-user segment holds the largest U.S. clinical trials management system market share?A: Contract Research Organizations (CROs) dominate, driven by the outsourcing of clinical trials and rising decentralized trial adoption.

-

Q: Who are the major players in the U.S. CTMS market?A: Key companies include IQVIA, Medidata (Dassault Systèmes), Oracle, DATATRAK, Clario, SimpleTrials, Veeva Systems, Wipro, and MedRhythms.

Need help to buy this report?