The United States Cell and Gene Therapy Contract Research Organizations Market Size, Share, and COVID-19 Impact Analysis, By Type (Drug Discovery, Preclinical, and Clinical), By Modality (Cell-Based Therapies, Gene Therapies, and Gene-Modified Cell Therapies), and United States Cell & Gene Therapy Contract Research Organizations Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareThe United States Cell & Gene Therapy Contract Research Organizations Market Insights Forecasts To 2035

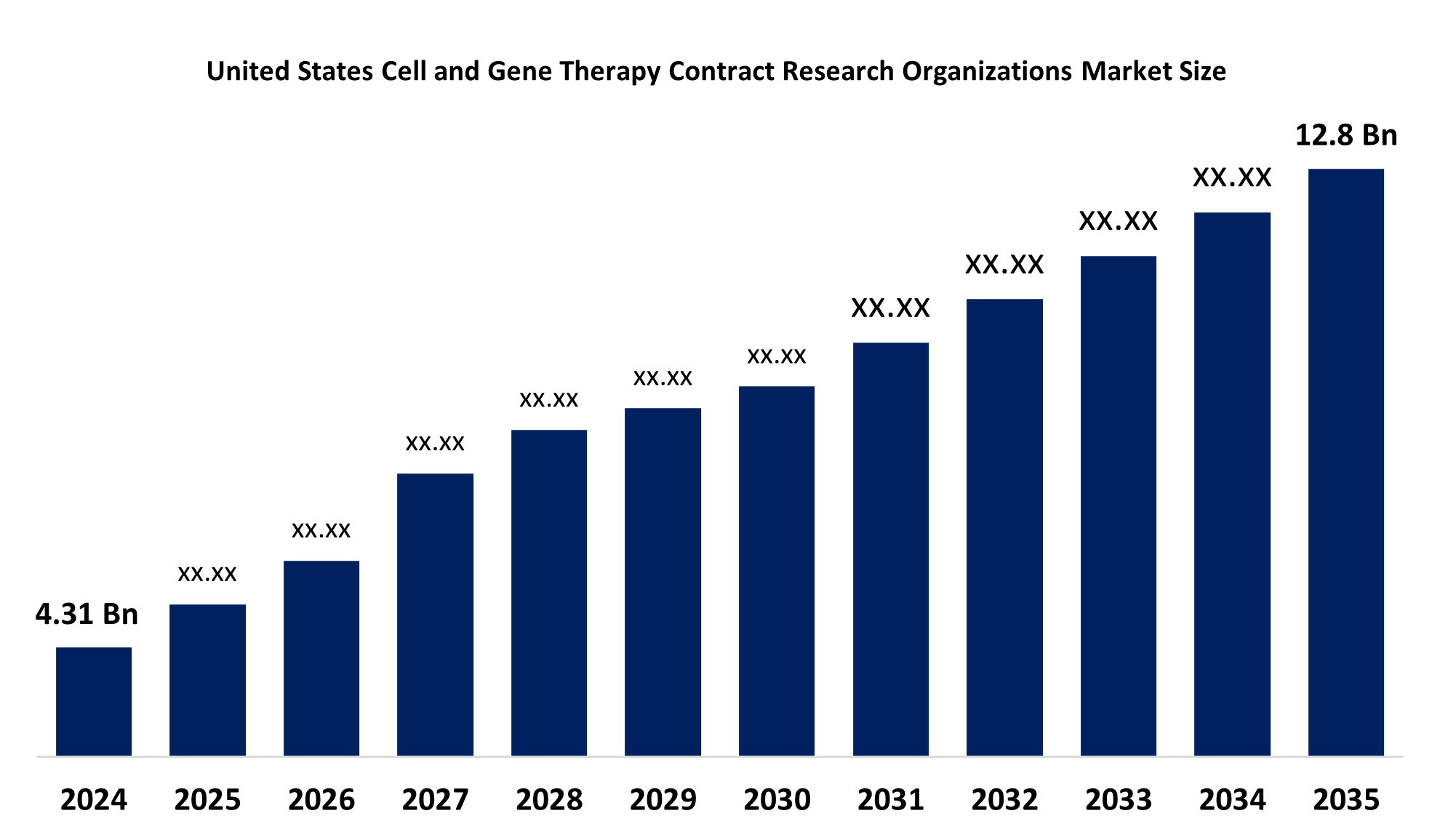

- The United States Cell Gene Therapy Contract Research Organizations Market Size is Expected to Grow at a CAGR of around 10.4% from 2025 to 2035

- The Market Size is Expected to Grow at a CAGR of around 10.4% from 2025 to 2035

- The USA Cell Gene Therapy Contract Research Organizations Market Size is Anticipated to Reach USD 12.8 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Cell and Gene Therapy Contract Research Organizations Market is Anticipated To Reach USD 12.8 Billion by 2035, Growing at a CAGR of 10.4% from 2025 to 2035. The increasing outsourcing by biotech companies, increasing clinical trial volume in CGT, expanding complexity of cell- and gene-based therapies, and regulatory complexity.

Market Overview

Cell and gene therapy contract research organization (CROS) is a special service provider that supports biotechnology and pharmaceutical companies in cell- and gene-based therapy research, development, testing, and regulatory processes. A cell and gene therapy contract research organization is required to offer this difference by offering comprehensive services of pharmaceutical and biotech companies, from cell line engineering, vector design, and discovery research to clinical trial administration and GMP manufacturing support. They also help with biopharmaceutical testing, pharmacovigilance, and regulatory route navigation, which guarantees that treatment moves through development stages without hiccups. RNAI and gene therapy CROS is inspired by the country's strong biotechnology sector, state -of -the -art research facilities, and regulatory structures. With the promise of treating previously incurable diseases, malformations, and genetic problems, cell and gene therapy represent a novel approach to the treatment of disease. Their development is extremely complex, however, and requires following specific features, technical knowledge, and strict FDA guidelines.

Report Coverage

This research report categorizes the market for the USA cell & gene therapy contract research organizations market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US cell & gene therapy contract research organizations market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. cell & gene therapy contract research organizations market.

Driving Factors

The U.S. cell & gene therapy contract research organizations are driven by rapidly expanding pipeline of therapies, strong FDA regulatory support, and increasing biotech investments in regenerative medicine. The need for specialized expertise, infrastructure, and faster clinical trial execution fuels outsourcing to CROs. Rising adoption of advanced technologies such as automation, AI, and bioanalytics further accelerates efficiency and market growth.

Restraining Factors

High development costs, complex regulatory compliance, and the shortage of skilled professionals limit market expansion. Additionally, manufacturing challenges, scalability issues, and data management complexities pose risks. Dependence on external CROs may increase costs and extend timelines if capabilities or resources are limited.

Market Segmentation

The US cell & gene therapy contract research organizations market share is classified into type and modality.

- The preclinical segment is anticipated to grow at the fastest CAGR during the forecast period.

The US cell & gene therapy contract research organizations market is segmented by product into drug discovery, preclinical, and clinical. Among these, the preclinical segment is anticipated to grow at the fastest CAGR during the forecast period. The early-stage gene therapy and cell therapy are coming into development, especially from academia spin-offs and small biotech companies. These treatments are required for these treatments, including Vivo poisoning, immunogenicity evaluation, and vector characterization in mechanism-action, highly specific pregnancy testing services, including biodistribution probes.

- The cell-based therapies segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US cell & gene therapy contract research organizations market is segmented by type into cell-based therapies, gene therapies, and gene-modified cell therapies. Among these, the cell-based therapies segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Approval of allogenic and autologous cell remedies in various types of medical fields, especially regenerative medicine and oncology. Due to their notable clinical success, these treatment-like CAR-T and Stem cell treatments have inspired the initiative of more clinical trials and commercialization.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States Cell & Gene Therapy Contract Research Organizations market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Altasciences

- Allucent

- Labcorp

- Linical

- Medpace

- Thermo Fisher Scientific Inc.

- Precision Medicine Group, LLC.

- QPS Holdings

- Others

Key Target Audience

- Market Players

- Investors

- End users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value Added Resellers (VARs)

United States Cell & Gene Therapy Contract Research Organizations Market, By Type

- Drug Discovery

- Preclinical

- Clinical

United States Cell & Gene Therapy Contract Research Organizations Market, By Modality

- Cell-Based Therapies

- Gene Therapies

- Gene-Modified Cell Therapies

Frequently Asked Questions (FAQ)

-

1. What was the market size of the U.S. cell & gene therapy CROs market in 2024?The market size was estimated at USD 4.31 billion in 2024.

-

2. What is the projected market size by 2035?The U.S. market is expected to reach USD 12.8 billion by 2035.

-

3. What is the CAGR of the U.S. cell & gene therapy CROs market during 2025–2035?The market is projected to grow at a CAGR of 10.4% during the forecast period.

-

4. What are the major growth drivers of this market?Key drivers include a rapidly expanding pipeline of therapies, FDA regulatory support, biotech investments in regenerative medicine, and the need for specialized expertise, infrastructure, and faster trial execution.

-

5. What are the major restraining factors?High development costs, complex regulatory compliance, shortage of skilled professionals, and manufacturing scalability challenges are major restraints limiting market growth.

-

6. Which modality segment dominated the market in 2024?The cell-based therapies segment held the largest market share in 2024, supported by the success of CAR-T and stem cell treatments.

-

7. Who are the key players in the U.S. cell & gene therapy CROs market?Major players include Altasciences, Allucent, Labcorp, Linical, Medpace, Thermo Fisher Scientific Inc., Precision Medicine Group, and QPS Holdings.

-

8. What is the forecast period covered in the report?The study covers 2020–2035, with 2024 as the base year and 2025–2035 as the forecast years.

Need help to buy this report?