United States Butadiene Market Size, Share, By Additive (SB Rubber, Butadiene Rubber, ABS, SB Latex, Ethylene Oxide, And Others), By End Use (Tire & Rubber, Plastics & Polymers, Adhesives & Sealants, Footwear, And Others), And United States Butadiene Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Butadiene Market Insights Forecasts to 2035

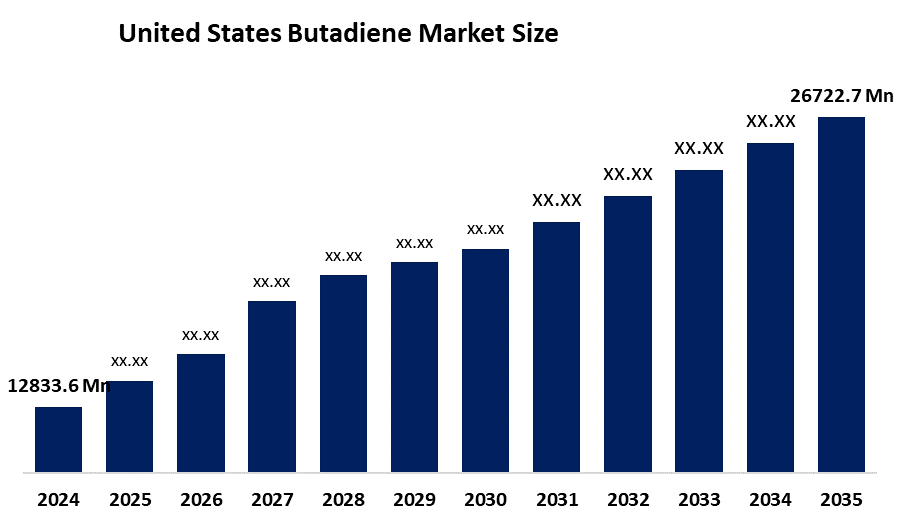

- United States Butadiene Market Size 2024: USD 12833.6 Million

- United States Butadiene Market Size 2035: USD 26722.7 Million

- United States Butadiene Market CAGR 2024: 6.9%

- United States Butadiene Market Segments: Additive and End Use

Get more details on this report -

The United States butadiene market includes all aspects of the manufacture, distribution, and usage of butadiene in US. Butadiene is a petrochemical made from crude oil and is used in the production of synthetic rubber, engineering plastics, and many other elastomers utilized by industries across the US. Butadiene has been established as an important contributor to the US chemical industry growth demand for tires and plastics for growth in automotive tire, building, and household consumer goods industries, which exemplifies the importance of butadiene for the overall industrial economy.

The butadiene in United States are backed by government support, including the U.S. Environmental Protection Agency (EPA), aimed adoption of cleaner production technologies and extensive emissions monitoring to comply with stricter standards. Additionally, federal incentives such as tax credits and grants for bio-based chemical R&D and production support the development of bio-butadiene and other sustainable alternatives, thereby encouraging innovation in greener manufacturing processes

As technology advances, United States butadiene providers are now using cutting-edge catalytic technologies and enhanced separation and recovery method development from steam crackers combined with implementation of digital automation to increase process control and reduce waste. At the same time advancement in technology for producing bio-based butadiene from renewable feedstuff using biotechnology conversion processes for reducing emissions and meeting environmental legislation to address the changing requirements of regulators and consumers.

Market Dynamics of the United States Butadiene Market:

The United States butadiene market is driven by the sustained demand from automotive and tire industries, trends toward performance and specialized tires, increasing butadiene consumption, increased demand for plastics and elastomers in construction, packaging, and consumer goods, and shift toward sustainable materials with strong government support policies.

The United States butadiene market is restrained by the raw material price volatility, feedstock costs and production economics challenges, stringent environmental and health-related regulations, high initial and operational costs, and emerging competition from sustainable materials.

The future of United States butadiene market is bright and promising, with versatile opportunities emerging from the green bio-butadiene and other industry-leading, renewable feed stock technologies to receive government incentives and are benefitting from the increasing number of companies moving towards sustainable business practices. There is growth in electric vehicle sales, which will create a opportunity for specialty tires and rubber like materials, thus expanding the market for butadiene-based products. Strategic investments into advanced manufacturing technologies as well as digitally integrated processes have the potential to create further opportunities within the manufacturing system and generate new, high-value engineering plastics and high-performance material sectors.

United States Butadiene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12833.6 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.9% |

| 2035 Value Projection: | USD 26722.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | ExxonMobil Chemical Company, LyondellBasell Industries, Shell Chemical Company, TPC Group, BASF Corporation, INEOS Group, Braskem S.A., Chevron Phillips Chemical Company, Formosa Plastics Corporation, U.S.A., Eastman Chemical Company, SABIC, Dow Chemical Company, Versalis S.p.A., LG Chem Ltd., ARLANXEO, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United States Butadiene Market share is classified into additive and end use.

By Additive:

The United States butadiene market is divided by additive into SB rubber, butadiene rubber, ABS, SB latex, ethylene oxide, and others. Among these, the SB rubber segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Essential role in tire manufacturing, high cost effectiveness, superior performance characteristics, and high value abrasion resistance, durability, and versatility in automotive applications all contribute to the SB rubber segment's largest share and higher spending on butadiene when compared to other additives.

By End Use:

The United States butadiene market is divided by end use into tire & rubber, plastics & polymers, adhesives & sealants, footwear, and others. Among these, the tire & rubber segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The tire & rubber segment dominates because they are the primary raw material for SB rubber, essential for producing high-performance and durable automotive tires, well established US automotive sector, and need for durable materials in tires ensuring steady demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United States butadiene market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United States Butadiene Market:

- ExxonMobil Chemical Company

- LyondellBasell Industries

- Shell Chemical Company

- TPC Group

- BASF Corporation

- INEOS Group

- Braskem S.A.

- Chevron Phillips Chemical Company

- Formosa Plastics Corporation, U.S.A.

- Eastman Chemical Company

- SABIC

- Dow Chemical Company

- Versalis S.p.A.

- LG Chem Ltd.

- ARLANXEO

- Others

Recent Developments in United States Butadiene Market

In October 2024, ExxonMobil announced to boost butadiene production capacity at its Baytown, Texas, facility to meet global demand for synthetic rubber. The strategic investment is planned to start up in 2028 and will support the continued delivery of essential energy products to meet future demand.

In April 2023, Epsilyte, a US-based company launched 124LR expandable polystyrene, a product created with at least 50% post-consumer recycled material, aligning with sustainability trends in the broader market for butadiene-based derivatives.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States butadiene market based on the below-mentioned segments:

United States Butadiene Market, By Additive

- SB Rubber

- Butadiene Rubber

- ABS

- SB Latex

- Ethylene Oxide

- Others

United States Butadiene Market, By End Use

- Tire & Rubber

- Plastics & Polymers

- Adhesives & Sealants

- Footwear

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the United States butadiene market size?A: United States butadiene market is expected to grow from USD 12833.6 million in 2024 to USD 26722.7 million by 2035, growing at a CAGR of 6.9% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the sustained demand from automotive and tire industries, trends toward performance and specialized tires, increasing butadiene consumption, increased demand for plastics and elastomers in construction, packaging, and consumer goods, and shift toward sustainable materials with strong government support policies.

-

Q: What factors restrain the United States butadiene market?A: Constraints include the raw material price volatility, feedstock costs and production economics challenges, stringent environmental and health-related regulations, high initial and operational costs, and emerging competition from sustainable materials.

-

Q: How is the market segmented by additive?A: The market is segmented into SB rubber, butadiene rubber, ABS, SB latex, ethylene oxide, and others.

-

Q: Who are the key players in the United States butadiene market?A: Key companies include ExxonMobil Chemical Company, LyondellBasell Industries, Shell Chemical Company, TPC Group, BASF Corporation, INEOS Group, Braskem S.A., Chevron Phillips Chemical Company, Formosa Plastics Corporation, U.S.A., Eastman Chemical Company, SABIC, Dow Chemical Company, Versalis S.p.A., LG Chem Ltd., ARLANXEO, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?