United States Blanket Market Size, Share, and COVID-19 Impact Analysis, By Material (Cotton, Wool, Polyester, and Others), By Application (Residential and Commercial), and United States Blanket Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Blanket Market Insights Forecasts to 2035

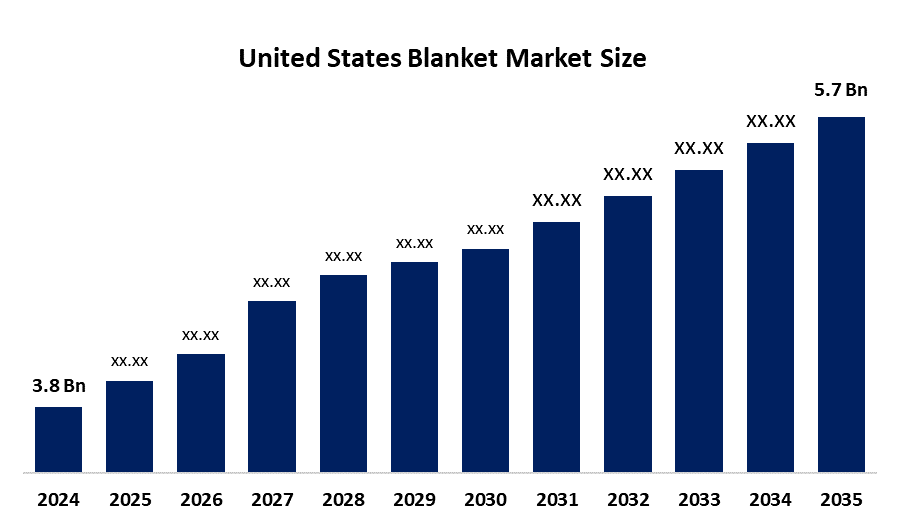

- The United States Blanket Market Size Was Estimated at USD 3.8 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.7% from 2025 to 2035

- The United States Blanket Market Size is Expected to Reach USD 5.7 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Blanket Market Size is Anticipated to reach USD 5.7 Billion by 2035, Growing at a CAGR of 3.7% from 2025 to 2035. The United States Blanket Market is driven by the growth of maritime trade, increasing shipping activities, government initiatives supporting port infrastructure, rising demand for fuel in logistics and transportation, and the adoption of cleaner, low-sulfur fuels in compliance with IMO regulations.

Market Overview

The United States blanket market is defined as the industry that deals with the production, distribution, and sales of blankets for purposes of warmth, comfort, and aesthetic value. Blankets are used in domestic settings, hotels, hospitals, and travel. The industry is made up of different types of materials, including cotton, wool, polyester, fleece, and electric-heated blankets. The demand for the industry is affected by seasonal changes in weather, lifestyle, home decoration, and consumer expenditure on bedding. Additionally, the industry is fueled by the rise in urban households, increased disposable income, growth in e-commerce platforms, and the adoption of energy-efficient electric blankets as an alternative to room heating.

The United States blanket industry is undergoing tremendous trends that will influence the future of the industry. Smart & Heated blankets are being adopted by consumers who are increasingly adopting electric and temperature-controlled blankets as a way of reducing heating costs and staying warm during the winter season. Sustainable & Eco-friendly materials are in high demand for organic cotton blankets, recycled polyester blankets, and eco-friendly wool blankets. E-commerce & Personalized Designs Online platforms are being utilized for customization, designer prints, and online sales.

The U.S. government supports the textile and home furnishing sector through consumer safety regulations and energy efficiency standards. Heated blankets must comply with electrical safety certifications and low-energy consumption guidelines. Sustainability initiatives and recycling programs are also encouraging manufacturers to adopt eco-friendly materials and production methods.

Report Coverage

This research report categorizes the market for the United States blanket market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States blanket market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States blanket market.

Driving Factors

The United States blanket industry is mainly fueled by the rising expenditure of consumers on home comfort and bedding. The rising construction and renovation of housing units is fueling the demand for home textiles. The rising number of camping and outdoor activities is fueling the demand for camping blankets that are durable, portable, and waterproof. The development of e-commerce platforms makes it easy for products to be available and for prices to be competitive. Moreover, the rising demand for heated blankets as a means of conserving energy for heating during winter is fueling the industry.

Restraining Factors

The market faces restraints from fluctuating raw material prices, such as cotton and wool, which increase production costs. Seasonal demand dependency and warmer climate conditions in some regions also limit sales growth. Additionally, safety concerns and higher prices of electric blankets may restrict adoption among price-sensitive consumers.

Market Segmentation

The United States Blanket market share is classified into material and application.

- The cotton segment accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States blanket market is segmented by material into cotton, wool, polyester, and others. Among these, the cotton segment accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period. Cotton blankets are skin-friendly and breathable, which makes them ideal for consumption by people of all ages. They are also easy to clean and can be found at all retail outlets, both online and offline. This makes them a preferred choice over wool and synthetic blankets. The rising demand for hypoallergenic bedding products also adds to the demand for cotton blankets.

- The residential segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States blanket market is segmented by application into residential and commercial. Among these, the residential segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Blankets are a household item that is used on a daily basis and is bought by almost every household. Cycles of frequent replacements because of wear & tear, winter demands, and home decor trends have a significant impact on household consumption. Online shopping platforms also make it easier for consumers to purchase multiple blankets for different rooms in the house, further increasing household demand as compared to commercial demand in hotels and hospitals, where purchases are made in bulk but are less frequent.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States blanket market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Berkshire Blanket & Home Co.

- Pendleton Woolen Mills

- Sunbeam Products

- Biddeford Blankets LLC

- American Blanket Company

- Brooklinen

- Boll & Branch

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2023, Xiaomi introduced the Mijia Smart Electric Blanket in the U.S., featuring Mi Home app integration for remote control.

- In Sept 2023, Zonli launched the Battery Heated Blanket Series (Z-Walk and Z-Walk Pro) featuring 6X Heat Targeting Tech and 12-inch heating areas.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Blanket market based on the below-mentioned segments:

United States Blanket Market, By Material

- Cotton

- Wool

- Polyester

- Others

United States Blanket Market, By Application

- Residential

- Commercial

Frequently Asked Questions (FAQ)

-

1. What is the United States blanket market?The United States blanket market refers to the industry involved in the manufacturing, distribution, and sale of blankets for residential and commercial usage.

-

2. What is the United States blanket market size?The United States blanket market size is expected to grow from USD 3.8 billion in 2024 to USD 5.7 billion by 2035, growing at a CAGR of 3.7% during the forecast period 2025-2035.

-

3. What are the key drivers of the United States blanket market?The market is driven by rising home decor spending, growing e-commerce sales, demand for heated blankets, and housing growth.

-

4. Which materials dominate the United States blanket market?Cotton dominates, while polyester and wool are also widely used.

-

5. What are the major trends in the United States blanket market?Smart heated blankets, sustainable materials, and personalized online designs.

-

6. Who are the key companies operating in the United States blanket market?Major players include Berkshire Blanket, Pendleton Woolen Mills, Biddeford Blankets, Sunbeam, and Brooklinen.

-

7. What is the future outlook for the United States blanket market?The market is expected to grow steadily, driven by lifestyle improvements, winter demand, smart blankets, and sustainable textile innovation.

Need help to buy this report?