United States Bisphenol S Market Size, Share, and COVID-19 Impact Analysis, By Application (Plastic Manufacturing, Thermal Paper, Epoxy Resins, Personal Care Products, and Others), By End User (Automotive, Electronics, Packaging, Healthcare, and Others), and United States Bisphenol S Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Bisphenol S Market Insights Forecasts to 2035

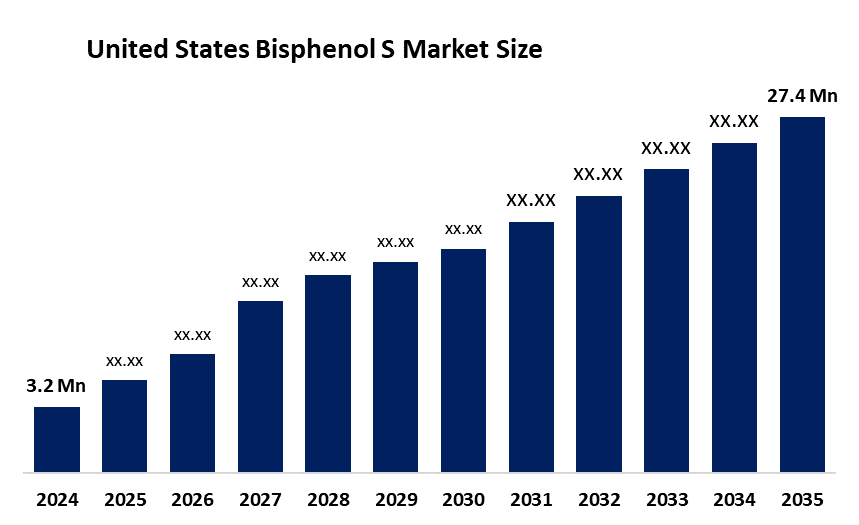

- The United States Bisphenol S Market Size Was Estimated at USD 3.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 21.56% from 2025 to 2035

- The United States Bisphenol S Market Size is Expected to Reach USD 27.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Bisphenol S market size is anticipated to reach USD 27.4 million by 2035, growing at a CAGR of 21.56% from 2025 to 2035. The Bisphenol S market in United States is driven by rising demand for BPA-free plastics, tighter regulations on bisphenol A, increased use in thermal paper and resins, and growing applications in electronics, coatings, and industrial manufacturing.

Market Overview

The United States Bisphenol S (BPS) market refers to the production and use of BPS, a chemical compound commonly used as an alternative to bisphenol A in manufacturing. BPS serves as a primary component in thermal paper production, epoxy resin manufacturing, polycarbonate plastic production, coating, adhesive, and electronic component applications because it provides chemical stability and heat resistance. The demand for BPA-free materials drives its adoption across consumer, industrial, and packaging sectors.

The U.S. government controls the Bisphenol S (BPS) market through its Environmental Protection Agency (EPA) authority, which oversees Toxic Substances Control Act (TSCA) regulations and conducts endocrine disruptor testing and enforces state laws such as California Proposition 65. The Environmental Protection Agency (EPA) Safer Choice program, together with green chemistry initiatives promotes safer chemical alternatives, which result in indirect effects on BPS demand and compliance expenses and research activities throughout the coatings and plastics and thermal paper sectors.

U.S. companies such as Addivant Corporation have developed their own specific Bisphenol S formulations, which now provide better thermal stability performance for use in coating materials and thermal paper products. The ongoing regulatory changes that ban BPA use have created more demand for BPS. The future will bring opportunities through sustainable BPS production and high-performance polymer usage and the development of eco-friendly solutions which will be used in packaging and electronics and industrial applications.

Report Coverage

This research report categorizes the market for the United States Bisphenol S market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States Bisphenol S market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States Bisphenol S market.

United States Bisphenol S Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.2 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 21.56% |

| 2035 Value Projection: | USD 27.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Addivant Corporation, SI Group, Huntsman Corporation, Kessler Chemical, Connect Chemicals United States LLC, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Bisphenol S market in United States is driven by the increasing restrictions on bisphenol A (BPA) and rising needs for safe chemical replacements, strong demand from thermal paper, epoxy resins, and high-performance plastics. The market experiences growth through two main factors, which are the rising need for BPA-free products and increased consumer knowledge about BPA-containing products and their health effects.

Restraining Factors

The Bisphenol S market in United States is mostly constrained by the potential health and environmental issues and regulatory requirements that match BPA standards, the absence of complete long-term safety data, and the current volatility of raw material costs, which results in higher compliance expenses and prevents widespread market acceptance.

Market Segmentation

The United States Bisphenol S market share is classified into application and end user.

- The thermal paper segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States Bisphenol S market is segmented by application into plastic manufacturing, thermal paper, epoxy resins, personal care products, and others. Among these, the thermal paper segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of its extensive use as a BPA substitute in receipts and labels, which is supported by consistent volume consumption and revenue growth due to stringent BPA regulations, an increase in retail transactions, and a significant desire for safer phenolic developers.

- The electronics segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The United States Bisphenol S market is segmented by end user into automotive, electronics, packaging, healthcare, and others. Among these, the electronics segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is fueled by its widespread use in high-performance epoxy resins and polycarbonate substitutes for circuit boards, connectors, and insulating materials, as well as by robust domestic electronics manufacturing and the need for robust, heat-resistant parts.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States Bisphenol S market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Addivant Corporation

- SI Group

- Huntsman Corporation

- Kessler Chemical

- Connect Chemicals United States LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In December 2025, Lignin-based receipt paper, which does away with BPA and BPS chemicals, is a recent scientific breakthrough that represents a shift in technology toward non-toxic substitutes for thermal applications.

- In August 2025, Research revealed possible health dangers associated with BPS exposure from regular thermal paper, raising consumer and regulatory concerns about the substance.

- In April 2025, High quantities of Bisphenol S were found in thermal paper receipts from American shops, according to a significant study. This finding resulted in violation notifications under California's Proposition 65 and may cause a move toward safer substitutes.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Bisphenol S market based on the below-mentioned segments:

United States Bisphenol S Market, By Application

- Plastic Manufacturing

- Thermal Paper

- Epoxy Resins

- Personal Care Products

- Others

United States Bisphenol S Market, By End User

- Automotive

- Electronics

- Packaging

- Healthcare

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the United States Bisphenol S market size?A: United States bisphenol S market size is expected to grow from USD 3.2 million in 2024 to USD 27.4 million by 2035, growing at a CAGR of 21.56% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing restrictions on bisphenol A (BPA) and rising needs for safe chemical replacements, strong demand from thermal paper, epoxy resins, and high-performance plastics.

-

Q: What factors restrain the United States Bisphenol S market?A: Constraints include the potential health and environmental issues and regulatory requirements that match BPA standards.

-

Q: How is the market segmented by application?A: The market is segmented into plastic manufacturing, thermal paper, epoxy resins, personal care products, and others.

-

Q: Who are the key players in the United States Bisphenol S market?A: Key companies include Addivant Corporation, SI Group, Huntsman Corporation, Kessler Chemical, Connect Chemicals United States LLC, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?