United States Beer and Cider Market Size, Share, And COVID-19 Impact Analysis, By Product (Beer, Cider, Ale, Stout, and Lager), By Packaging (Bottles, Cans, and Others), By Distribution Channel (On-trade, Off-trade, Hypermarkets & Supermarkets), and United States Beer and Cider Market Insights, Industry Trend, Forecasts To 2035

Industry: Food & BeveragesUnited States Beer and Cider Market Insights Forecasts to 2035

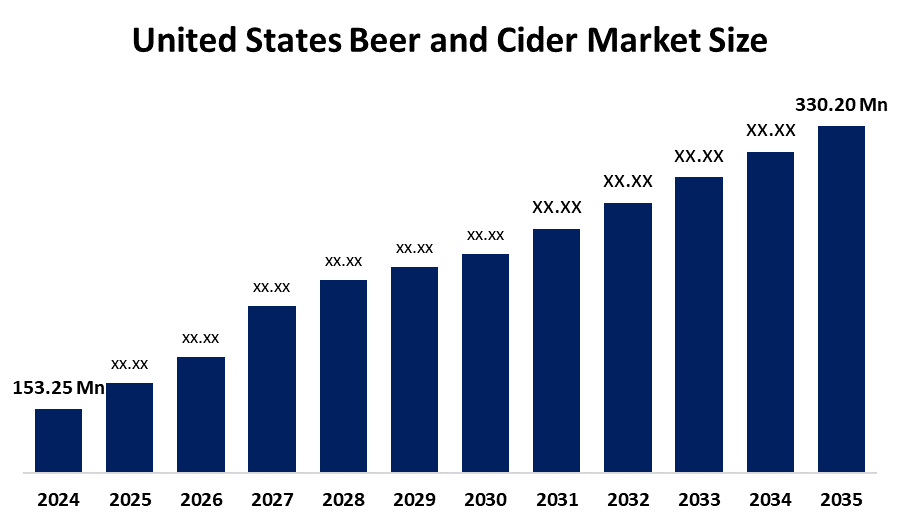

- The United States Beer and Cider Market Size Was Estimated at USD 153.25 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.23% from 2025 to 2035

- The United States Beer and Cider Market Size is Expected to Reach USD 330.20 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Beer and Cider Market Size is Anticipated to reach USD 330.20 Million by 2035, growing at a CAGR of 7.23% from 2025 to 2035. The United States beer and cider market is being driven by a rising demand for ready-to-drink (RTD) cocktails and flavored ciders, appealing to younger demographics looking for convenience and novelty.

Market Overview

Beer and cider are among the most widely consumed alcoholic beverages, appreciated for their cultural significance, variety, and versatility. Beer is a fermented beverage typically produced from malted grains such as barley, hops, yeast, and water, offering a broad spectrum of flavors, alcohol content, and styles ranging from lagers to stouts. Cider, on the other hand, is crafted from fermented apple juice or pear juice in the case of perry, offering a naturally refreshing and often gluten-free alternative to beer, appealing to both traditional and health-conscious consumers. Health-conscious trends also favor cider, as it is often perceived as a lighter, fruit-based alternative with lower gluten and calorie content, attracting younger demographics and wellness-focused consumers. Additionally, rising interest in low-alcohol and alcohol-free options has spurred innovation, allowing beer and cider brands to tap into a broader consumer base without compromising on taste. Overall, beer and cider are thriving beverage categories because they combine tradition with innovation. Their popularity, cultural importance, wide variety, and ability to adapt to changing consumer tastes ensure that both drinks will remain strong choices in the beverage market.

Report Coverage

This research report categorizes the United States beer and cider market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States beer and cider market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States beer and cider market.

United States Beer and Cider Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 153.25 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.23% |

| 2035 Value Projection: | USD 330.20 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 217 |

| Tables, Charts & Figures: | 135 |

| Segments covered: | By Product, By Product and By Distribution Channel |

| Companies covered:: | Anheuser-Busch InBev, Heineken, Carlsberg Breweries A/S, Molson Coors Beverage Company, Asahi Group Holdings, Ltd., Diageo, Sierra Nevada Brewing Co., United Breweries Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

The United States beer and cider market is driven by the rising consumer demand for craft and premium beverages, the increasing popularity of low-alcohol and alcohol-free options, and the growing preference for natural, gluten-free, and fruit-based drinks. Expanding social consumption, innovation in flavors, and sustainable production practices further strengthen market growth

Restraining Factor

The United States beer and cider market has to face restrictions due to rising health concerns over alcohol consumption, stringent government regulations, and high taxation. Shifting consumer preferences toward healthier non-alcoholic beverages, coupled with supply chain challenges and raw material price fluctuations, may also limit growth.

Market Segmentation

The United States Beer and Cider market share is classified into product, packaging, and distribution channel.

- The beer segment held the largest market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United States beer and cider market is segmented by product into beer, cider, ale, stout, and lager. Among these, the beer segment held the largest market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is due to growing interest in craft beer among consumers. Because of their emphasis on premium ingredients, creative brewing techniques, and uncommon flavors, craft breweries have carved out a distinct market niche. Unlike mass-produced beers, craft beers are often manufactured in smaller quantities, allowing brewers to experiment with a greater variety of ingredients.

- The can segment accounted for the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United States beer and cider market is segmented by packaging into bottles, cans, and others. Among these, the can segment accounted for the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. Cans offer significant cost advantages in the production, transportation, and storage of beer and cider, contributing to their attractiveness in the market. From a production standpoint, cans are typically cheaper to manufacture than glass bottles due to lower material costs and simpler production processes.

- The on-trade distribution channel held the largest share in 2024 and is anticipated to grow substantial CAGR during the forecast period.

The United States beer and cider market is segmented by distribution channel into on-trade, off-trade, hypermarkets & supermarkets. Among these, the on-trade distribution channel held the largest share in 2024 and is anticipated to grow substantial CAGR during the forecast period. On-trade distribution channels play an important role in enhancing the overall drinking experience by providing consumers with opportunities to pair beer and cider with dining experiences and social gatherings. This culinary interaction encourages experimentation with different beer styles and flavors.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States beer and cider market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Anheuser-Busch InBev

- Heineken

- Carlsberg Breweries A/S

- Molson Coors Beverage Company

- Asahi Group Holdings, Ltd.

- Diageo

- Sierra Nevada Brewing Co.

- United Breweries Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States beer and cider market based on the below-mentioned segments:

United States Beer and Cider Market, By Product

- Beer

- Cider

- Ale

- Stout

- Lager

United States Beer and Cider Market, By Packaging

- Bottles

- Cans

- Others

United States Beer and Cider Market, By Distribution Channel

- On-trade

- Off-trade

- Hypermarkets & Supermarkets

Frequently Asked Questions (FAQ)

-

Q: What are beer and cider?A: Beer is a fermented alcoholic beverage made from malted grains such as barley, hops, yeast, and water, available in various styles like lagers, ales, and stouts. Cider is a fermented drink made from apple or pear juice, often naturally gluten-free and fruity.

-

Q: What was the U.S. beer and cider market size in 2024?A: The market was estimated at USD 153.25 million in 2024.

-

Q: What is the forecasted growth of the U.S. beer and cider market?A: The market is expected to grow at a CAGR of 7.23% from 2025 to 2035, reaching USD 330.20 million by 2035.

-

Q: What factors are driving market growth?A: Growth is driven by rising demand for craft and premium beverages, low-alcohol and alcohol-free options, natural and gluten-free products, social consumption, flavor innovation, and sustainable production practices.

-

Q: What restrains the U.S. beer and cider market?A: Restraints include health concerns over alcohol consumption, strict government regulations, high taxation, shifting consumer preferences toward non-alcoholic beverages, supply chain challenges, and raw material price fluctuations.

-

Q: Which product segment holds the largest share?A: The beer segment held the largest market share in 2024, fueled by growing interest in craft beers with premium ingredients, unique flavors, and artisanal brewing methods.

-

Q: Which packaging segment dominates the market?A: Cans accounted for the largest share, offering cost advantages in production, storage, and transportation, and providing convenience for consumers.

-

Q: Who are the key players in the U.S. beer and cider market?A: Major companies include Anheuser-Busch InBev, Heineken, Carlsberg, Molson Coors, Asahi Group, Diageo, Sierra Nevada, and United Breweries.

-

Q: What types of beer and cider are included in the market segmentation?A: Market types include Beer, Cider, Ale, Stout, and Lager.

-

Q: What are the key end-use channels for beer and cider?A: End-use channels include On-trade, Off-trade, and Hypermarkets & Supermarkets.

Need help to buy this report?