United States Basalt Rock Market Size, Share, and COVID-19 Impact Analysis, By Product (Basalt Fiber, Basalt Aggregates, Basalt Tiles/ Slabs, and Others), By End-Use (Building & Construction, Infrastructure, Automotive & Transportation, Aerospace & Defense, Energy & Power, and Others), and United States Basalt Rock Market Insights, Industry Trend, Forecasts To 2035

Industry: Advanced MaterialsUnited States Basalt Rock Market Insights Forecasts To 2035

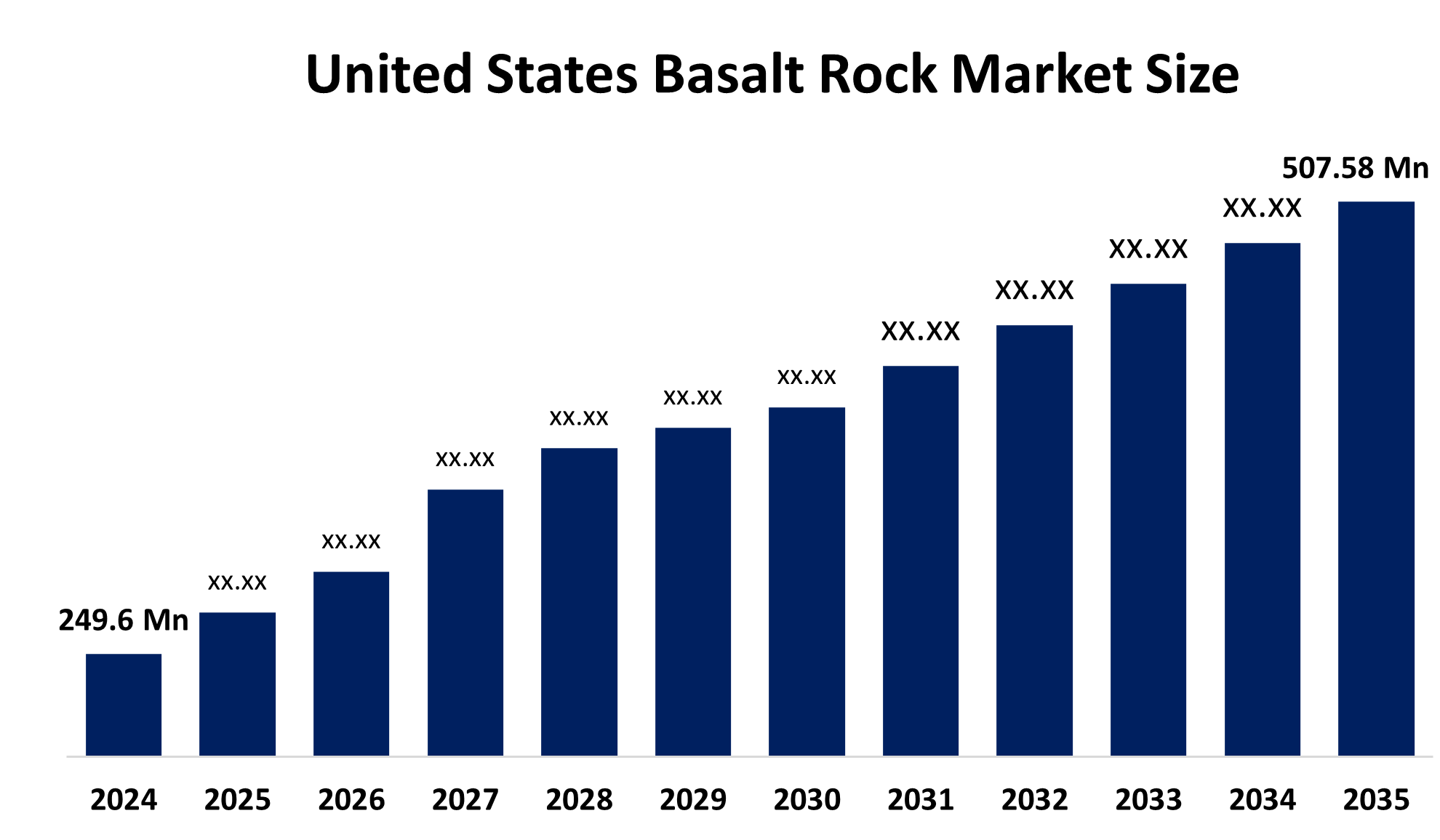

- The US Basalt Rock Market Size Was Estimated at USD 249.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.67% from 2025 to 2035

- The US Basalt Rock Market Size is Expected to Reach USD 507.58 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Basalt Rock Market Size is Anticipated To Reach USD 507.58 Million by 2035, Growing at a CAGR of 6.67% from 2025 to 2035. The United States basalt rock market is being driven by basalt's exceptional physical qualities, which include corrosion resistance, high compressive strength, and thermal stability.

Market Overview

Basalt rock is a dark, fine-grained rock made by rapid cooling of basaltic lava on or near the earth's surface. It is mostly made up of minerals such as plagioclase, pyroxene, and olivine, which give it excellent durability, density, and thermal resistance. Basalt is one of earth's most common volcanic rocks, found in the oceanic crust, volcanic islands, and continental lava flows. Because of its mechanical strength, chemical stability, and natural abundance, basalt rock is a very versatile material utilized in a wide range of industries. In construction, basalt is used as crushed stone, collected for concrete, asphalt, and road base, and is more durable than previous materials. Its great compressed power and weather resistance make it suitable for bridges, highways, and infrastructure projects. Basalt is also used to make tiles, slabs, and decorative stones for architectural and landscaping projects. In addition, the basalt can be processed into basalt fiber, an environmentally benign material that is used as an alternative to glass or carbon fiber in insulating materials due to its construction, motor vehicle, aerospace, and its great tensile power and heat resistance.

Report Coverage

This research report categorizes the United States basalt rock market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States basalt rock market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States basalt rock market.

United States Basalt Rock Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 249.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.67% |

| 2035 Value Projection: | USD 19.56 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End-Use |

| Companies covered:: | American Basalt Company Inc., American Basaltworks LLC., Basalt Engineering USA, Basanite Industries, United States Basalt Corp, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

The US basalt rock market is driven by increased infrastructure development, the requirement of sustainable construction materials, and an increase in road and highway projects. Increased use of basalt fibers as environmentally friendly, high-performance options in market expansion in the building, motor vehicle, and aerospace industries. The tendency towards stability has also increased its industrial applications.

Restraining Factor

The US basalt rock market has to face restrictions due to higher processing and production costs, low awareness about basalt rock applications, and competition from proven materials such as glass and carbon fibers inhibit all market expansion. In addition, the supply chain issues and the lack of defined industrial processes may disrupt the adoption in special areas.

The United States basalt rock market share is classified into product and end-use.

- The basalt fiber segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The U.S. basalt rock market is segmented by product into basalt fiber, basalt aggregates, basalt tiles/ slabs, and others. Among these, the basalt fiber segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. Basalt fiber has extraordinary mechanical, thermal, and chemical properties. Its high tensile strength, excessive temperature, rust, chemical attacks, and flexibility for environmentalism make it popular in a variety of industries, including construction, motor vehicles, aerospace, and sea.

- The building & construction segment accounted for the highest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The U.S. basalt rock market is segmented by end-use into building & construction, infrastructure, automotive & transportation, aerospace & defense, energy & power, and others. Among these, the building & construction segment accounted for the highest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to basalt being widely used in this industry for a wide variety of purposes, including the set, tile, slabs, and, most importantly, the basalt fiber ribar. Its high, narrow strength, resistance to weathering, fire resistance, and longevity are a great option for many construction projects, including residential and commercial structures and large-scale infrastructure.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States basalt rock market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- American Basalt Company Inc.

- American Basaltworks LLC.

- Basalt Engineering USA

- Basanite Industries

- United States Basalt Corp.

- Others

Key Target Audience

- Market Players

- Investors

- End users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States basalt rock market based on the below-mentioned segments:

United States Basalt Rock Market, By Product

- Basalt Fiber

- Basalt Aggregates

- Basalt Tiles/ Slabs

- Others

United States Basalt Rock Market, By End-Use

- Building & Construction

- Infrastructure

- Automotive & Transportation

- Aerospace & Defense

- Energy & Power

- Others

Frequently Asked Questions (FAQ)

-

1. What is the United States sealing membrane market size in 2024?The U.S. sealing membrane market size was estimated at USD 3.3 billion in 2024.

-

2. What is the projected market size by 2035?The market is expected to reach USD 6.98 billion by 2035

-

3. What is the expected growth rate (CAGR) of the market?The market is projected to grow at a CAGR of 7.05% from 2025 to 2035.

-

4. What are the main product types in the U.S. sealing membrane market?The market is segmented into sheet membranes and liquid-applied membranes.

-

5. Which product segment dominated the U.S. sealing membrane market in 2024?The liquid-applied membranes segment accounted for the highest revenue share due to flexibility, easy application, and suitability for complex surfaces.

-

6. Which end-use sector led the U.S. sealing membrane market in 2024?The residential sector is dominated, driven by rising demand for waterproofing in foundations, roofs, and basements.

-

7.What factors are driving the U.S. sealing membrane market?Key drivers include increasing infrastructure investment, green building initiatives, government support, and the growing need for durable waterproofing solutions.

-

8. What are the restraining factors in the U.S. sealing membrane market?Challenges include high installation costs, limited awareness in smaller projects, weather-related performance concerns, raw material price fluctuations, and competition from traditional waterproofing methods.

-

9. Who are the key players in the U.S. sealing membrane market?Major players include GAF Materials LLC, Carlisle SynTec Systems, Johns Manville (Berkshire Hathaway), and Sika Sarnafil.

-

1. What are the main restraints in the U.S. basalt rock market?High production costs, limited awareness of basalt’s applications, competition from glass and carbon fibers, and supply chain challenges restrain market growth.

-

2. Which product segment dominated the U.S. basalt rock market in 2024?The basalt fiber segment dominated in 2024 due to its exceptional tensile strength, thermal resistance, and eco-friendly properties.

-

3. Which end-use segment held the largest market share in 2024?The building & construction segment held the highest revenue share in 2024, driven by demand for basalt aggregates, tiles, slabs, and basalt fiber rebars.

-

4. Who are the major players in the U.S. basalt rock market?Key companies include American Basalt Company Inc., American Basaltworks LLC, Basalt Engineering USA, Basanite Industries, and United States Basalt Corp.

-

5. What is the forecast period covered in this report?The report covers historical data from 2020–2023, the base year 2024, and forecasts from 2025 to 2035.

-

6. What was the market size of the U.S. basalt rock market in 2024?The U.S. basalt rock market size was estimated at USD 249.6 million in 2024.

-

7. what is the expected market size by 2035?The market is projected to reach USD 507.58 million by 2035.

-

8. What is the CAGR of the U.S. basalt rock market from 2025 to 2035?The market is expected to grow at a CAGR of 6.67% during the forecast period.

-

9. What are the key drivers of the U.S. basalt rock market?Growth is driven by rising infrastructure development, demand for sustainable construction materials, and growing adoption of basalt fibers in automotive, aerospace, and building industries.

Need help to buy this report?