United States Baby Monitor Market Size, Share, and COVID-19 Impact Analysis, By Product (Video Monitor Device, Audio Monitor Device, and Movement Tracker), By Connectivity (Wired and Wireless), By Distribution Channel (Online and Offline), and United States Baby Monitor Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Baby Monitor Market Insights Forecasts to 2035

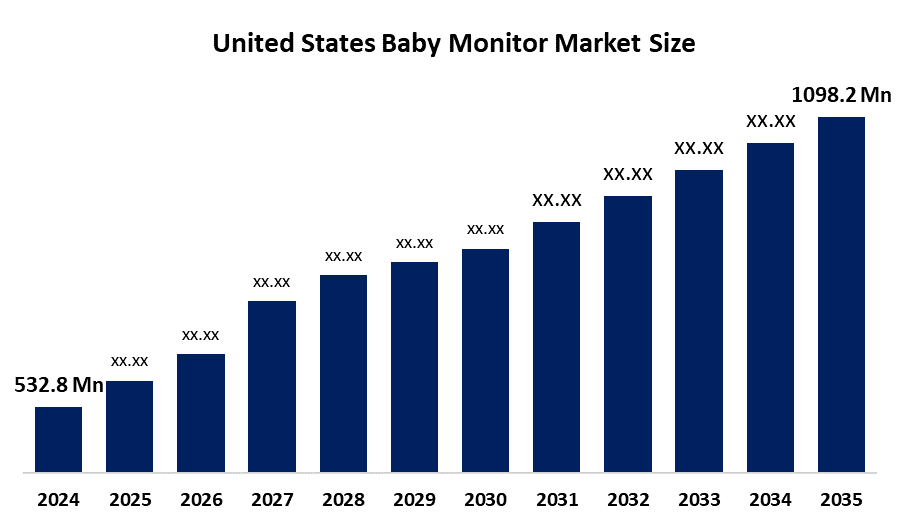

- The United States Baby Monitor Market Size Was Estimated at USD 532.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.8% from 2025 to 2035

- The United States Baby Monitor Market Size is Expected to Reach USD 1098.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Baby Monitor Market Size is Anticipated to Reach USD 1098.2 Million by 2035, Growing at a CAGR of 6.8% from 2025 to 2035. The United States Baby Monitor Market is driven by rising parental awareness about infant safety, increasing dual-income households, higher adoption of smart home devices, and growing demand for real-time monitoring solutions. The COVID-19 pandemic accelerated adoption as parents spent more time at home and invested more in child safety and connected baby care products.

Market Overview

The United States baby monitor market is defined as the market for consumer electronics that are used for the purpose of parents being able to monitor their infants from a distance. The devices that are used for this purpose include audio monitors, video monitors, and movement tracking monitors that are equipped with cameras and Wi-Fi connectivity. The latest baby monitors come equipped with features such as live video streaming, sleep tracking, temperature measurement, breathing measurement, and notifications on smartphones. The market is growing at a rapid pace due to the inclusion of smart technology. AI-powered cry alerts, motion alerts, and sleep insights are also being incorporated into the devices.

The United States baby monitor market is experiencing some major trends that will influence its future growth. There is a major drift towards smart Wi-Fi-enabled baby monitors that come with mobile app support, enabling parents to track their babies from anywhere. Artificial intelligence-powered baby monitor functionalities such as cry alerts, breathing alerts, sleep analysis, and motion alerts are gaining popularity to improve baby safety and alleviate parents’ concerns. Compatibility with smart home systems and voice assistants is enhancing product convenience and fueling the demand for high-end products.

Government regulations and safety standards in the United States are a major factor in the growth of the baby monitor market. Bodies such as the Consumer Product Safety Commission (CPSC) issue guidelines for baby monitoring devices to ensure the safety of babies. Data privacy regulations and wireless communication regulations are factors in the development of secure baby monitors. Furthermore, public awareness programs regarding sudden infant death syndrome (SIDS) and infant safety monitoring indirectly promote the adoption of advanced monitoring devices among parents

Report Coverage

This research report categorizes the market for the United States baby monitor market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States baby monitor market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States baby monitor market.

United States Baby Monitor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 532.8 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.8% |

| 2035 Value Projection: | USD 1098.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Motorola Mobility LLC, VTech Communications Inc., Nanit, Owlet Baby Care, Angelcare Monitor Inc., Summer Infant Inc., iBaby Labs Inc., Arlo Technologies Inc., Philips Avent, Infant Optics, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States baby monitor market is primarily driven by the rising concern among parents about the safety and health of infants, which is also fueling the demand for baby monitoring solutions. The increasing use of smart home ecosystems and IoT devices is also encouraging the demand for connected baby monitoring solutions. The growing number of working parents and nuclear families has increased their dependence on remote monitoring solutions. In addition, technological advancements are also fueling the adoption of baby monitoring solutions. Furthermore, adopting smart technology integration with AI, voice assistants, and smartphone apps for real-time monitoring of breathing and temperature is a primary driver.

Restraining Factors

The market is expected to face restraints such as high product costs for smart monitors with advanced technology and issues related to data privacy and hacking in Wi-Fi-enabled devices. Lack of awareness among low-income households and a preference for conventional parenting practices are also expected to act as restraints.

Market Segmentation

The United States baby monitor market share is classified into product, connectivity, and distribution channel.

- The video monitor devices segment accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States baby monitor market is segmented by product into video monitor devices, audio monitor devices, and movement trackers. Among these, the video monitor devices segment accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance of video monitor devices is because parents want real-time visual monitoring of infants, as compared to just audio alerts. The additional features, such as high-definition cameras, night vision, motion detection, breathing monitoring, and smartphone streaming, make the product more valuable and expensive as compared to audio monitors. As video monitors are a premium product and are largely used in urban households, they generate the largest share of revenue in the overall market.

- The wireless segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the connectivity, the United States baby monitor market is segmented into wired and wireless. Among these, the wireless segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The wireless segment dominates the market because Wi-Fi-enabled monitors allow parents to monitor babies remotely through smartphones from any location. Convenience, portability, and smart home integration make wireless devices more popular than wired monitors, leading to higher adoption and revenue generation.

- The online segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the United States baby monitor market is bifurcated into online and offline. Among these, the online segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The online segment holds the highest revenue share due to the growing preference for e-commerce platforms where parents can compare features, read reviews, and access a wider range of smart monitoring devices. Discounts, product availability, and doorstep delivery further increase online sales compared to physical retail stores.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States baby monitor market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Motorola Mobility LLC

- VTech Communications Inc.

- Nanit

- Owlet Baby Care

- Angelcare Monitor Inc.

- Summer Infant Inc.

- iBaby Labs Inc.

- Arlo Technologies Inc.

- Philips Avent

- Infant Optics

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In February 2026, Baberio announced its official launch as a new U.S.-based consumer brand in the parenting industry.

In August 2024, Jartoo introduced a 2K resolution baby monitor with an exclusive cry sensor and advanced night vision.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States baby monitor market based on the below-mentioned segments:

United States Baby Monitor Market, By Product

- Video Monitor Device

- Audio Monitor Device

- Movement Tracker

United States Baby Monitor Market, By Connectivity

- Wired

- Wireless

United States Baby Monitor Market, By Distribution Channel

- Online

- Offline

Frequently Asked Questions (FAQ)

-

1. What is the United States baby monitor market?The United States baby monitor market is for electronic devices that allow parents to monitor infants remotely using audio, video, and sensor-based technologies.

-

2. What is the United States baby monitor market size?United States baby monitor market size is expected to grow from USD 532.8 million in 2024 to USD 1098.2 million by 2035, growing at a CAGR of 6.8% during the forecast period 2025-2035.

-

3. What are the key drivers of the United States baby monitor market?The market is driven by rising infant safety awareness, smart home adoption, and increasing working parents.

-

4. Which product dominates the United States baby monitor market?Video baby monitors dominate due to real-time visual monitoring features.

-

5. What are the major trends in the United States baby monitor market?Key trends include AI-enabled monitoring, smartphone integration, and wireless connectivity.

-

6. Who are the key companies operating in the United States baby monitor market?Major players include Motorola Mobility LLC, VTech Communications Inc., Nanit, Owlet Baby Care, Angelcare Monitor Inc., Summer Infant Inc., iBaby Labs Inc., Arlo Technologies Inc., Philips Avent, Infant Optics

-

7. What is the future outlook for the United States baby monitor market?The market is expected to grow steadily due to increasing demand for smart childcare monitoring solutions.

Need help to buy this report?