United States Automotive Steel Wheel Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Heavy Commercial Vehicle, Light Commercial Vehicle, Passenger Vehicle, and Others), By Application (OEM, Aftermarket, and Others) and United States Automotive Steel Wheel Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited States Automotive Steel Wheel Market Insights Forecasts to 2035

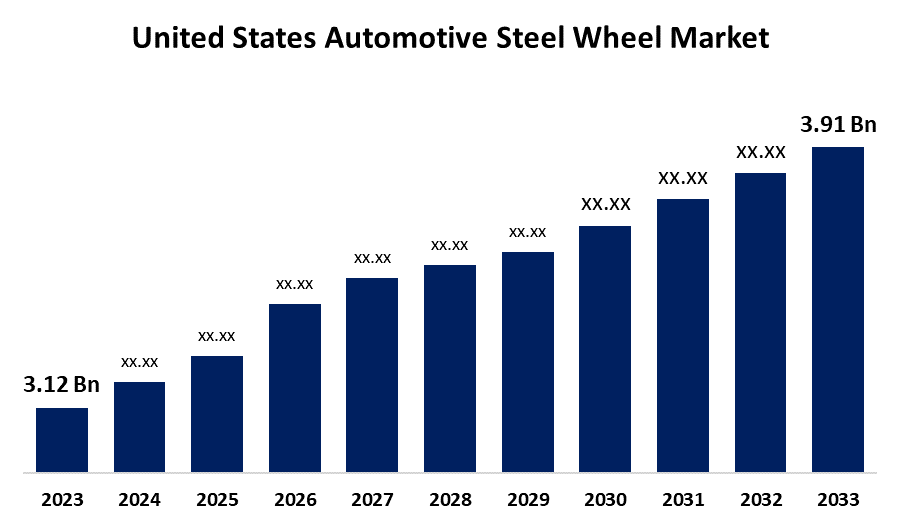

- The United States Automotive Steel Wheel Market Size Was Estimated at USD 3.12 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 2.07% from 2025 to 2035

- The United States Automotive Steel Wheel Market Size is Expected to Reach USD 3.91 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Automotive Steel Wheel Market Size is anticipated to reach USD 3.91 billion by 2035, growing at a CAGR of 2.07% from 2025 to 2035. The United States automotive steel wheel market is driven by the need for strong, reasonably priced steel wheels for heavy-duty commercial and passenger cars is driving this expansion, although lightweight aluminium alloys are also posing a threat to the industry. Lightweight aluminium alloy wheels are a major contender, especially for high-end and electric cars, where weight reduction is essential.

Market Overview

The United States Automotive Steel Wheel Market Size consists of the production, distribution, and sale of durable steel wheels for passenger and commercial vehicles, driven by the demand for cost-effective, strong, and reliable wheel solutions. The expansion of the electric vehicle (EV) industry and the growing aftermarket, due to cost-conscious consumers and commercial use, present opportunities for the US automotive steel wheel market. The use of automation and smart manufacturing offers significant potential for increasing productivity and cost-effectiveness, as well as meeting sustainability requirements with environmentally friendly production methods and materials. Growth factors given by market variables contributing to increased geopolitical tensions could lead to supply chain disruptions and fluctuations in steel prices, which could have a detrimental impact on seller profitability and market expansion.

U.S. government initiatives affecting the automotive steel wheel industry are driven by more general policies related to domestic production, environmental regulations, and import duties on steel. These broader policies and programs impact the industry by influencing supply chains, material selection, and production methods, even though there are no efforts that focus solely on steel wheels.

Report Coverage

This research report categorises the United States automotive steel wheels market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States automotive steel wheels market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States automotive steel wheels market.

United States Automotive Steel Wheel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.12 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 2.07% |

| 2035 Value Projection: | USD 3.91 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Vehicle Type, By Application |

| Companies covered:: | Mitsubishi Corporation, Sumitomo Corporation, Maxion Wheels, Accuride Corporation, U.S. Wheel Corp., The Carlstar Group, LLC., Thyssenkrupp AG, Central Motor Wheel of America, Inc., Topy America, Inc., ALCAR WHEELS GMBH, Steel Strips Group, and Others, Key Player |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing production of automobiles, the affordability and strength of steel wheels, and the increasing demand for commercial vehicles, especially vehicles used for last-mile delivery, are the primary factors driving the US automotive steel wheel market. In addition, considerations include government regulations promoting fuel efficiency, manufacturing technological breakthroughs, and continued demand for aftermarket replacement components. Also, the growing demand for heavy-duty commercial vehicles and the wheels that go with them is being driven by the growth of commercial and logistics sectors, as well as e-commerce.

Restraining Factors

The US automotive steel wheel market consumer preferences for lighter and more aesthetically pleasing alloy wheels, fluctuations in raw material prices, and the move toward heavier cars with more sophisticated components can all harm the automobile steel wheel market. Steel wheels are becoming less common, especially in new passenger automobiles, as alloy wheels are gaining popularity due to their aesthetic appeal.

Market Segmentation

The United States automotive steel wheel market share is classified into vehicle type and application.

- The passenger vehicle segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States automotive steel wheel market is segmented by vehicle type into heavy commercial vehicle, light commercial vehicle, passenger vehicle, and others. Among these, the passenger vehicle segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The passenger segment, due to passenger automobiles, had the largest production volumes and is often equipped with standard, reasonably priced steel wheels. Most newly manufactured automobiles are represented by the largest number of vehicles already on the road.

- The original equipment manufacturer (OEM) segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States automotive steel wheel market is segmented by application into OEM, aftermarket, and others. Among these, the original equipment manufacturer (OEM) segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The original equipment manufacturer (OEM) segment given by steel wheels is a common and economical part of many vehicles, especially low-end and commercial vehicles, and it is directly related to the large volume of new car production. Replacement and customisation have made the aftermarket the fastest growing segment still, the sheer volume of the OEM segment keeps it dominant. Due to its affordability and longevity, steel wheels are often the standard choice for automakers in specific vehicle categories, guaranteeing continued demand from producers.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United States automotive steel wheel market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Corporation

- Sumitomo Corporation

- Maxion Wheels

- Accuride Corporation

- U.S. Wheel Corp.

- The Carlstar Group, LLC.

- Thyssenkrupp AG

- Central Motor Wheel of America, Inc.

- Topy America, Inc.

- ALCAR WHEELS GMBH

- Steel Strips Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In May 2025, Steel Strip Wheels Ltd (SSWL), a leading Indian wheel manufacturer, is planning to expand its annual wheel manufacturing capacity to 5.3 million units by FY26 from the current 4.8 million units in FY25. The expansion comes as the company positions itself to capitalise on expected orders from Maruti Suzuki and anticipates a gradual recovery in both European and US markets.

- In January 2025, Rex-Cut Abrasives acquired the Non-Woven Unitised and Convolute Wheels division of Westfield Grinding Wheel Company, enhancing its capabilities in precision abrasive solutions. This acquisition expands Rex-Cut's product line, providing more diverse solutions to its industrial customers.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States automotive steel wheel market based on the following segment.

U.S. Automotive Steel Wheel Market, By Vehicle Type

- Heavy Commercial Vehicle

- Light Commercial Vehicle

- Passenger Vehicle

- Others

U.S. Automotive Steel Wheel Market, By Application

- OEM

- Aftermarket

- Others

Frequently Asked Questions (FAQ)

-

What is the United States automotive steel wheel market size?The United States automotive steel wheel market was estimated at USD 3.12 billion in 2024 and is projected to reach USD 3.91 billion by 2035, growing at a CAGR of 2.07% during 2025–2035.

-

What are the advantages of steel wheels?Strength and durability are two benefits of steel wheels. They are better suited for off-road driving and tough road conditions as they are much less likely to bend or break when hitting potholes or turns.

-

Which type of steel is commonly used in automotive parts?The types of steel used in the automotive industry can range from stainless steel, high-strength steel, high-carbon, low-carbon, or galvanised steel. This type of steel is used in the production of various vehicle and engine components.

-

What are the elements of market segmentation?Market segmentation is about dividing the target market into smaller segments for better research. To do this effectively, there are five key steps: measurability, accessibility, substantiality, differentiability, and actionability.

-

How is the market segmented by vehicle type?The market is segmented into heavy commercial vehicle, light commercial vehicle and passenger vehicle.

Need help to buy this report?