United States Automotive Stainless Steel Tubes Market Size, Share, and COVID-19 Impact Analysis, By Type (Welded, Seamless, and Others), By Application (Exhaust System, Motor & Fuel System, Structural Composition, and Others), and United States Automotive Stainless Steel Tubes Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited States Automotive Stainless Steel Tubes Market Insights Forecasts to 2035

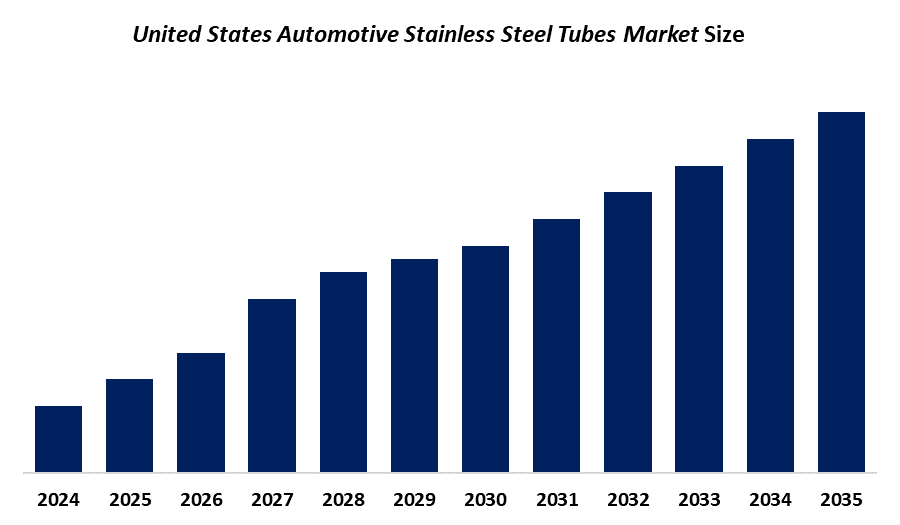

- The United States Automotive Stainless Steel Tubes Market size is expected to grow at a CAGR of around 4.17% from 2025 to 2035.

- The United States Automotive Stainless Steel Tubes Market size is expected to hold a significant Share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Automotive Stainless Steel Tubes Market Size is expected to grow at a CAGR of 4.17% from 2025 to 2035. The United States automotive stainless steel tubes market is driven by stricter pollution standards, innovative car designs, and government initiatives like the USMCA, that require the use of North American steel are important growth driver. Even though the US market faces obstacles such as possible variations in material quality, producers are coming up with new ways to meet demand and enhance quality.

Market Overview

The U.S. automotive stainless steel tube market size involves the manufacturing, distribution, and use of corrosion-resistant stainless steel tubes for use in fuel lines, exhaust systems, and structural elements. The opportunities to capitalise on the growing demand for EV components, lightweight and fuel-efficient cars, and advanced pollution control systems are presented by the US automotive stainless steel tube market. There are opportunities to develop new materials and production technologies as well as enter the aftermarket sector. These reasons require the use of stainless steel tubes in new parts of EVs, including fuel lines, exhaust systems, battery casings and thermal management systems. Furthermore, developments in materials science and the overall expansion of the automotive sector support the growth of the market. The US market for automotive stainless steel tubes is mostly driven by government programs such as the bipartisan infrastructure legislation and strict emissions regulations. Emissions requirements drive the use of corrosion-resistant stainless steel for cleaner and more efficient vehicle components, such as EVs and exhaust systems, while infrastructure legislation drives demand through expansion in industry and general transportation. These government initiatives help the market by creating a need for stronger, lighter and higher-performance materials to meet performance and environmental objectives.

Report Coverage

This research report categorises the market for the United States automotive stainless steel tubes market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States automotive stainless steel tubes market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States automotive stainless steel tubes market.

United States Automotive Stainless Steel Tubes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.17% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Plymouth Tube Company, Handytube Corporation, Penn Stainless Products Inc., Cleveland-Cliffs Inc., Arcelor Mittal, Sandvik AB, Outokumpu Oyj, POSCO, Cleveland-Cliffs Inc., Nippon Steel Corporation, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Market Size for Automotive Stainless Steel Tubes in US is primarily driven by rising vehicle production, the demand for strong, corrosion-resistant materials, and more stringent emission standards. The increasing use of electric vehicles (EVs), which need specific tubes for battery and cooling systems, is another important driver. The special needs of EVs, such as effective thermal management and battery cooling systems, are opening new markets for high-performance stainless steel tubes. Due to the excellent strength-to-weight ratio of stainless steel, vehicles weigh less, thereby increasing fuel efficiency. This is an important factor, especially given the increasing demand for both personal and business automobiles.

Restraining Factors

The Automotive Stainless Steel Tubes Market Size in US is influenced by high production and material costs, driven by expensive raw materials such as nickel and chromium. Additional variables include disruptions in the supply chain, the availability of less expensive alternatives such as carbon steel, aluminium and galvanised steel, fluctuations in raw material prices, and manufacturing difficulties encountered due to the hardness and heat resistance of stainless steel.

Market Segmentation

The United States automotive stainless steel tubes market share is classified into type and application.

- The welded seamless batteries segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States automotive stainless steel tubes market is segmented by type into welded, seamless and others. Among these, the welded seamless batteries segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Welded tube section increases due to its affordability and ease of mass production. Applications such as hydroforming, coolant systems and exhaust systems make extensive use of these tubes. Welded tubes may be produced in larger quantities, given their manufacturing technique, which gives producers quicker availability and shorter wait times. For many automotive applications, welded tubes are more cost-effective than seamless tubes because they are less expensive to make.

- The exhaust systems segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States automotive stainless steel tubes market is segmented by application into exhaust system, motor & fuel system, structural composition and others. Among these, the exhaust systems segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period . The exhaust systems segment due to stainless steel being perfect for exhaust pipes, mufflers and catalytic converters due to its great corrosion resistance, durability and ability to withstand high temperatures. Production of automobiles that run on petrol and diesel calls for durable exhaust systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United States automotive stainless steel tubes market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Plymouth Tube Company

- Handytube Corporation

- Penn Stainless Products Inc.

- Cleveland-Cliffs Inc.

- Arcelor Mittal

- Sandvik AB

- Outokumpu Oyj

- POSCO

- Cleveland-Cliffs Inc.

- Nippon Steel Corporation

- Others

Key Target Audience

- Market players

- Investors

- End-users

- Government authorities

- Consulting and research firm

- Venture capitalists

- Value-added resellers (vars)

Recent Developments:

- In July 2025, LOXLEY, Alabama, announced plans. Butting, a global stainless steel pipe manufacturer, is to establish its North American headquarters and first United States production facility in Baldwin County as part of a USD 61 million growth project.

- In August 2024, Kirloskar Ferrous Industries Ltd (KFIL) and Indian Seamless Metal Tubes Ltd (ISMT) are pleased to announce that they have begun operations as a merged entity. This merger represents a significant milestone in KFIL’s strategic growth plan. The consolidation aims to leverage synergies, enhance operational efficiency, and create long-term value for all stakeholders.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States automotive stainless steel tubes market based on the following segments:

United States Automotive Stainless Steel Tubes Market, By Type

- Welded

- Seamless

- Others

United States Automotive Stainless Steel Tubes Market, By Application

- Exhaust System

- Motor & Fuel System

- Structural Composition

- Others

Frequently Asked Questions (FAQ)

-

What is the United States Automotive Stainless Steel Tubes Market size?The United States Automotive Stainless Steel Tubes Market size is estimated to grow at a CAGR of around 4.17% from 2025 to 2035.

-

What are the main advantages of stainless steel?Stainless steel is the preferred material in many industries due to its exceptional strength, durability, and resistance to corrosion. It is the perfect material for heavy-duty machinery, medical implants, and equipment because of its affordability, adaptability, and low maintenance needs.

-

What are the challenges of stainless steel?Stainless steel's hardness and heat resistance make it more challenging to cut than ordinary steel. The machinability of austenitic stainless steels is generally decreased by higher concentrations of chromium, nickel, and molybdenum.

-

Which type of steel is commonly used in automotive parts?The steel types utilised in the automobile sector include galvanised steel, high-strength steel, high-carbon steel, low-carbon steel, and stainless steel. Many engine and vehicle parts are made from these kinds of steel.

-

How is the market segmented by application?The market is segmented into exhaust system, motor & fuel system, structural composition

Need help to buy this report?