United States Automotive Coolant Market Size, Share, and COVID-19 Impact Analysis, By Product (Ethylene Glycol, Propylene Glycol, and Glycerin), By Technology (Inorganic Acid, Organic Acid, and Hybrid Organic Acid), and United States Automotive Coolant Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited States Automotive Coolant Market Insights Forecasts to 2035

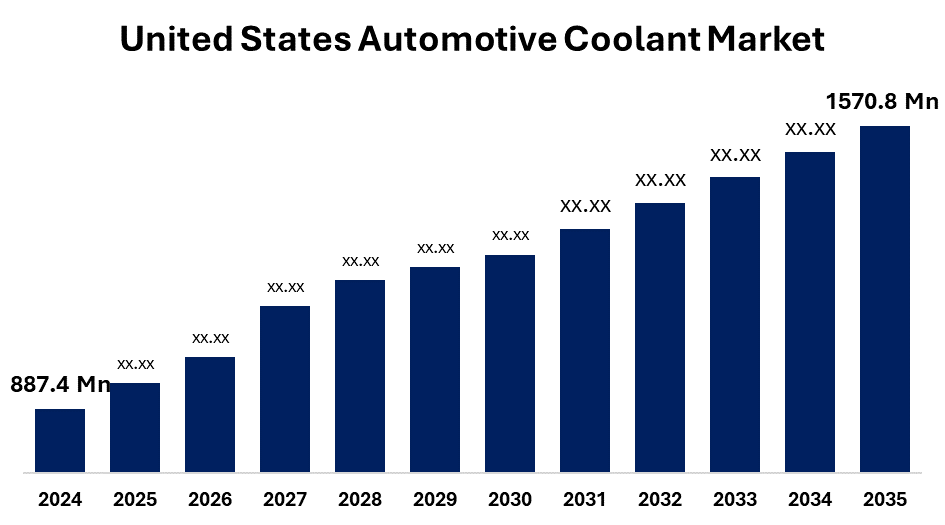

- The United States Automotive Coolant Market Size Was Estimated at USD 887.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.33% from 2025 to 2035

- The United States Automotive Coolant Market Size is Expected to Reach USD 1570.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States automotive coolant Market Size is anticipated to reach USD 1570.8 Million by 2035, Growing at a CAGR of 5.33% from 2025 to 2035. The increasing complexity of internal combustion engines, coupled with the growing adoption of hybrid and electric vehicles, necessitates advanced coolant formulations to manage thermal conditions effectively and ensure optimal performance.

Market Overview

The automotive coolant refers to maintaining the performance of the vehicle and preventing overheating of the engine, avoiding corrosion, and avoiding cold in extremely hot or cold climates. Since the automobile industry is turning from traditional internal combustion engines to electric and hybrid versions, the market is becoming an important part of the vehicle design for the automotive coolant. Due to the rigorous climate in some areas, the growing requirement of high-performance engines, and the production of vehicles, is expected to increase the market steadily. The variety of car models is a major driver of this market. Electric vehicles (EVS) now require expert coolant for battery thermal regulation, while internal combustion engine (ICES) still needs to consume a lot of coolant to control the engine temperature. A new class of non-functional, biodegradable, and thermally stable coolant has emerged as a result of this change, increasing innovation in the supply chain. In addition, environmentally safe, long-lasting coolant is a growing requirement in the US that follows to reach GHS rules. To create special formulas for consumer’s car model, OEMs are rapidly collaborating with chemical manufacturers. The demand for sophisticated, environmentally friendly, and effective coolants with an increase in global car production is constantly increasing, and consumers hold a high value on vehicle longevity. The demand for effective thermal management is estimated to drive the expansion of the market, especially in high-performance and electric vehicles.

Report Coverage

This research report categorizes the market for United States automotive coolant market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States automotive coolant market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment United States automotive coolant market.

United States Automotive Coolant Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 887.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.33% |

| 2035 Value Projection: | USD 1570.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Product, By Technology |

| Companies covered:: | Royal Dutch Shell, ExxonMobil Corporation, Chevron Philips Corporation, Sinopec, Total S.A., Kost USA, Motul, Ashland Corporation, Petronas, Sinclair Oil Corporation., Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States automotive coolant market is driven by increasing automobile manufacturing, a rise in the need for high-performance and fuel-efficient engines, and tighter pollution standards that call for sophisticated heat management systems. In addition, innovation and market growth are further supported by the growing popularity of electric and hybrid cars as well as developments in cooling technologies like liquid-cooled batteries and smart thermal systems.

Restraining Factors

The United States automotive coolant market is restrained by manufacturers serving to preserve the ability in a value-sensitive market, changes in the cost of raw materials, especially glycol-based compounds and corrosion inhibitors, impact the production cost, also Lack of knowledge about the benefits of coolant in special markets is another significant obstacle.

Market Segmentation

The United States automotive coolant market share is classified into product and technology.

- The ethylene glycol dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States automotive coolant market is segmented by product into ethylene glycol, propylene glycol, and glycerin. Among these, the ethylene glycol dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to better thermal properties and strength than the other option. Due to its low viscosity, which improves heat transfer in closed car engine systems, the category is well known. For manufacturers, ethylene glycol-based coolants are more cost-effective and efficient because they require low volume to reach the cold, similar to other options.

- The organic acid segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States automotive coolant market is segmented by technology into inorganic acid, organic acid, and hybrid organic acid. Among these, the organic acid segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Long-lasting performance properties and low environmental impacts, unlike the silicate, unlike traditional totals. OAT-based coolants are suitable for contemporary engine systems that require prolonged service intervals, as they include organic carbocyanine inhibitors, providing prolonged protection against rust and scale.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States automotive coolant market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Royal Dutch Shell

- ExxonMobil Corporation

- Chevron Philips Corporation

- Sinopec

- Total S.A.

- Kost USA

- Motul

- Ashland Corporation

- Petronas

- Sinclair Oil Corporation.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States automotive coolant market based on the below-mentioned segments:

United States Automotive Coolant Market, By Product

- Ethylene Glycol

- Propylene Glycol

- Glycerin

United States Automotive Coolant Market, By Technology

- Inorganic Acid

- Organic Acid

- Hybrid Organic Acid

Frequently Asked Questions (FAQ)

-

Q: What was the market size of the U.S. automotive coolant market in 2024?A: The U.S. automotive coolant market size was estimated at USD 887.4 million in 2024.

-

Q: What is the projected market size of the U.S. automotive coolant market by 2035?A: The market is expected to reach USD 1570.8 million by 2035.

-

Q: What is the forecasted CAGR for the U.S. automotive coolant market?A: The market is projected to grow at a CAGR of 5.33% during 2025–2035.

-

Q: What are the main product types in the U.S. automotive coolant market?A: The market is segmented by Ethylene Glycol, Propylene Glycol, and Glycerin.

-

Q: Which product segment dominated the U.S. automotive coolant market in 2024?A: Ethylene glycol dominated in 2024 due to its superior thermal properties, cost-effectiveness, and efficiency in heat transfer for closed engine systems.

-

Q: Which technology segment held the largest market share in 2024?A: The Organic Acid Technology (OAT) segment held the largest share, driven by its long-lasting performance, low environmental impact, and suitability for modern engines requiring extended service intervals.

-

Q: What factors are driving the growth of the U.S. automotive coolant market?A: Growth is driven by rising vehicle production, demand for high-performance engines, stricter emission standards, increasing EV and hybrid adoption, and innovation in advanced cooling solutions like liquid-cooled batteries and smart thermal systems.

-

Q: What factors are restraining the U.S. automotive coolant market growth?A: Restraints include fluctuating raw material costs (especially glycol compounds), price-sensitive customers, lack of awareness in some markets, and challenges in balancing cost with high-performance and eco-friendly formulations.

-

Q: Who are the key players in the U.S. automotive coolant market?A: Major companies include Royal Dutch Shell, ExxonMobil Corporation, Chevron Philips Corporation, Sinopec, Total S.A., Kost USA, Motul, Ashland Corporation, and Petronas, and Others.

Need help to buy this report?