United States Arc Welding Equipment Market Size, Share, By Gases (Argon, Helium, Hydrogen, Carbon Dioxide, Oxygen, Nitrogen, And Others), By Process (Shielded Metal Arc Welding, Gas Metal Arc Welding, Flux Core Arc Welding, Gas Tungsten Arc Welding, And Submerged Arc Welding), By Automation Level (Manual, Automatic, And Semi-Automatic), And United States Arc Welding Equipment Market Insights, Industry Trend, Forecasts to 2035.

Industry: Machinery & EquipmentUnited States Arc Welding Equipment Market Insights Forecasts to 2035

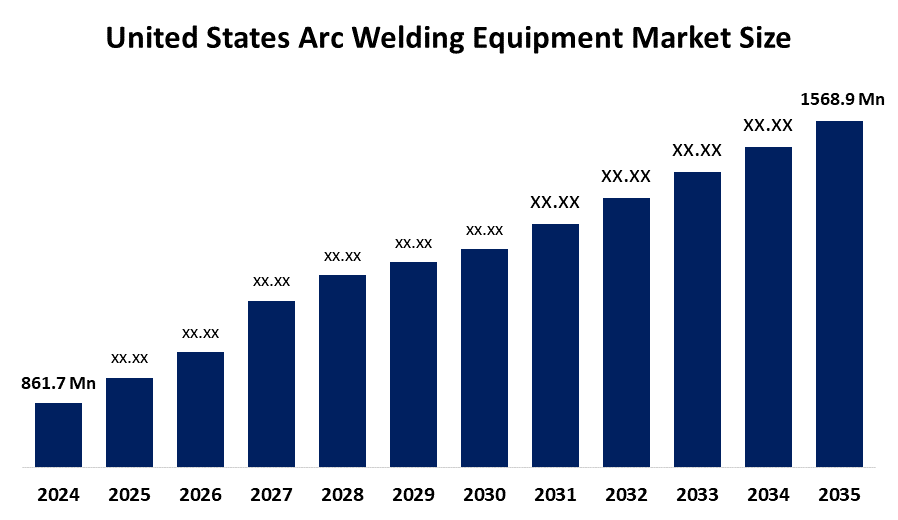

- United States Arc Welding Equipment Market Size 2024: USD 861.7 Mn

- United States Arc Welding Equipment Market Size 2035: USD 1568.9 Mn

- United States Arc Welding Equipment Market CAGR 2024: 5.6%

- United States Arc Welding Equipment Market Segments: Gases, Process, and Automation Level

Get more details on this report -

The United States arc welding equipment market is made up of tools and systems that utilize an electric arc in order to join together the various components of metallic parts. Different types of arc welding processes are included in this market like shielded metal arc welding, gas tungsten arc welding (TIG) as well as other automated and semi-automated welders. Due to being strong and versatile, and having the ability to perform numerous tasks while still being cost-effective, arc welding equipment is used in many industries including construction, automotive, aerospace, shipbuilding, energy, and general manufacturing. The trend in the market is shifting towards greater utilization of automated, digitally-enabled welding solutions.

The arc welding equipment in US are backed by government support, including the Infrastructure Investment and Jobs Act (IIJA), the federal government has provided a large amount of funding through IIJA to support the rebuilding and expansion of the physical infrastructure, including highways and streets. The United States will have a need for more than 320,000 new welders by 2029 to meet the manufacturing and industrial needs, based on industry and labour statistics. This number indicates the extent of welding activity in relation to the manufacturing, industrial and energy sectors, and this will ultimately create an indirect demand for welding equipment and automations.

As technology advances, US arc welding equipment providers are now using robotics, automation, advanced weld monitoring, and intelligent power supplies, welding machines are becoming more efficient and effective than ever. Today's modern welding machines utilize advanced sensors, automated controls, and data collection methods to ensure that the weld is made accurately, with as little waste material as possible, on every occasion. The energy-efficiency of the inverter-based welding tools is increasing rapidly because they are energy-efficient welding machines and provide better overall efficiency and performance than traditional transformer-based welding machinery.

Market Dynamics of the United States Arc Welding Equipment Market:

The United States arc welding equipment market is driven by the demand for durable metal bonding solutions, increased investment across several sectors including construction, transportation, energy, and automotive manufacturing, increased interests in 4.0 practices and digitalization, technological advancement in robotics welding and automation, reduction in labour dependency, and strong government support and policies drives the market.

The United States arc welding equipment market is restrained by the high initial investment for arc welding equipment, proliferation in adoption of technology among small enterprises, and lack of qualified and experienced welder’s compliance with environmental safety and regulations

The future of United States arc welding equipment market is bright and promising, with versatile opportunities emerging from the renewable energy, electric vehicle manufacturing and defence projects are all experiencing remarkable growth in tandem with the increased implementation of Industry 4.0 practices, smart manufacturing and technology-driven business models. Due to the increased interest in Industry 4.0 practices and digitalisation, there has been a growing need for connected welding solutions through welding technology. Also, the growing number of automated welding garments and training programs to create skilled labour is providing long-term growth opportunities for businesses that utilise and produce automated welding solutions.

United States Arc Welding Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 861.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.6% |

| 2035 Value Projection: | USD 1568.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Lincoln Electric Holdings, Inc., Miller Electric Mfg. LLC, ESAB Corporation, Illinois Tool Works Inc., Panasonic Corporation, Fronius International GmbH, Hobart Brothers LLC, OTC Daihen Inc., Voestalpine Bohler Welding Group, Air Liquide S.A., Kemppi Oy, Carl Cloos SchweiBtechnik GmbH, Telwin S.p.A., ARO Welding Technologies SAS, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United States Arc Welding Equipment Market share is classified into gases, process, and automation level.

By Gases:

The United States arc welding equipment market is divided by gases into argon, helium, hydrogen, carbon dioxide, oxygen, nitrogen, and others. Among these, the argon segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Inert shielding to form protective barrier, high quality finishes with superior weld quality, versatile with key metals, and provides a very stable electric arc and good heat transfer all contribute to the argon segment's largest share and higher spending on arc welding equipment when compared to other gases.

By Process:

The United States arc welding equipment market is divided by process into shielded metal arc welding, gas metal arc welding, flux core arc welding, gas tungsten arc welding, and submerged arc welding. Among these, the gas metal arc welding segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The gas metal arc welding segment dominates because of its speed, ease of use, versatility across many metals, and suitability for high volume industries like automotive and construction, offering cost savings and making it efficient for mass production.

By Automation Level:

The United States arc welding equipment market is divided by automation level into manual, automatic and semi-automatic. Among these, the automatic segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Increased productivity and efficiency, superior with consistent weld quality, addressing skilled labour shortage, and enhanced safety all contribute to the automatic segment's largest share and higher spending on arc welding equipment when compared to other automation level.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United States arc welding equipment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United States Arc Welding Equipment Market:

- Lincoln Electric Holdings, Inc.

- Miller Electric Mfg. LLC

- ESAB Corporation

- Illinois Tool Works Inc.

- Panasonic Corporation

- Fronius International GmbH

- Hobart Brothers LLC

- OTC Daihen Inc.

- Voestalpine Bohler Welding Group

- Air Liquide S.A.

- Kemppi Oy

- Carl Cloos SchweiBtechnik GmbH

- Telwin S.p.A.

- ARO Welding Technologies SAS

- Others

Recent Developments in United States Arc Welding Equipment Market:

In September 2025, Miller Electric Mfg. LLC. launched Auto Elite Wire Drive, engineered specifically to pair with the Auto Deltaweld and major robot arms, this system supports full auxillary power and consistent arc stability in automated settings.

In September 2025, Lincoln Electric Holdings, Inc. showcased several new products at the FABTECH 2025 event, including the AlumaFab, Aluminum Welding System, LT-10D Submerged Arc Welding Tractor, and Cooper Adapt Welding System collaborative welding solutions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the United States arc welding equipment market based on the below-mentioned segments:

United States Arc Welding Equipment Market, By Gases

- Argon

- Helium

- Hydrogen

- Carbon Dioxide

- Oxygen

- Nitrogen

- Others

United States Arc Welding Equipment Market, By Process

- Shielded Metal Arc Welding

- Gas Metal Arc Welding

- Flux Core Arc Welding

- Gas Tungsten Arc Welding

- Submerged Arc Welding

United States Arc Welding Equipment Market, By Automation Level

- Manual

- Automatic

- Semi-Automatic

Frequently Asked Questions (FAQ)

-

Q:What is the United States arc welding equipment market size?A:United States arc welding equipment market is expected to grow from USD 861.7 million in 2024 to USD 1568.9 million by 2035, growing at a CAGR of 5.6% during the forecast period 2025-2035.

-

Q:What are the key growth drivers of the market?A:Market growth is driven by the rising infrastructure development, increased manufacturing activities, and the reshoring of industrial production, growing investments in construction, transportation, energy, and automotive manufacturing are increasing demand for durable metal joining solutions, the adoption of automation and robotic welding to improve productivity, reduce labour dependency, and enhance weld quality further accelerates market growth.

-

Q:What factors restrain the United States arc welding equipment market?A:Constraints include the high initial cost of advanced welding and robotic systems, limit adoption among small and medium-sized enterprises, shortage of skilled welders and technicians, and compliance with safety and environmental regulations.

-

Q:How is the market segmented by automation level?A:The market is segmented into manual, automatic, and semi-automatic.

-

Q:Who are the key players in the United States arc welding equipment market?A:Key companies include Lincoln Electric Holdings, Inc., Miller Electric Mfg. LLC, ESAB Corporation, Illinois Tool Works Inc., Panasonic Corporation, Fronius International GmbH, Hobart Brothers LLC, OTC Daihen Inc., Voestalpine Bohler Welding Group, Air Liquide S.A., Kemppi Oy, Carl Cloos SchweiBtechnik GmbH, Telwin S.p.A., ARO Welding Technologies SAS, and Others.

-

Q:Who are the target audiences for this market report?A:The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?