United States Allergy Diagnostics Market Size, Share, and COVID-19 Impact Analysis, By Products and Services (Instruments, Consumables, and services), By Test Type (In Vivo Test and In Vitro Test), By End Use (Hospitals & Clinics, Diagnostics Laboratories, Research Institutions, and Others), and United States Allergy Diagnostics Market Insights, Industry Trend, Forecasts To 2035

Industry: HealthcareUnited States Allergy Diagnostics Market Size Insights Forecasts to 2035

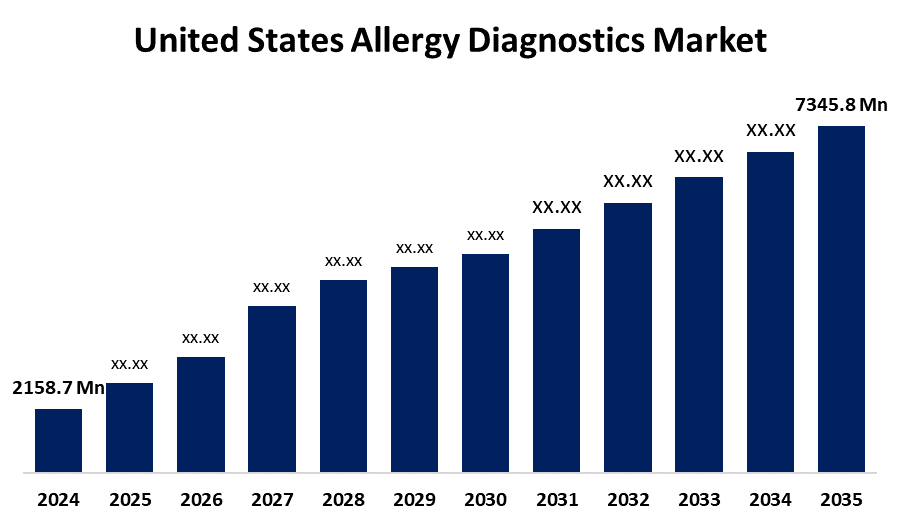

- The USA Allergy Diagnostics Market Size Was Estimated at USD 2158.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.78% from 2025 to 2035

- The USA Allergy Diagnostics Market Size is Expected to Reach USD 7345.8 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical insights Consulting, The US Allergy Diagnostics Market Size is anticipated to Reach USD 7345.8 Million by 2035, Growing at a CAGR of 11.78% from 2025 to 2035. The market growth is driven by the growing frequency of allergy problems in children and the elderly population, increased use of IVD techniques, and easier access to diagnostic equipment in the US. These are some of the key drivers propelling the market's expansion

Report Coverage

This research report categorizes the USA allergy diagnostics market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. allergy diagnostics market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US allergy diagnostics market.

United States Allergy Diagnostics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2158.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.78% |

| 2035 Value Projection: | USD 7345.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 243 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Products, By Test Type and COVID-19 Impact Analysis |

| Companies covered:: | Lincoln Diagnostics, Hycor Biomedical, Danaher Corporation, Alerchek Inc., Siemens Healthcare Diagnostics, Inc, Thermo Fisher Scientific Inc., Omega Diagnostic LLC, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factor

The US allergy diagnostics market is driven by the Increasing incidence of allergies such as rhinitis, food allergies, and asthma. Increased awareness in adoption of eclipse, improvement in access to healthcare, and development in these vitro and molecular clinical processes is boosting. The auxiliary FDA rules for allergen labeling and demand for initial, accurate diagnosis accelerate market expansion.

Restraining Factor

The US allergy diagnostics market has to face restrictions due to the high expenditure of sophisticated clinical trials, a lack of adequate insurance coverage, and a lack of qualified laboratory personnel. Additionally, the regulatory complications around laboratory developed tests LDTs obstruct adoption widely due to the regulatory complications and test accuracy, especially in small scale healthcare settings.

The United States allergy diagnostics market share is classified into products & services, test type, and end-use.

- The consumables held the largest revenue share in 2024 and are expected to grow at a substantial CAGR during the projected timeframe.

The United States allergy diagnostics market is segmented by products and services into instruments, consumables, and services. Among these, the consumables held the largest revenue share in 2024 and are expected to grow at a substantial CAGR during the projected timeframe. This is due to essential elements that are required for both in vitro and vivo tests, such as allergen extracts, assay kits, and reagents. The frequent requirement of consumable materials is driven by allergic testing, with a repeated nature in clinical settings.

- The in-vivo test segment is anticipated to grow at the fastest rate over the forecast period.

The United States allergy diagnostics market is segmented by test type into in vivo tests and in vitro tests. Among these, the in-vivo test segment is anticipated to grow at the fastest rate over the forecast period. Skin prick tests (SPT), patch tests, and intradermal tests are ready to obtain rapid traction, especially in outpatient clinics where visual evaluation of immediate reactions is possible. Clinical methods that integrate in vitro and vivo tests, with technological progress in testing devices, have improved the patient's experience and clinical accuracy.

- The hospitals & clinics held the largest share in the market in 2024 and are expected to grow at a remarkable CAGR during the forecast period.

The United States allergy diagnostics market is segmented by end-use into hospitals & clinics, diagnostics laboratories, research institutions, and others. Among these, the hospitals & clinics held the largest share in the market in 2024 and are expected to grow at a remarkable CAGR during the forecast period. The hospitals & clinics offering both clinical services and immunotherapy intervention under a roof it is a center for allergic diagnosis, management, and treatment plan. Availability of sophisticated clinical techniques and the increasing incidence of allergic disorders contribute to the ongoing expansion of this

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States allergy diagnostics market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lincoln Diagnostics

- Hycor Biomedical

- Danaher Corporation

- Alerchek Inc.

- Siemens Healthcare Diagnostics, Inc

- Thermo Fisher Scientific Inc.

- Omega Diagnostic LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. allergy diagnostics market based on the below mentioned segments:

United States Allergy Diagnostics Market, By Product

- Instruments

- Consumables

- Services

United States Allergy Diagnostics Market, By Test Type

- In Vivo Test

- In Vitro Test

United States Allergy Diagnostics Market, By End-Use

- Hospitals & Clinics

- Diagnostics Laboratories

- Research Institutions

- Others

Frequently Asked Questions (FAQ)

-

Q: What was the market size of the U.S. Allergy Diagnostics Market in 2024?A: The market size was valued at USD 2,158.7 million in 2024.

-

Q: What is the projected market size by 2035?A: It is expected to reach USD 7,345.8 million by 2035.

-

Q: What is the forecasted CAGR during 2025–2035?A: The market is anticipated to grow at a CAGR of 11.78% during the forecast period.

-

Q: What factors are driving the growth of the U.S. Allergy Diagnostics Market?A: Key drivers include the rising prevalence of allergies, increasing use of in vitro diagnostic techniques, and FDA allergen labeling regulations that improve early and accurate diagnosis.

-

Q: What are the main restraints in the market?A: High cost of advanced tests, limited insurance coverage, shortage of skilled professionals, and regulatory complexities around LDTs (laboratory-developed tests) are major restraints.

-

Q6. Which product dominated the market in 2024?A: The consumables segment held the largest revenue share, driven by repeated demand for assay kits, allergen extracts, and reagents.

-

Q: Which test type is growing fastest in the market?A: The in vivo test segment (skin prick tests, patch tests, intradermal tests) is projected to grow at the fastest rate.

-

Q: Which end-use segment accounted for the largest market share in 2024?A: Hospitals & clinics dominated the market due to integrated diagnosis, management, and treatment services.

-

Q: Which companies are key players in this market?A: Major players include Danaher Corporation, Thermo Fisher Scientific Inc., Siemens Healthcare Diagnostics, Lincoln Diagnostics, Hycor Biomedical, Alerchek Inc., and Omega Diagnostic LLC., and Others.

-

Q: What is the forecast period covered in this report?A: The report covers historical data from 2020 to 2023, with forecasts from 2025 to 2035.

Need help to buy this report?