United States Aesthetic Devices Market Size, Share, By Device Type (Energy-Based Devices And Non-Energy-Based Devices), By Application (Skin Resurfacing & Tightening, Body Contouring & Cellulite Reduction, Hair Removal, And Others), And United States Aesthetic Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Aesthetic Devices Market Insights Forecasts to 2035

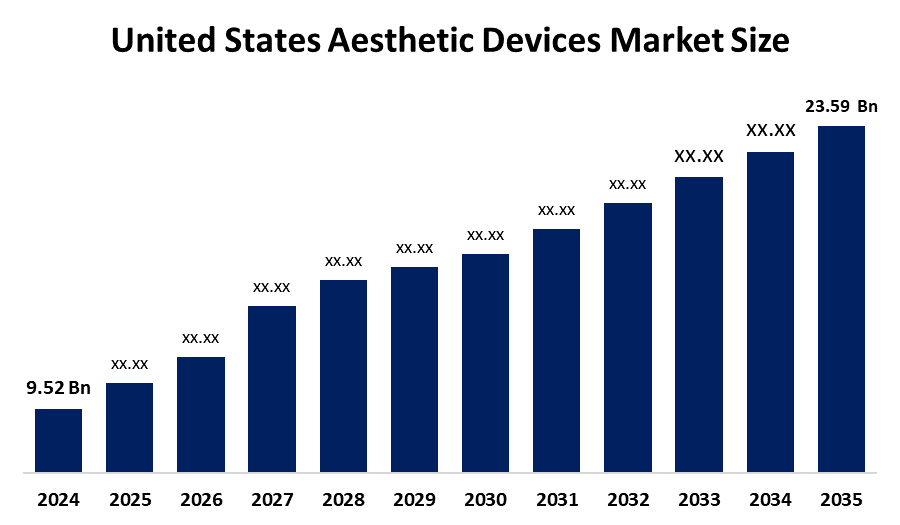

- United States Aesthetic Devices Market Size 2024: USD 9.52 Bn

- United States Aesthetic Devices Market Size 2035: USD 23.59 Bn

- United States Aesthetic Devices Market CAGR 2024: 8.6%

- United States Aesthetic Devices Market Segments: Device Type and Application

Get more details on this report -

The United States Aesthetic Devices Market Size represents the economic environment that encompasses the manufacturing, selling and use of medical devices that are specifically made for aesthetic enhancement procedures, on many different platforms including laser, radio frequency, intense pulse light (IPL), and ultrasound, body contouring devices, and other non-invasive and minimally invasive treatment technologies, used in dermatology practices, medical spas, and cosmetic surgery centers. As the trend of offering non-invasive and less-invasive options continues to grow, many clinics have expanded their services and patients are beginning to view these procedures as self-care rather than luxury.

The aesthetic devices in US are backed by government support, including the U.S. Food and Drug Administration (FDA) for medical device clearance, including aesthetic devices. United States accounts for a substantial share of global aesthetic procedures and devices consumption approximately 40 % of the global aesthetics market, reflecting both high awareness and willingness to invest in cosmetic enhancements, underscoring how deeply integrated aesthetic procedures have become into U.S. healthcare and lifestyle sectors,

As technology advances, US aesthetic devices providers are now using artificial intelligence, robotics and multi-modal platform technologies into future generations of devices, continue to allow for improved precision and personalization of aesthetic treatment and improved patient outcomes. The rapid advancements in energy-based devices like improvement of the laser wavelength, development of next-generation radio frequency devices, and addition of integrated imaging capabilities enables practitioners to expand treatments.

United States Aesthetic Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.52 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 8.6% |

| 2035 Value Projection: | USD 23.59 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Device Type ,By Application |

| Companies covered:: | AbbVie, Cynosure, Lumenis, Bausch Health, Alma Lasers, Candela Medical, Cutera, Sciton, InMode, Merz Pharma, Galderma, Venus Concept, Lutronic Corp, Hologic Inc., Johnson & Johnson, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the United States Aesthetic Devices Market:

The United States Aesthetic Devices Market Size is driven by the rising demand for non-invasive and minimally invasive aesthetic procedures, propelled by consumer preferences for treatments that offer noticeable results, decreased risks and downtime associated with surgery, aging population seeking anti-aging solutions, social media and celebrity influence, and increasing availability of financing options and flexible payment plans

The United States Aesthetic Devices Market Size is restrained by the high cost of advanced aesthetic devices and procedures, lack of insurance reimbursement for cosmetic services, stringent regulatory approval processes, and continuing concerns around procedural safety and potential adverse events challenges.

The future of United States Aesthetic Devices Market Size is bright and promising, with versatile opportunities emerging from the AI-enabled customized experiences, the expansion of home-based and OTC devices, growing application of body contouring devices, expanding consumer demographics continued improvements in device utilization, an increase in the amount of capital investment into the aesthetic device space, and an increase in the number and types of distribution channels will provide opportunities for continued growth in the marketplace while also attracting further investment and moving into the area of health and wellness.

Market Segmentation

The United States Aesthetic Devices Market share is classified into device type and application.

By Device Type:

The United States Aesthetic Devices Market Size is divided by device type into energy-based devices and non-energy-based devices. Among these, the energy-based devices segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Versatile applications, strong consumer preference for convenient and safe procedures, technological advancements, growing focus on wellness, and increasing disposable incomes all contribute to the energy-based devices segment's largest share and higher spending on aesthetic devices when compared to other device type.

By Application:

The United States Aesthetic Devices Market Size is divided by application into skin resurfacing & tightening, body contouring & cellulite reduction, hair removal, and others. Among these, the skin resurfacing & tightening segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The skin resurfacing & tightening segment dominates because of high consumer demand for anti-aging, minimally invasive preference fueling adoption of devices like RF microneedling, technological advancements, and versatile application among consumer in US.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United States Aesthetic Devices Market Size , along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United States Aesthetic Devices Market:

- AbbVie

- Cynosure

- Lumenis

- Bausch Health

- Alma Lasers

- Candela Medical

- Cutera

- Sciton

- InMode

- Merz Pharma

- Galderma

- Venus Concept

- Lutronic Corp

- Hologic Inc.

- Johnson & Johnson

- Others

Recent Developments in United States Aesthetic Devices Market:

In May 2025, Teoxane launched its dermocosmetics line directly to consumers online in the United States, broadening access beyond aesthetic professionals and moving beyond just dermal fillers.

In October 2024, Tiger Aesthetic Medical, LLC acquired BellaFill (a biostimulatory dermal filler) from Suneva Medical, expanding their regenerative aesthetics portfolio.

In March 2024, Allergan Aesthetics received FDA approval for Juvederm Voluma XC for treating moderate to severe temple hollowing, a first for HA fillers, with significant patient improvement.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the United States Aesthetic Devices Market Size based on the below-mentioned segments:

United States Aesthetic Devices Market, By Device Type

- Energy-Based Devices

- Non-Energy-Based Devices

United States Aesthetic Devices Market, By Application

- Skin Resurfacing & Tightening

- Body Contouring & Cellulite Reduction

- Hair Removal

- Others

Frequently Asked Questions (FAQ)

-

What is the United States aesthetic devices market size?United States aesthetic devices market is expected to grow from USD 9.52 billion in 2024 to USD 23.59 billion by 2035, growing at a CAGR of 8.6% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the rising demand for non-invasive and minimally invasive aesthetic procedures, propelled by consumer preferences for treatments that offer noticeable results, decreased risks and downtime associated with surgery, aging population seeking anti-aging solutions, social media and celebrity influence, and increasing availability of financing options and flexible payment plans

-

What factors restrain the United States aesthetic devices market?Constraints include the high cost of advanced aesthetic devices and procedures, lack of insurance reimbursement for cosmetic services, stringent regulatory approval processes, and continuing concerns around procedural safety and potential adverse events challenges.

-

How is the market segmented by device type?The market is segmented into energy-based devices and non-energy-based devices.

-

Who are the key players in the United States aesthetic devices market?Key companies include AbbVie, Cynosure, Lumenis, Bausch Health, Alma Lasers, Candela Medical, Cutera, Sciton, InMode, Merz Pharma, Galderma, Venus Concept, Lutronic Corp, Hologic Inc., Johnson & Johnson, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?