United States 3D Medical Imaging Devices Market Size, Share, and COVID-19 Impact Analysis, By Device Type (Hardware and Software), By Hardware (X-ray Devices, CT Devices, Ultrasound Systems, and MRI Equipment), By End Use (Hospitals and Diagnostic Imaging Centers), and United States 3D Medical Imaging Devices Market Insights, Industry Trend, Forecasts To 2035

Industry: HealthcareUnited States 3D Medical Imaging Devices Market Insights Forecasts To 2035

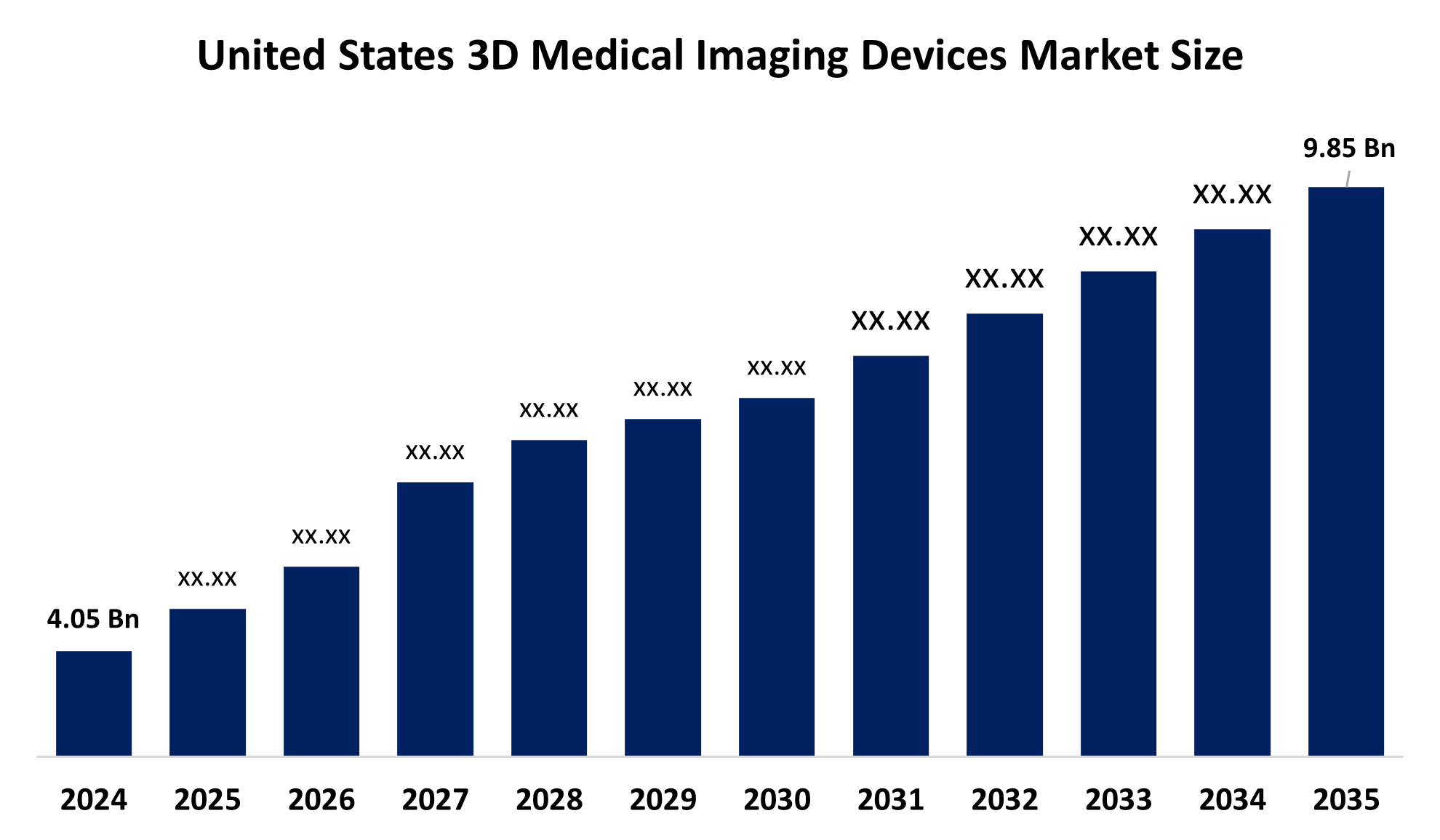

- The United States 3D Medical Imaging Devices Market Size Was Estimated at USD 4.05 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.41% from 2025 to 2035

- The United States 3D Medical Imaging Devices Market Size is Expected to Reach USD 9.85 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States 3D Medical Imaging Devices Market Size is Anticipates to Reach USD 9.85 Billion by 2035, Growing at a CAGR of 8.41% from 2025 to 2035. The United States 3D medical imaging devices market is being driven by an increasing prevalence of long-term diseases, rising preference for procedures that are less invasive, innovations in technology, and an aging population.

Market Overview

3D medical imaging is an innovative optical imaging technique that displays increased images inside the human body, and can be used for medical examination purposes. 3D medical imaging technologies are upgraded to clinical technologies to provide three-dimensional visual performance of the body, tissues, bones, and vascular structures, such as internal body structures. 3D technologies provide deepening and different viewing angles, providing more complete and accurate information to health workers about the condition of a patient, compared to traditional two-dimensional imaging. These technologies use methods such as calculation tomography (CT), magnetic resonance imaging (MRI), ultrasound, positron emission tomography (PET), and 3D mammography, and have often been extended or featured by computer-aided design and artificial intelligence for reconstruction and analysis. One of the major objectives of 3D medical imaging is to improve the accuracy of diagnosis, treatment plan and surgical intervention. Generally, the use of 3D technologies will help physicians to imagine discrepancies, monitor the development of the disease, and plan minimal invasive intervention with better confidence and surgical results. The advances added to imaging technologies have made 3D imaging rapidly expedient, accurate, and less aggressive. The current technology that is out supports better workflows to use digital processing, cloud storage, and AI analytics, and increases decision-making for the patient's benefits.

Report Coverage

This research report categorizes the United States 3D medical imaging devices market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States 3D medical imaging devices market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States 3D medical imaging devices market.

United States 3D Medical Imaging Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 4.05 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.41% |

| 2035 Value Projection: | USD 9.85 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Device Type, By Hardware, By End Use |

| Companies covered:: | Siemens Healthineers AG, Esaote SPA, Koninklijke Philips N.V., GE Healthcare, CANON MEDICAL SYSTEMS CORPORATION, Hitachi High-Tech Corporation, Shimadzu Corporation, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

The United States 3D medical imaging devices market is driven by the increasing proliferation of chronic diseases, and the demand for initial and accurate diagnosis is high. Increased advances and minimally invasive procedures and favorable healthcare investment in AI and imaging, as well as increasing use in oncology, cardiology, neurology, and orthopedics, are being made, leading to better patient results and efficiency in clinical practice.

Restraining Factor

The United States 3D medical imaging devices market has to face restrictions due to high capital expenditure, strict regulatory approval, a limited supply of trained experts, and radiation risk in certain types of races to implement the 3D medical imaging system. Operating complexity and equipment maintenance costs create additional obstacles for wide adoption, especially because some industries are sensitive.

The United States 3D medical imaging devices market share is classified into device type, hardware, and end use.

- The hardware segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United States 3D medical imaging devices market is segmented by device type into hardware and software. Among these, the hardware segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is due to all medical imaging equipment containing hardware components, as these components are essential for any technology, including MRI machines, CT scanners, and ultrasound devices. These major components play an important role in medical imaging, and healthcare organizations invest in hardware components to provide the best results for patients.

- The X-ray devices segment is projected to grow at the fastest CAGR over the forecast period.

The United States 3D medical imaging devices market is segmented by packaging into X-ray devices, CT devices, ultrasound systems, and MRI equipment. Among these, the X-ray devices segment is projected to grow at the fastest CAGR over the forecast period. The X-ray technique is a major component for many clinical applications, including image-guided surgical processes, especially with traditional systems such as C-arms that provide real-time imaging during the process. Additionally, technological progresses such as digital radiography, flat panel detectors, and small arms has helped improve the quality and image of X-rays, which is useful for clinical diagnosis to improve X-ray machines.

- The hospital segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the projected timeframe.

The United States 3D medical imaging devices market is segmented by end use into hospitals and diagnostic imaging centers. Among these, the hospital segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the projected timeframe. Hospitals are the relevant final users of 3D medical imaging technologies, providing clinical, medical, and surgical services. These devices play an important role in identifying and monitoring various health conditions, including cancer, cardiovascular, orthopedic, and neurological disorders, enabling hospitals to provide comprehensive healthcare services.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States 3D medical imaging devices market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Siemens Healthineers AG

- Esaote SPA

- Koninklijke Philips N.V.

- GE Healthcare

- CANON MEDICAL SYSTEMS CORPORATION

- Hitachi High-Tech Corporation

- Shimadzu Corporation

- Others

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States 3D medical imaging devices market based on the below-mentioned segments:

United States 3D Medical Imaging Devices Market, By Device Type

- Hardware

- Software

United States 3D Medical Imaging Devices Market, By Hardware

- X-ray Devices

- CT Devices

- Ultrasound Systems

- MRI Equipment

United States 3D Medical Imaging Devices Market, By End Use

- Hospitals

- Diagnostic Imaging Centers

Frequently Asked Questions (FAQ)

-

1. What is the market size of the United States 3D medical imaging devices market in 2024?The market size was estimated at USD 4.05 billion in 2024.

-

2. What is the projected United States 3D medical imaging devices market size by 2035?The market is expected to reach USD 9.85 billion by 2035.

-

3. What is the expected CAGR for the United States 3D medical imaging devices market during 2025–2035?The market is projected to grow at a CAGR of 8.41%.

-

4. What are the main driving factors of the United States 3D medical imaging devices market?Key drivers include the rising prevalence of chronic diseases, demand for early and accurate diagnosis, growing adoption of minimally invasive procedures, healthcare investments, and technological advancements in AI-powered imaging.

-

5. Key drivers include the rising prevalence of chronic diseases, demand for early and accurate diagnosis, growing adoption of minimally invasive procedures, healthcare investments, and technological advancements in AI-powered imaging.High capital costs, stringent regulatory approvals, shortage of skilled professionals, radiation risks in some modalities, and high maintenance costs are major restraints.

-

6. Which segment dominated the United States 3D medical imaging devices market by device type in 2024?The hardware segment dominated due to the essential role of equipment like MRI machines, CT scanners, ultrasound systems, and X-ray devices.

-

7. Which hardware segment is projected to grow at the fastest CAGR?The X-ray devices segment is expected to grow the fastest, driven by advancements in digital radiography, flat panel detectors, and real-time imaging systems.

-

8. Which end-use segment dominated the United States 3D medical imaging devices market in 2024?The hospital segment dominated, as hospitals are primary users of advanced imaging technologies for diagnosis, treatment planning, and surgeries.

-

9. What role does AI play in 3D medical imaging?AI improves image reconstruction, accelerates diagnostics, reduces errors, and enhances workflow efficiency through automated analytics and cloud integration.

-

10. Who are the major players in the United States 3D medical imaging device market?Key companies include Siemens Healthineers, Philips, GE Healthcare, Canon Medical Systems, Hitachi High-Tech, Esaote, Shimadzu Corporation, and others.

Need help to buy this report?