United Kingdom Vodka Market Size, Share, By Type (Flavored, Non-Flavored), By Distribution Channel (On-Trade, Off-Trade), United Kingdom Vodka Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesUnited Kingdom Vodka Market Size Insights Forecasts to 2035

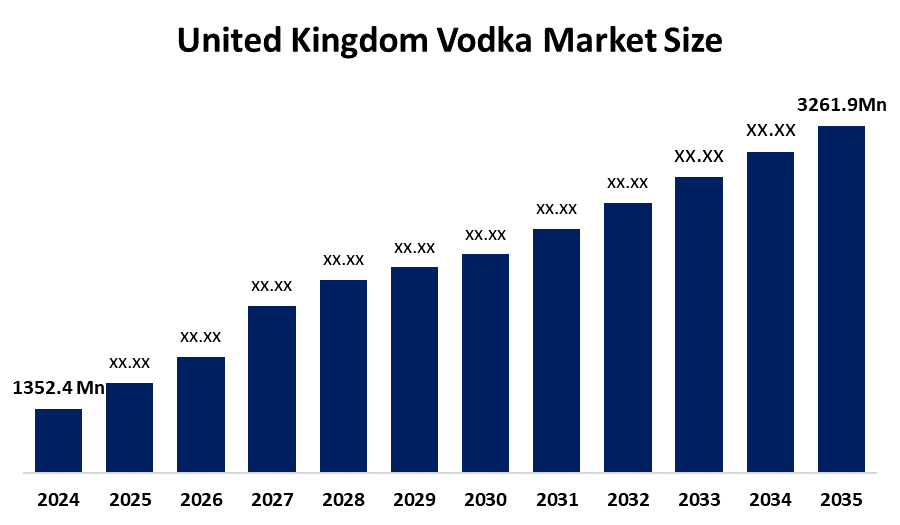

- United Kingdom Vodka Market Size 2024: USD 1352.4 Million

- United Kingdom Vodka Market Size 2035: USD 3261.9 Million

- United Kingdom Vodka Market CAGR 2024: 8.33%

- United Kingdom Vodka Market Segments: Type and Distribution channel

Get more details on this report -

The Market For The Vodka In The United Kingdom Is Growing Steadily Due To Its Higher Demand For The Premium Or Craft Vodka, Innovative Flavor Infusions, And The Low Alcohol Or Health-Focused Vodka. The high level of drinking in urban areas, changing consumer demands, and the healthy competition among local distilleries and overseas companies are the driving factors behind this growing market for vodka. Moreover, strict government regulations with regard to the production, labeling, advertisement, and sale of alcohol also sustain a competitive yet regulated market for local as well as overseas vodka manufacturers.

The vodka market in the UK is expected to continue growing, mainly due to fast urban consumption, increased disposable incomes of people, and the shift in consumer preference to premium, flavored, and low-ABV vodka variants. It is, therefore, a market place characterised by the premium and craft vodka segments, abetted by a stern government regulatory framework that encourages quality, authenticity, and responsible production standards. The segment of premium and specialty vodka is growing rapidly as brands are diversifying into this segment, unique marketing strategies are being employed to attract consumers, and most importantly, advanced distillation technologies are embraced, including AI-enabled quality monitoring, sustainable production processes, and eco-friendly packaging solutions that enhance the competitive and constantly evolving spirits market in the UK.

United Kingdom Vodka Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1352.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.33% |

| 2035 Value Projection: | USD 3261.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Companies covered:: | AppsSignify (Philips Lighting), LEDVANCE GmbH (MLS Co Ltd), Thorn Lighting Ltd (Zumtobel Group), FW Thorpe plc (Thorlux Lighting), Dialight plc, Aurora Lighting Group, Whitecroft Lighting, Luceco plc, Dextra Lighting Ltd, Crompton Lamps Limited, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the United Kingdom Vodka Market

The United Kingdom vodka industry is driven with a large and affluent population that highly emphasizes trends. Also, stringent government policies regarding vodka quality and responsible consumption of vodka are taking place. The demand for premium vodka styles, including flavored vodka styles, and crafts is rising due to the increased demand from the middle class. The younger generations want to experience experimental vodka styles. The industry is gradually moving from traditional vodka styles to innovation-driven vodka styles. This move allows vodka producers to increase their engagement levels by adding premium bars and e-commerce throughout the United Kingdom vodka industry. In addition, increased investments in artificial intelligence and distillation technologies are providing opportunities to expand this changing vodka industry.

The United Kingdom vodka market faces several restraints, including strict government regulations related to alcohol production, labeling, advertising, and distribution, along with strong compliance requirements. Intense competition among established global brands and emerging craft distilleries also challenges market expansion.

The future trends in the vodka industry in United Kingdom appear bright and promising. This is due to innovations, premium trends, and changing consumption patterns. Flavored Vodka with lower alcohol content and limited edition vodka are opening up new avenues. Smart distillation technology, AI-fermentation, digitalized quality control, sustainable production, and supply chain enhancement are making the UK’s vodka industry more efficient, legitimate, and consumer-centric. The efforts being made by the government are supplemented by environmental sustainability, quality, and consumption patterns in United Kingdom, thereby making the vodka industry attractive to new and old producers who are focusing on innovations and production enhancement to appeal to young and health-conscious consumers.

Market Segmentation

The United Kingdom vodka market share is classified into type and distribution channel.

By type

The United Kingdom Vodka market is divided by type into flavored, non-flavored. Among these, the non-flavored segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because the non-flavored vodka's dominance is its neutral taste, which makes it the preferred, versatile base for a wide range of cocktails, including favourites like the Martini, Bloody Mary, and Vodka Soda.

By Distribution Channel

The United Kingdom Vodka market is divided by distribution channel into on-trade, off-trade. Among these, the off-trade segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because the consumers often opt for the affordability and convenience of purchasing vodka from supermarkets, which often run promotions, over higher-priced on-trade venues.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom vodka market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom Vodka Market

- Diageo

- Pernod Ricard (Absolut)

- Bacardi Limited (Grey Goose)

- Au Vodka

- Russian Standard

- Sipsmith

- Chase Distillery

- J.J. Whitley

- BrewDog Distilling Co

- Others

Recent Developments in United Kingdom Vodka Market

In June 2024, Mikolasch Vodka was revived and launched by Origen X Group, marking the return of the historic Ukrainian brand to international markets, including the UK, strengthening competition in the premium vodka segment across channels.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom vodka market based on the below-mentioned segments

United Kingdom Vodka Market, By Type

- Flavored

- Non-Flavored

United Kingdom Vodka Market, By Distribution Channel

- On-Trade

- Off-Trade

Frequently Asked Questions (FAQ)

-

Q: What is the United Kingdom vodka market size?A: United Kingdom vodka market is expected to grow from USD 1352.4 million in 2024 to USD 3261.9 million by 2035, growing at a CAGR of 8.33% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven with a large and affluent population that highly emphasizes trends.

-

Q: What factors restrain the United Kingdom vodka market?A: Constraints include the strict government regulations related to alcohol production, labeling, advertising, and distribution, along with strong compliance requirements. Intense competition among established global brands and emerging craft distilleries also challenges market expansion.

-

Q: Who are the key players in the United Kingdom vodka market?A: Key companies include Diageo (Smirnoff, Ketel One, Cîroc), Pernod Ricard (Absolut), Bacardi Limited (Grey Goose), Au Vodka, Russian Standard, Sipsmith, Chase Distillery, J.J. Whitley, BrewDog Distilling Co., and Others.

Need help to buy this report?