United Kingdom Smart TV Market Size, Share, By Resolution (4K UHD TV, HDTV, Full HD TV, 8K TV), By Operating System (Android, Tizen, WebOS, Roku, and Others), By Screen Shape (Flat and Curved), and United Kingdom Smart TV Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsUnited Kingdom Smart TV Market Insights Forecasts to 2035

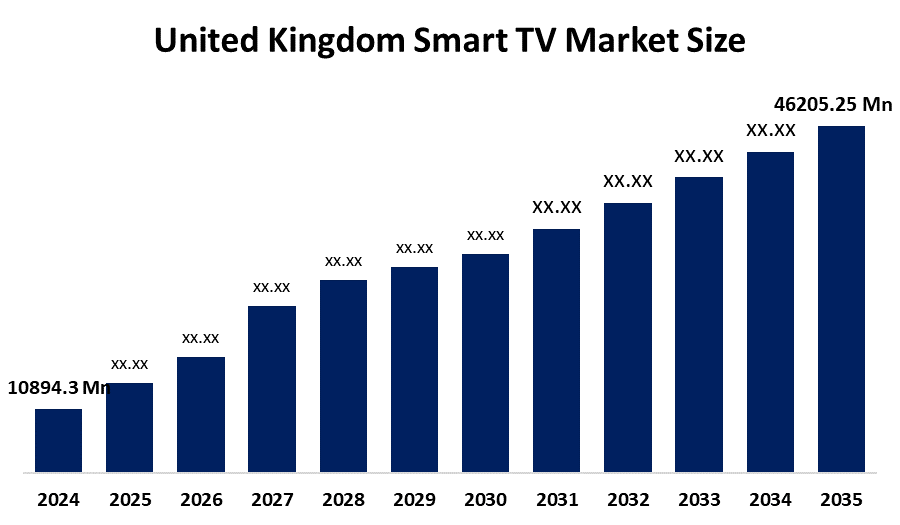

- United Kingdom Smart TV Market Size 2024: USD 10894.3 Mn

- United Kingdom Smart TV Market Size 2035: USD 46205.25 Mn

- United Kingdom Smart TV Market CAGR: 14.04%System, and Screen Shape

Get more details on this report -

The market for smart TVs in the UK is still expanding as more people switch from standard broadcast TVs to internet-connected smart TVs due to the popularity of streaming services and increased Internet penetration. IPTV adoption is further supported by the fact that most families currently have internet capable primary TV sets, and predictions indicate that by 2030, almost all UK homes will have access to gigabit capable networks.

The UK is actively enhancing its digital infrastructure from a governmental and policy standpoint. The goal of projects like the growth of gigabit and superfast internet is to guarantee that by 2025, at least of homes will have access to top tier networks, enabling smooth streaming on smart TVs. A government organization called Building Digital UK BDUK seeks to close the digital gap that may restrict access to connected TV services by expanding broadband coverage to rural and underserved areas.

The advent of next-generation IPTV services like Freely, a free-to-air internet TV service introduced by public broadcasters that combines live and on-demand programming into a single interface on compatible smart TVs, is technologically advancing smart TV platforms. These developments are improving user experiences and speeding up the adoption of smart TVs in the UK market, especially when combined with AI enhanced displays, voice control, and app ecosystems.

Market Dynamics of the United Kingdom Smart TV Market:

The United Kingdom smart TV market is experiencing steady growth, driven by rising consumer demand for advanced home entertainment systems and widespread adoption of high-speed broadband services. The demand for televisions with internet access has increased dramatically as streaming services like Netflix, Amazon Prime Video, Disney+, and BBC iPlayer have been more widely used. Technological developments like as OLED and QLED screens, 4K and 8K resolution, voice assistants, AI powered image improvement, and smart home integration all contribute to the market's growth.

However, the United Kingdom smart TV market faces certain restraints. Rapid expansion is constrained by price sensitivity, complex replacement cycles, and market saturation in metropolitan families. Mass adoption is further hampered by the high price of premium models like OLED and 8K TVs. Trust among customers may also be hampered by worries about data privacy, cybersecurity threats, and incompatibilities with developing applications.

Despite these challenges, significant opportunities exist. New revenue sources are produced by the proliferation of ad-supported streaming services FAST channels, integration with IoT devices, gaming optimization features, and the growing need for connected ecosystems. The rise in demand for energy efficient, AI enabled smart TVs and the rise of broadband only platforms like Freely are anticipated to create profitable development opportunities over the course of the forecast period.

United Kingdom Smart TV Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 10894.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 14.04% |

| 2035 Value Projection: | USD 46205.25 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Resolution,By Screen Shape |

| Companies covered:: | Samsung Electronics,LG Electronics,Panasonic UK,Hisense UK Limited And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom smart TV market share is classified into resolution, operating system, and screen shape.

By Resolution:

By resolution, the United Kingdom smart TV market is categorized into 4K UHD TV, HDTV, full HD TV, 8K TV. Among these, the 4K UHD TV segment held the largest market share in 2024 and is expected to grow at a remarkable rate over the forecast period. Growing customer preferences for better picture quality, improved viewing experiences, and the expansion of 4K content availability on streaming services like Netflix, Amazon Prime Video, and Disney+ are all factors contributing to the domination of 4K UHD TVs.

By Operating System:

Based on the operating system, the United Kingdom smart TV market is divided into android, tizen, webOS, roku, and others. Among these, the tizen segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. The main reason for Tizen's domination in the UK television industry is Samsung's robust presence, as the company incorporates its in-house Tizen OS into a variety of its smart TV models.

By Screen Shape:

The United Kingdom smart TV market is classified by screen shape into flat and curved. Among these, the flat segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The dominance of flat TVs is primarily driven by their affordability, wide availability across different price ranges, and compatibility with various room sizes and wall-mounting preferences. Flat-screen models are preferred by UK consumers because of their elegant appearance, improved viewing angles, and adaptability to both home and business environments.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom smart TV market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the United Kingdom Smart TV Market:

- Samsung Electronics

- LG Electronics

- Sony Europe BV

- Panasonic UK

- Hisense UK Limited

- Hitachi, Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom smart TV market based on the following segments:

United Kingdom Smart TV Market, By Resolution

- 4K UHD TV

- HDTV

- Full HD TV

- 8K TV

United Kingdom Smart TV Market, By Operating System

- Android

- Tizen

- WebOS

- Roku

- Others

United Kingdom Smart TV Market, By Screen Shape

- Flat

- Curved

Frequently Asked Questions (FAQ)

-

1. What is the projected market size of the UK smart TV market by 2035?The market is expected to reach USD 46,205.25 million by 2035, growing from USD 10,894.3 million in 2024.

-

2. What is the expected CAGR during the forecast period?The market is projected to grow at a CAGR of 14.04% during 2025–2035.

-

3. What are the key growth drivers of the market?Major drivers include rising streaming service adoption, broadband expansion, AI-enabled features, smart home integration, and technological advancements such as OLED and QLED displays.

-

4. Who are the key players in the UK smart TV market?Leading companies include Samsung Electronics, LG Electronics, Sony Europe, Panasonic UK, Hisense UK, Philips Electronics, TCL Electronics, Sharp, and Hitachi.

Need help to buy this report?