United Kingdom Skin Cancer Diagnostics Market Size, Share, By Cancer Type (Melanoma, Non-Melanoma), By Test Type (Dermatoscopy, Skin Biopsy, Lymph node biopsy, Imaging Tests, and Others), By End Use (Hospitals and Clinics, Laboratories, and Others), and United Kingdom Skin Cancer Diagnostics Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Skin Cancer Diagnostics Market Insights Forecasts to 2035

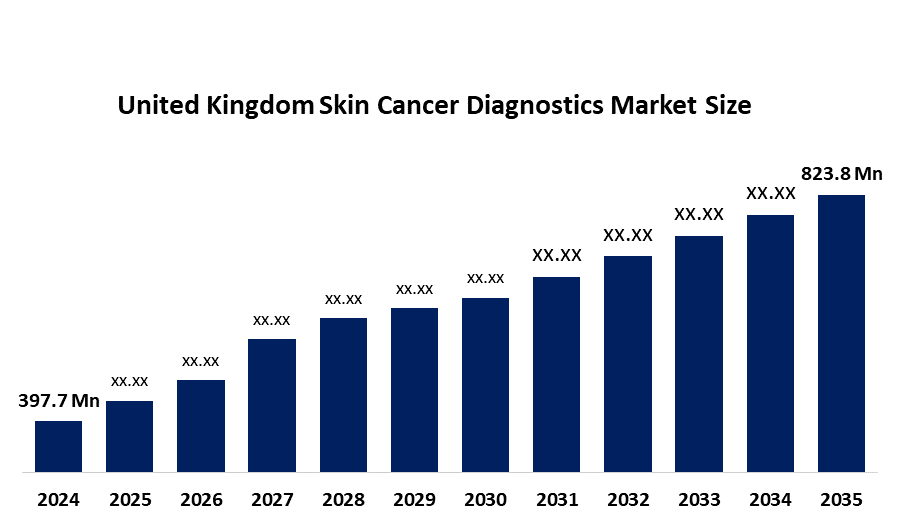

- United Kingdom Skin Cancer Diagnostics Market Size 2024: USD 397. 7 Million

- United Kingdom Skin Cancer Diagnostics Market Size 2035: USD 823.8 Million

- United Kingdom Skin Cancer Diagnostics Market CAGR: 6.89%

- United Kingdom Skin Cancer Diagnostics Market Segments: Cancer Type, Test Type, and End Use

Get more details on this report -

The United Kingdom Skin Cancer Diagnostics Market has witnessed steady growth, supported by Strong healthcare infrastructure, rising skin cancer incidence, and growing desire for early and precise detection. Hospitals and dermatology clinics remain the primary end-users, driven by patient volume and advanced diagnostic capabilities. Due to its more frequent occurrence, non-melanoma skin cancers still account for the biggest share, and sophisticated genetic and imaging tools aid in the diagnosis of melanoma.

Government initiatives play a pivotal role in shaping the market. Early cancer diagnosis has been given top priority by the UK government and NHS through national screening programs and the NHS Long Term Plan, which aims to shorten cancer waiting times and increase the use of digital health solutions. Additionally, NICE has released guidelines that encourage the use of AI-based diagnostic tools, such as autonomous lesion assessment systems, which will help NHS trusts adopt these tools more widely.

Developments in technology are revolutionizing the diagnosis of skin cancer. Digital dermatoscopy, optical coherence tomography (OCT), and reflectance confocal microscopy are examples of non-invasive imaging methods that improve lesion visualization and diagnostic precision. To minimize needless referrals and speed up diagnosis, digital dermatology platforms and AI-driven tools are being used more frequently to triage lesions in primary care.

Market Dynamics of the United Kingdom Skin Cancer Diagnostics Market:

The market for skin cancer diagnostics in the UK is fueled by a number of factors, including the growing incidence of the disease, advancements in technology, and favorable healthcare regulations. The primary contributor is the increasing incidence of melanoma and non-melanoma skin cancers, which are primarily triggered by changes in lifestyle, increased sunlight exposure, and the advancing age of the population. The need for precise and prompt diagnostic solutions is further increased by rising public awareness, nationwide screening programs, and the NHS's strong emphasis on early cancer identification. Additionally, advancements in AI-based diagnostics, dermatoscopy, imaging technologies, and molecular testing are improving diagnostic accuracy while reducing clinician workload.

Despite strong growth prospects, the market faces certain restraints. Adoption might be hampered by the high cost of specialized testing supplies, the scarcity of qualified dermatologists, and difficulties with funding for cutting-edge AI-enabled technology. Barriers also include data privacy issues and the complexity of regulations pertaining to AI medical devices, especially when the NHS is using these technologies widely.

The market presents significant opportunities for innovation and expansion. Significant development potential can be found in the expansion of remote dermatology services, the application of non-invasive diagnostic testing, and the growing integration of artificial intelligence in primary care and community clinics. The UK skin cancer diagnostics ecosystem is anticipated to benefit from new product releases, collaborations, and technological breakthroughs as a result of government initiatives to shorten cancer waiting times and continuous investments in digital health infrastructure.

United Kingdom Skin Cancer Diagnostics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 397. 7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.89% |

| 2035 Value Projection: | USD 823.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Cancer Type, By Test Type |

| Companies covered:: | Skin Analytics, Michelson Diagnostics Ltd, Randox (Diagnostics Division), Roche Diagnostics (F. Hoffmann-La Roche Ltd.), Thermo Fisher Scientific, Illumina, Inc., QIAGEN N.V., NeoGenomics Laboratories, Castle Biosciences, DermTech, Inc., Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom skin cancer diagnostics market share is classified into cancer type, test type, and end use.

By Cancer Type:

On the basis of cancer type, the United Kingdom skin cancer diagnostics market is categorized into melanoma and non-melanoma. Among these, the non-melanoma segment held the largest market share in 2024 and is expected to grow at a remarkable rate over the forecast period. This dominance is driven by its high prevalence and frequent diagnostic screening. Rising awareness, health programs, and growing use of non-invasive diagnostic technologies are major contributors to this segment's impressive growth over the forecast period.

By Test Type:

Based on test type, the United Kingdom skin cancer diagnostics market is divided into dermatoscopy, skin biopsy, lymph node biopsy, imaging tests, and others. Among these, the dermatoscopy segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. This dominance is attributed to dermatoscopy's extensive use as a non-invasive, first-line diagnostic method, its high accuracy in assessing lesions early on, and its growing use by primary care physicians and dermatologists throughout the United Kingdom.

By End Use:

The United Kingdom skin cancer diagnostics market is classified by end use into hospitals and clinics, laboratories, and others. Among these, the hospitals and clinics segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. This growth is driven by the high patient footfall in hospital settings, the availability of advanced diagnostic infrastructure, increasing integration of AI-based and imaging diagnostics, and the central role of NHS hospitals and dermatology clinics in early detection and treatment pathways.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom skin cancer diagnostics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the United Kingdom Skin Cancer Diagnostics Market:

- Skin Analytics

- Michelson Diagnostics Ltd

- Randox (Diagnostics Division)

- Roche Diagnostics (F. Hoffmann-La Roche Ltd.)

- Thermo Fisher Scientific

- Illumina, Inc.

- QIAGEN N.V.

- NeoGenomics Laboratories

- Castle Biosciences

- DermTech, Inc.

- Others

Recent Developments in the United Kingdom Skin Cancer Diagnostics Market:

- In April 2025, British health-tech company Skin Analytics secured EURO 15 million in Series B funding, led by Intrepid Growth Partners. Funding will enable its AI skin cancer detection technology (DERM) to be expanded globally (to the US, Europe, and Australia) and its product line to be expanded beyond skin cancer.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom skin cancer diagnostics market based on the following segments:

United Kingdom Skin Cancer Diagnostics Market, By Cancer Type

- Melanoma

- Non-Melanoma

United Kingdom Skin Cancer Diagnostics Market, By Test Type

- Dermatoscopy

- Skin Biopsy

- Lymph node biopsy

- Imaging Tests

- Others

United Kingdom Skin Cancer Diagnostics Market, By End Use

- Hospitals and Clinics

- Laboratories

- Others

Frequently Asked Questions (FAQ)

-

1.What is the expected market size of the United Kingdom skin cancer diagnostics market by 2035?The market is projected to grow from USD 397.7 million in 2024 to USD 823.8 million by 2035, at a CAGR of 6.89% during 2025–2035.

-

2.What are the key factors driving the United Kingdom skin cancer diagnostics market growth?Key growth drivers include the rising incidence of skin cancer, strong UK healthcare infrastructure, increasing awareness of early diagnosis, technological advancements in diagnostics, and supportive NHS and government initiatives.

-

3.How do government initiatives support the United Kingdom skin cancer diagnostics market growth?Government initiatives such as the NHS Long Term Plan, national screening programs, and NICE guidance on AI-based diagnostics strongly support early detection and adoption of innovative technologies.

-

4.What role does technology play in skin cancer diagnostics?Technologies such as AI-based diagnostic tools, digital dermatoscopy, optical coherence tomography (OCT), reflectance confocal microscopy, and teledermatology platforms are improving accuracy and reducing diagnosis time.

Need help to buy this report?