United Kingdom Satcom Market Size, Share, By Component (Equipment, Satcom Transmitter, Satcom Antenna, Satcom Transceiver, Satcom Receiver, Satcom Router, and Others), By Application (Airtime, M2M, Voice, Data, and Drones Connectivity), United Kingdom Satcom Market Insights, Industry Trend, Forecasts to 2035

Industry: Electronics, ICT & MediaUnited Kingdom Satcom Market Insights Forecasts to 2035

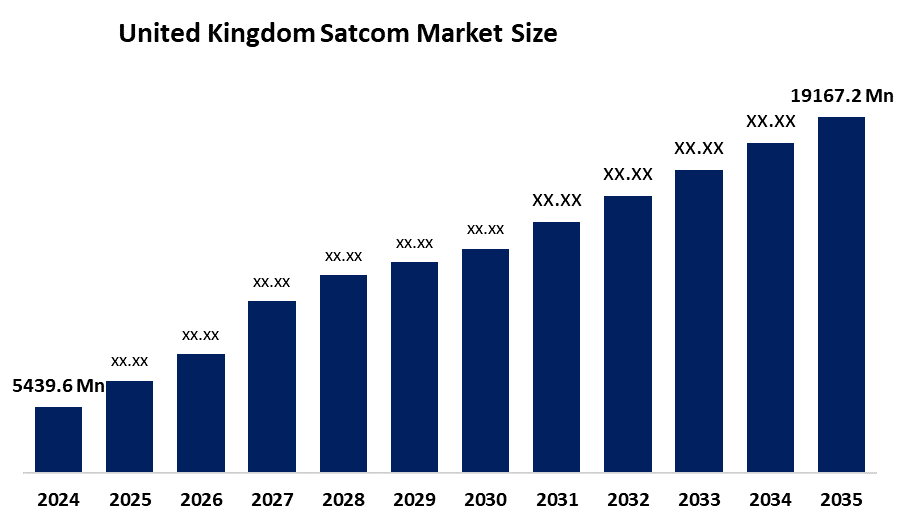

- United Kingdom Satcom Market Size 2024: USD 5439.6 Million

- United Kingdom Satcom Market Size 2035: USD 19167.2 Million

- United Kingdom Satcom Market CAGR 2024: 12.13%

- United Kingdom Satcom Market Segments: Component and Application

Get more details on this report -

Unlocking Space for Government (USG) is a UK Space Agency initiative that enables public sector bodies, including the NHS and transport authorities, to adopt space-enabled technologies such as satellite communications, Earth observation, and PNT, improving public services while stimulating demand and growth in the UK satcom market.

The United Kingdom satcom market offers high growth prospects, the growing need for secure connectivity, broadband development in rural and underserved areas, defense and public sector modernization initiatives, and the increasing use of Satcom in maritime, aviation, energy, and emergency services. The technological developments in high-throughput satellites, low Earth orbit satellite constellations, software-defined payloads, and ground system virtualization are opening up opportunities for next-generation terminals, networking, and value-added services. The satcom industry is aided by the UK’s vibrant aerospace and space technology industry, public-private partnerships, and continued investment in R&D and space infrastructure through the UK’s national space strategies. The focus on resilient and sovereign communications solutions, 5G and digital networks, and export-focused Satcom services enhances long-term prospects, despite difficulties in spectrum regulation, regulatory requirements, and pricing pressures.

Market Dynamics of the United Kingdom Satcom Market

The United Kingdom satcom industry is driven by a strong aerospace and space technology sector, government support for the country’s space and the defense programs, favorable public funding and procurement structures, and R&D innovation in satellite technology, ground systems, and network software. The new focus on secure, high-capacity connectivity solutions is propelling the UK from a traditional satellite services industry to a center of excellence for innovative Satcom design, systems integration, and high-value service exports. The growing need for broadband connectivity in rural areas, increased dependence on satellite communications for maritime, aviation, energy, and emergency services, and the explosive growth of data-intensive services are driving adoption, while advances in automation, digital ground systems, and scalable LEO and hybrid satellite architectures continue to attract substantial investment.

The United Kingdom satellite communications (Satcom) market faces restraints including high capital expenditure requirements for satellite deployment and ground infrastructure, long development and procurement cycles, and intense competition from global operators and emerging LEO constellations, which place pressure on pricing and margins.

The future outlook for the United Kingdom Satcom market seems very promising, the fast paced developments in space and digital technology, the national space and defense initiatives, and the increasing need for reliable and high-capacity connectivity solutions. The developments in Low Earth Orbit and High Throughput Satellite technology, Software-Defined Payloads, Ground Segment Virtualization, Inter-Satellite Links, and AI-driven Network Management are improving the performance, scalability, security, and interoperability of the services. At the same time, the increasing broadband penetration in rural areas, mobility services in maritime and aviation, integration with 5G and digital infrastructure, and the UK’s focus on developing space capabilities are improving operational efficiency, regulatory alignment, and global competitiveness in the United Kingdom Satcom market.

United Kingdom Satcom Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5439.6 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 12.13% |

| 2035 Value Projection: | USD 19167.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Inmarsat Global Limited, OneWeb, Surrey Satellite Technology Limited (SSTL), Airbus Defence and Space Ltd, Cobham Limited, BAE Systems, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom satcom market share is classified into component and application.

By Component

The United Kingdom satcom market is divided by component into equipment, satcom transmitter, satcom antenna, satcom transceiver, satcom receiver, satcom router, and others. Among these, the equipment segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to the high demand for advanced ground station hardware, including high-throughput satellites (HTS) and phased-array antennas, driven by increasing satellite broadband usage and defense requirements.

By Application

The United Kingdom satcom market is divided by application into airtime, M2M, voice, data, and drone’s connectivity. Among these, the airtime segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because the UK market is witnessing a major shift toward LEO, led by initiatives involving companies like OneWeb, which enhance data transmission speeds and reduce latency for both consumer and enterprise data/airtime services.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom satcom market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom Satcom Market

- Inmarsat Global Limited

- OneWeb

- Surrey Satellite Technology Limited (SSTL)

- Airbus Defence and Space Ltd

- Cobham Limited

- BAE Systems

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the United Kingdom satcom market based on the below-mentioned segments:

United Kingdom Satcom Market, By Component

- Equipment

- Satcom Transmitter

- Satcom Antenna

- Satcom Transceiver

- Satcom Receiver

- Satcom Router

- Others

United Kingdom Satcom Market, By Application

- Airtime

- M2M

- Voice

- Data

- Drones Connectivity

Frequently Asked Questions (FAQ)

-

Q: What is the United Kingdom satcom market size?A: United Kingdom satcom market is expected to grow from USD 5439.6 million in 2024 to USD 19167.2 million by 2035, growing at a CAGR of 12.13% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by strong aerospace and space technology sector, government support for the country’s space and the defense programs, favorable public funding and procurement structures.

-

Q: What factors restrain the United Kingdom satcom market?A: Constraints include the high capital expenditure requirements for satellite deployment and ground infrastructure, long development and procurement cycles, and intense competition from global operators and emerging LEO constellations, which place pressure on pricing and margins.

-

Q: How is the market segmented by component?A: The market is segmented into equipment, satcom transmitter, satcom antenna, satcom transceiver, satcom receiver, satcom router, and others.

-

Q: Who are the key players in the United Kingdom satcom market?A: Key companies include Inmarsat Global Limited, OneWeb, Surrey Satellite Technology Limited (SSTL), Airbus Defence and Space Ltd, Cobham Limited, BAE Systems.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?