United Kingdom Refrigerant Market Size, Share, By Product (Fluorocarbon, Hydrocarbon, Inorganic, and Other Product), By Application (Industrial Refrigeration, Domestic Refrigeration, Transport Refrigeration, Commercial Refrigeration, Stationary Air Conditioning, Heat Pumps, Chillers, and Mobile Air Conditioning), United Kingdom Refrigerant Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited Kingdom Refrigerant Market Insights Forecasts to 2035

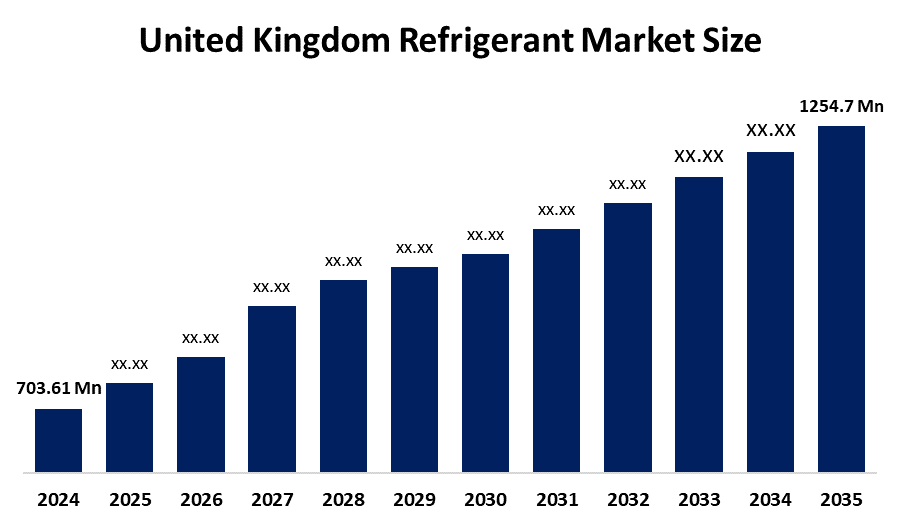

- United Kingdom Refrigerant Market Size 2024: USD 703.61Mn

- United Kingdom Refrigerant Market Size 2035: USD 1254.7Mn

- United Kingdom Refrigerant Market CAGR 2024: 5.4%

- United Kingdom Refrigerant Market Segments: Product and Application

Get more details on this report -

There is growth in the UK refrigerant market in the HVAC systems and expansion of commercial refrigeration, cold-chain logistics, food retailing, and pharmaceuticals due to the growing demand for new construction around the UK has been the main driver behind the refrigerant market in the UK; however, this phase of growth is now subsiding. As UK refrigerant markets move forward, efficiency, safety and sustainability will become more important than volume driven growth. The market will be driven by large providers of F-gas products as well as carbon pricing measures to meet net-zero targets, thus accelerating the move toward low-GWP alternatives and also by heat pump systems, efficient energy cooling products, leak detection technologies and refrigerant recovery/recycling products. The consolidation of refrigerant suppliers and retrofitting of older systems will continue to impact the valuation of existing systems and reduce the number of products available in the market. Monitoring of systems via digital technologies will also contribute to the transformation of the refrigerant marketplace in the UK as customers will be increasingly demanding for highly compliant, low carbon and high valued products.

The UK government is reforming F-Gas regulations to accelerate the phase-down of high-GWP HFC refrigerants, proposing to strengthen the reduction target from 79% by 2030 to 98.6% by 2048 from 2027, significantly impacting HVAC, refrigeration, and heat-pump markets.

The United Kingdom Refrigerant Market Size has moved from stable growth upwards due to increased need for HVAC Equipment (Heating), Heat Pumps, Cold Chain Infrastructure and Energy Efficient Buildings. The UK government has also developed decarbonisation strategies along with the expansion of green infrastructure and the growth of cities. Current refrigerants have a lower potential for greenhouse gases; therefore, existing systems with lower GWP refrigerants must comply with legislation, and customers will be provided with system efficiencies and environmentally friendly refrigerant blends.

United Kingdom Refrigerant Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 703.61 million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | of 5.4% |

| 2035 Value Projection: | USD 1254.7 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product ,By Application |

| Companies covered:: | Honeywell International Inc. The Chemours Company Arkema S.A. Daikin Industries Ltd. Dongyue Group Co. Ltd. Linde plc Asahi Glass Co. Ltd. A-Gas International Ltd. and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the United Kingdom Refrigerant Market:

The United Kingdom Refrigerant Market Size is driven by the strong demand from HVAC systems, heat pumps, cold-chain logistics, food retail, pharmaceuticals, and the data centres, which is supported by the urbanisation, building upgrades, and government-backed decarbonisation and energy-efficiency initiatives. The development of the market is increasingly influenced by sustainability policies, such as phase-out of high-GWP refrigerants and net-zero emissions targets, which is resulting in the migration towards lower-GWP refrigerants, natural refrigerants and new blends. The major drivers of market growth are investment in fixed systems, construction activity, and climate-related policies that support creating greener heating and cooling solutions. The market continues to rationalise obsolete products, control costs related to complying with regulations, and overcome the challenges of excess inventory and retrofitting systems that were not compatible with contemporary standards.

The United Kingdom Refrigerant Market Size is restrained by the slowdown in construction and commercial real estate activity, legacy system dependence, and persistent regulatory pressure. The UK’s commitment to net-zero emissions has led to increasingly strict F-Gas regulations, higher compliance costs, and expanded carbon-reduction measures, accelerating the phase-out of high-GWP refrigerants and constraining traditional refrigerant demand while reshaping market dynamics.

The United Kingdom refrigerant market’s future opportunities lie in low-GWP and natural refrigerants, energy-efficient systems, digital monitoring, smart cooling solutions, and advanced refrigerant blends, driven by government decarbonisation goals, expanding green infrastructure, and rising demand for sustainable HVAC and refrigeration solutions. Despite slower growth in legacy systems, future success depends on shifting from volume to quality, innovation, regulatory compliance, and meeting stricter environmental and safety standards, particularly in modular and industrial applications.

Market Segmentation

The United Kingdom Refrigerant Market share is classified into product and application.

By Product

The United Kingdom Refrigerant Market Size is divided by product into fluorocarbon, hydrocarbon, inorganic, and other product. Among these, the blended segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because they are extensively used across commercial refrigeration, air conditioning, and industrial cooling due to their strong thermodynamic performance, safety (lower flammability compared to hydrocarbons), and stability.

By Application

The United Kingdom Refrigerant Market Size is divided by application into industrial refrigeration, domestic refrigeration, transport refrigeration, commercial refrigeration, stationary air conditioning, heat pumps, chillers, and mobile air conditioning. Among these, the commercial refrigeration segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period .It is because food retail sector (supermarkets, convenience stores) requires vast, high-performance cooling systems to maintain product quality, driving demand for refrigerants.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom Refrigerant Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the United Kingdom Refrigerant Market

• Honeywell International Inc.

• The Chemours Company

• Arkema S.A.

• Daikin Industries Ltd.

• Dongyue Group Co. Ltd.

• Linde plc

• Asahi Glass Co. Ltd.

• A-Gas International Ltd.

• Others

Recent Developments in United Kingdom Refrigerant Market

In September 2024, Orbia’s Klea Edge 444A was launched in the UK/EU automotive aftermarket as a low-GWP refrigerant, promoting decarbonisation in vehicle cooling and supporting regulatory compliance with evolving environmental standards.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the United Kingdom Refrigerant Market Size based on the below-mentioned segments:

United Kingdom Refrigerant Market, By Product

- Fluorocarbon

- Hydrocarbon

- Inorganic

- Other Product

United Kingdom Refrigerant Market, By Application

- Industrial Refrigeration

- Domestic Refrigeration

- Transport Refrigeration

- Commercial Refrigeration

- Stationary Air Conditioning, Heat Pumps, Chillers

- Mobile Air Conditioning

Frequently Asked Questions (FAQ)

-

What is the United Kingdom refrigerant market size?United Kingdom refrigerant market is expected to grow from USD 703.61 million in 2024 to USD 1254.7 million by 2035, growing at a CAGR of 5.4% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the strong demand from HVAC systems, heat pumps, cold-chain logistics, food retail, pharmaceuticals, and the data centres.

-

What are the key growth drivers of the market?Market growth is driven by the strong demand from HVAC systems, heat pumps, cold-chain logistics, food retail, pharmaceuticals, and the data centres.

-

What factors restrain the United Kingdom refrigerant market?Constraints includes the slowdown in construction and commercial real estate activity, legacy system dependence, and persistent regulatory pressure.

-

How is the market segmented by product?The market is segmented into fluorocarbon, hydrocarbon, inorganic, and other product.

-

Who are the key players in the United Kingdom refrigerant market?Key companies include Honeywell International Inc., The Chemours Company, Arkema S.A., Daikin Industries Ltd., Dongyue Group Co. Ltd., Linde plc, Asahi Glass Co. Ltd., and A‑Gas International Ltd., and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?