United Kingdom Radiation Oncology Market Size, Share, By Type (External Beam radiation Therapy, Internal Radiation Therapy, and Systemic Radiation Therapy), By Technology (Intensity Modulated Radiation Therapy, Image Guided Radiation Therapy, Stereotactic Body Radiation Therapy), By Application (Breast Cancer, Lung Cancer, Prostate Cancer, Head and Neck Cancer, Colorectal cancer, and Others), and United Kingdom Radiation Oncology Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited Kingdom Radiation Oncology Market Insights Forecasts to 2035

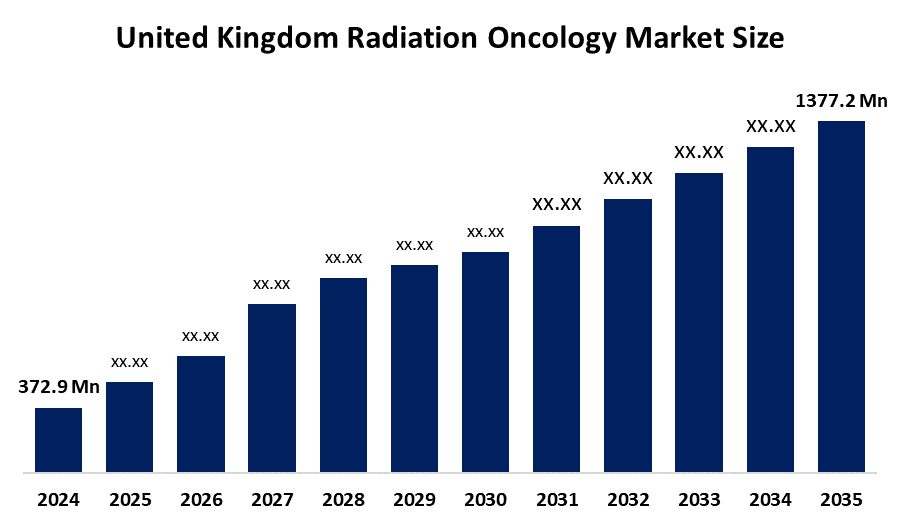

- United Kingdom Radiation Oncology Market Size 2024: USD 372.9 Mn

- United Kingdom Radiation Oncology Market Size 2035: USD 1377.2 Mn

- United Kingdom Radiation Oncology Market CAGR: 12.61%

- United Kingdom Radiation Oncology Market Segments: Type, Technology, and Application

Get more details on this report -

The market for radiation oncology in the UK is gradually growing due to rising cancer incidence and rising demand for accurate, efficient treatment options. A significant percentage of patients with lung, prostate, breast, and other malignancies receive radiation therapy at some point, making it a vital component of cancer treatment. To improve capacity and care quality, the National Health Service (NHS) is investing in cutting-edge linear accelerators, sophisticated imaging systems, and integrated treatment planning platforms.

Government initiatives play a key role in driving market growth. The national cancer policies of NHS England and the UK government place a high priority on prompt detection and availability of cutting-edge treatment options. Modern radiation equipment and worker training have been implemented with the help of strategic funding programs in an effort to shorten wait times and enhance results. Expanding access to proton therapy and testing novel radiation models in local cancer centers are also supported by the public.

The use of more accurate and patient-friendly treatments is being accelerated by technological developments. With less exposure to healthy tissue, innovations like intensity-modulated radiation therapy (IMRT), image-guided radiation therapy (IGRT), and stereotactic body radiation therapy (SBRT) provide better tumor targeting. Treatment planning that incorporates AI and cutting-edge tools improves workflow efficiency and customisation. The UK radiation oncology market is expected to continue growing as a result of these advancements, infrastructure expenditures, and supportive health policy.

United Kingdom Radiation Oncology Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 372.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 12.61% |

| 2035 Value Projection: | USD 1377.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Type,By Technology,By Application |

| Companies covered:: | Alpha Omega Services, Oncology Systems Limited, Xstrahl Ltd., RTsafe, Precision Dose, Varian Medical Systems, Elekta AB, Accuray Incorporated, IBA, ViewRay, Inc., RaySearch Laboratories AB, Mevion Medical Systems, Hitachi, Ltd., Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the United Kingdom Radiation Oncology Market:

The main factor propelling market expansion is the rising incidence of cancer, especially lung, prostate, and breast malignancies. Demand is still being driven by the growing use of radiation therapy as a fundamental part of cancer treatment, either on its own or in conjunction with chemotherapy and surgery. Adoption is being accelerated by significant NHS expenditures in cutting-edge linear accelerators and digital treatment planning systems, among other modern radiotherapy facilities. Technological developments, including IMRT, IGRT, SBRT, and hypofractionated radiation, are also enhancing patient outcomes, workflow efficiency, and treatment precision.

Notwithstanding the market's potential for expansion, the high initial costs of radiation oncology equipment as well as continuing maintenance and upgrade expenditures, provide obstacles. Service capacity is further limited by the scarcity of qualified medical physicists, radiologists, and radiation oncologists. Additionally, funding constraints and lengthy wait periods in some NHS institutions may cause a delay in the introduction of new equipment.

The expanding usage of AI-driven treatment planning, the expansion of precision and individualized radiotherapy, and the growing acceptance of shorter treatment regimens present significant prospects for the market. Rising public–private partnerships, outpatient radiotherapy centers, and continued government focus on early cancer diagnosis and treatment access are expected to unlock sustained growth across the UK radiation oncology landscape.

Market Segmentation

The United Kingdom radiation oncology market share is classified into type, technology, and application.

By Type:

On the basis of the type, the United Kingdom radiation oncology market is categorized into external beam radiation therapy, internal radiation therapy, and systemic radiation therapy. Among these, the external beam radiation therapy segment held the majority market share in 2024 and is predicted to grow at a remarkable rate during the predicted period. The extensive clinical use, non-invasive nature, and ongoing technological developments, including intensity-modulated radiation treatment (IMRT), image-guided radiation therapy (IGRT), and stereotactic body radiation therapy (SBRT), are the reasons for EBRT's dominance.

By Technology:

Based on the technology, the United Kingdom radiation oncology market is divided into intensity modulated radiation therapy, image-guided radiation therapy, and stereotactic body radiation therapy. Among these, the intensity modulated radiation therapy segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. IMRT's superior dose delivery precision, capacity to reduce radiation exposure to nearby healthy tissues, and wide clinical applicability across many cancer types are what propel its dominant position.

By Application:

The United Kingdom radiation oncology market is classified by application into breast cancer, lung cancer, prostate cancer, head and neck cancer, colorectal cancer, and others. Among these, the breast cancer segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The high prevalence of breast cancer in the UK, extensive nationwide screening and early-diagnosis initiatives, and the crucial role that radiation plays in breast-conserving treatment and post-operative care all support this leadership.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the United Kingdom Radiation Oncology Market:

- Alpha Omega Services

- Oncology Systems Limited

- Xstrahl Ltd.

- RTsafe

- Precision Dose

- Varian Medical Systems

- Elekta AB

- Accuray Incorporated

- IBA

- ViewRay, Inc.

- RaySearch Laboratories AB

- Mevion Medical Systems

- Hitachi, Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom radiation oncology market based on the following segments:

United Kingdom Radiation Oncology Market, By Type

- External Beam Radiation Therapy

- Internal Radiation Therapy

- Systemic Radiation Therapy

United Kingdom Radiation Oncology Market, By Technology

- Intensity Modulated Radiation Therapy

- Image Guided Radiation Therapy

- Stereotactic Body Radiation Therapy

United Kingdom Radiation Oncology Market, By Application

- Breast Cancer

- Lung Cancer

- Prostate Cancer

- Head and Neck Cancer

- Colorectal cancer

- Others

Frequently Asked Questions (FAQ)

-

1. What is the current and projected market size of the UK radiation oncology market?The market was valued at USD 372.9 million in 2024 and is projected to reach USD 1,377.2 million by 2035, growing at a CAGR of 12.61% during the forecast period.

-

2. What factors are driving the growth of the UK radiation oncology market?Key growth drivers include the rising incidence of cancer, increasing adoption of radiation therapy as a standard treatment, NHS investments in advanced radiotherapy infrastructure, and rapid advancements in precision radiation technologies.

-

3. What are the major challenges faced by the UK radiation oncology market?Challenges include high capital and maintenance costs of radiation equipment, a shortage of skilled professionals, NHS budget constraints, and long waiting times in certain healthcare facilities

-

4. What opportunities exist in the UK radiation oncology market?Major opportunities include growth in AI-driven treatment planning, expansion of personalized and precision radiotherapy, adoption of shorter treatment regimens, and increased public–private partnerships in cancer care.

-

5. Who are the key players operating in the UK radiation oncology market?Prominent companies include Varian Medical Systems, Elekta AB, Accuray Incorporated, IBA, ViewRay Inc., RaySearch Laboratories AB, Xstrahl Ltd., Hitachi Ltd., Mevion Medical Systems, and others.

Need help to buy this report?