United Kingdom Precision Machining Market Size, Share, By Operation (Manual Operation and CNC Operation), By Type (Milling Machining, Laser Machining, Electric Discharge Machining (EDM), Turning, Grinding, and Others), and United Kingdom Precision Machining Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Precision Machining Market Insights Forecasts to 2035

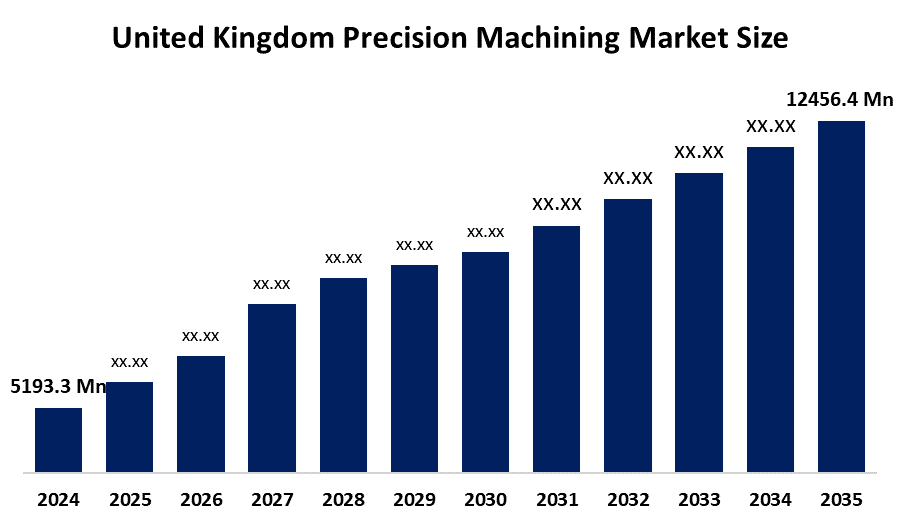

- United Kingdom Precision Machining Market Size 2024: USD 5193.3 Mn

- United Kingdom Precision Machining Market Size 2035: USD 12456.4 Mn

- United Kingdom Precision Machining Market CAGR: 8.28%

- United Kingdom Precision Machining Market Segments: Operation and Type

Get more details on this report -

The United Kingdom precision machining market is a significant segment within the broader advanced manufacturing landscape, characterised by robust demand for precision-engineered parts across sectors with stringent quality standards. CNC milling, turning, grinding, laser machining, and electric discharge machining (EDM) are examples of advanced machining techniques used in the production of high-accuracy components with tight tolerances. The aerospace, automotive, medical device, defense, electronics, and energy sectors are all supported by this industry, which is vital to the UK's advanced manufacturing ecosystem. Producing complicated items that need repeatability, surface finish quality, and dimensional accuracy requires precision machining.

Manufacturing resilience and innovation are becoming more important in government policy, as demonstrated by multibillion-pound industrial policies that promote automation, digital technology, and workforce development. The goal of programs like the Made Smarter adoption initiative and the Advanced Manufacturing Plan is to modernize manufacturing facilities across the country and promote digital transformation. Additionally, strategic investments in technical training and apprenticeships strengthen the pipeline of skilled talent needed to sustain future growth.

Technological advancement remains central to competitive advantage in precision machining. UK manufacturers are adopting cutting-edge technologies, including collaborative robotics, artificial intelligence AI and predictive analytics to enhance precision, reduce waste, and increase throughput. CNC machining centres are evolving with automation and smart factory capabilities that support real-time process optimisation and autonomous operations. The integration of digital twins and IoT-enabled systems further improves quality control, operational visibility, and lifecycle performance. These technologies form a contemporary precision machining ecosystem that is in line with global Industry 4.0 trends when combined with sustainable production practices.

Market Dynamics of the United Kingdom Precision Machining Market:

The UK precision machining market is propelled by strong demand for high-precision components across key sectors such as aerospace, automotive, medical devices, and electronics, where tight tolerances and reliability are critical. Precision machining solutions are essential for contemporary manufacturing since technological developments like automation, robotics, and CNC advances greatly increase productivity, repeatability, and precision. Government support for innovative manufacturing and industrial strategies increases investment confidence and propels sector growth.

A barrier to entry is the high capital cost of purchasing and maintaining sophisticated precision machining machinery, especially for small and medium-sized businesses. Additionally, there is a chronic lack of skilled workers who can operate and program complex machinery, which restricts productivity and affects competitiveness. Supply chain volatility and fluctuating raw material prices further constrain growth by increasing production costs and lead times.

New opportunities for precision machining services are presented by emerging applications in industries including biotechnology, renewable energy, and customized medical equipment. Design flexibility and faster turnaround times are provided by the integration of hybrid manufacturing, which combines additive and subtractive techniques. In the meantime, firms may unlock value and improve operational efficiency through digitalization prospects, including IoT analytics, digital twins, and predictive maintenance.

United Kingdom Precision Machining Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5193.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.28% |

| 2035 Value Projection: | USD 12456.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Operation,By Type |

| Companies covered:: | UK Precision,NTG Group,NTG Group,Oracle Precision,QCD Precision,Aerotech Precision Manufacturing Ltd,UK Precision Engineering Ltd And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom precision machining market share is classified into operation and type.

By Operation:

Based on the operation, the United Kingdom precision machining market is divided into manual operation and CNC operation. Among these, the CNC operations segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. This dominance is driven by rising demand for high-precision components, automation, and improved production efficiency across manufacturing industries.

By Type:

The United Kingdom precision machining market is classified by type into milling machining, laser machining, electric discharge machining EDM, turning, grinding, and others. Among these, the milling machining segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The versatility of milling machining in creating intricate and highly precise parts, its extensive application in important end-use sectors, and the ongoing development of CNC milling technologies that improve accuracy and productivity are the main factors contributing to its supremacy.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom precision machining market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the United Kingdom Precision Machining Market:

- UK Precision

- NTG Group

- Oracle Precision

- Parallel Precision

- QCD Precision

- Aerotech Precision Manufacturing Ltd

- UK Precision Engineering Ltd

- Unicut Precision

- MAS Precision Engineering

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom precision machining market based on the following segments:

United Kingdom Precision Machining Market, By Operation

- Manual Operation

- CNC Operation

United Kingdom Precision Machining Market, By Type

- Milling Machining

- Laser Machining

- Electric Discharge Machining (EDM)

- Turning

- Grinding

- Others

Frequently Asked Questions (FAQ)

-

1. What is the current and projected size of the UK precision machining market?The market is valued at USD 5,193.3 million in 2024 and is expected to reach USD 12,456.4 million by 2035, growing at a CAGR of 8.28% during the forecast period.

-

2. What factors are driving the growth of the UK precision machining market?Growth is driven by rising demand for high-precision components from aerospace, automotive, medical devices, defence, and electronics sectors, along with increased adoption of CNC machining, automation, and Industry 4.0 technologies.

-

3. What are the major challenges faced by the UK precision machining market?Key challenges include high capital investment requirements for advanced machinery, shortages of skilled labor, supply chain volatility, and fluctuating raw material prices.

-

4. What opportunities exist in the UK precision machining market?Opportunities lie in emerging applications such as biotechnology, renewable energy, and customized medical devices, along with the adoption of hybrid manufacturing, AI-driven process optimization, and IoT-enabled smart factories

Need help to buy this report?