United Kingdom Polypropylene Market Size, Share, By Polymer (Homopolymer, Copolymer), By Application (Fiber, Film & Sheet, Raffia, and Others), End Use (Automotive, Building & Construction, Packaging, Medical, Electrical & Electronics, and Others) United Kingdom Polypropylene Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsUnited Kingdom Polypropylene Market Insights Forecasts to 2035

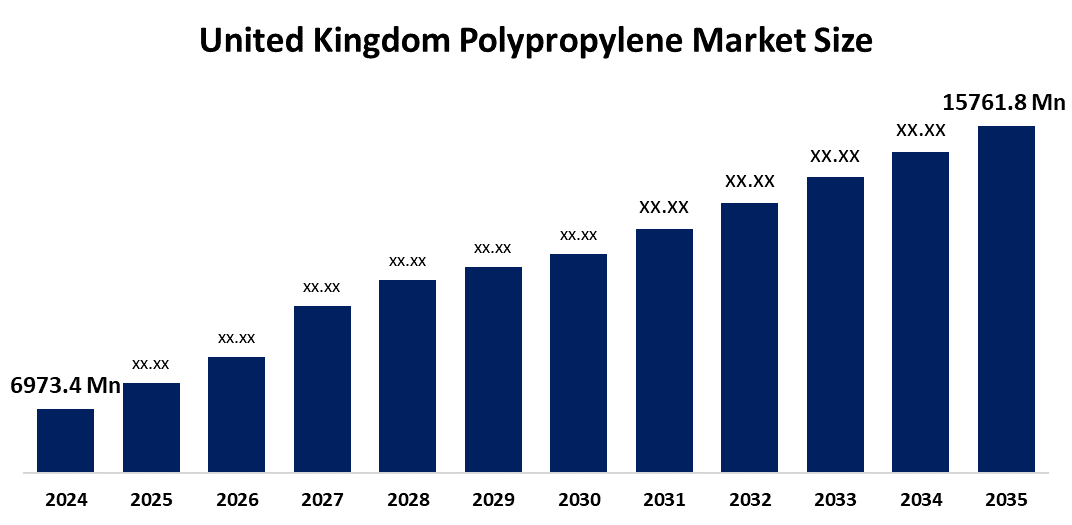

- United Kingdom Polypropylene Market Size 2024: USD 6973.4 Million

- United Kingdom Polypropylene Market Size 2035: USD 15761.8 Million

- United Kingdom Polypropylene Market CAGR 2024: 7.7%

- United Kingdom Polypropylene Market Segments: Polymer, Application, and End Use

Get more details on this report -

The United Kingdom Polypropylene Market Is Classified As A Matured But The Growing Market, Including Homopolymers, Copolymers, And Sophisticated Polypropylene Compounds. The United Kingdom market is moving from traditional resin usage to the advanced, lightweight, and recyclable polypropylene materials based on the strong industrial demand, sustainability initiatives, and technological modernization. The United Kingdom polypropylene market is associated with established domestic demand, reliance on imported supplies, competitive pricing forces, and fierce competition between European manufacturers and other global suppliers owing to the effects of circular economy legislation, the drive for lightweight materials, or innovative mono-material & recycled polypropylene materials.

Starting in 2025, the UK Government’s Extended Producer Responsibility (EPR) for Packaging scheme requires producers to cover the full cost of collecting, sorting, and managing household plastic waste. This policy directly impacts the UK polypropylene market, pushing manufacturers toward recyclable designs, lightweight packaging, and greater use of recycled polypropylene to reduce compliance costs.

The United Kingdom polypropylene market is moderately expanding on the back of increasing applications in packaging materials, the automotive sector for lightweight construction, the construction sector, and medical applications. Research and development activities related to recycled and bio-based polypropylene materials, advanced compounding technologies, and mono-material packaging are fueling high-value domains. High-impact polypropylene materials for the construction sector, medical-grade polypropylene products for healthcare applications, and lightweight materials for the automotive sector are some of the main areas with significant growth potential.

United Kingdom Polypropylene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6973.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.7% |

| 2035 Value Projection: | USD 15761.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Polymer, By Application, By End Use |

| Companies covered:: | LyondellBasell Industries, INEOS Grangemouth, SABIC, ExxonMobil Chemical, Braskem, Borealis, Plastoplan Polymers Ltd., Whatmore UK Ltd., Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the United Kingdom Polypropylene Market

The United Kingdom polypropylene market is driven by the increasing use of the material in various industries such as the packaging, construction, automotive, and healthcare industries, the support of sustainability projects, recycling, and the circular economy promoted by the UK government. This trend of the use of high value polypropylene, including recyclable, lightweight, medical-grade, materials, is changing the market trend of the UK from basic material use to innovative materials. Urbanization, infrastructure growth, flexible, rigid packaging, increasing consumer awareness of sustainable living, and the spending capacity of UK customers on sustainable, high-quality items are all increasing the adoption of polypropylene in the UK, making it a prominent player in the European market.

Restraints for the United Kingdom polypropylene market include high energy and production costs, volatility in crude oil and feedstock prices, reliance on imports, and intense competition with low-cost global producers. Besides, strict environmental regulations, gaps in recycling infrastructure, trade uncertainties, and pricing pressures restrain margins and slow expansion of domestic capacity.

The future of the United Kingdom polypropylene market looks positive, supported by sustainability-driven regulations, steady industrial demand, and ongoing material innovation. Advanced recycled and bio-based polypropylene, chemical recycling, lightweight automotive applications, and mono-material packaging are creating new opportunities for growth. With the ongoing adoption of polypropylene into healthcare, construction, and renewable energy applications, and the significant investment being made into circular-economy infrastructure, the UK Polypropylene ecosystem is becoming increasingly robust and competitive over the long term.

Market Segmentation

The United Kingdom polypropylene market share is classified into polymer, application, and end use.

By Polymer

The United Kingdom polypropylene market is divided by polymer into homopolymer, copolymer. Among these, the homopolymer segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because the homopolymer PP is stiffer, stronger, and has a higher strength-to-weight ratio compared to copolymer, making it ideal for structural applications.

By Application

The United Kingdom polypropylene market is divided by application into fiber, film & sheet, raffia, and others. Among these, the film & sheet segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because there is rise in online retail and food delivery in the UK has driven demand for durable, lightweight, and protective PP-based films and containers.

By End Use

The United Kingdom polypropylene market is divided by end use automotive, building & construction, packaging, medical, electrical & electronics, and others. Among these, the construction material segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is due to PP's versatility, light weight, chemical resistance, and suitability for both rigid and flexible food/consumer goods packaging.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom polypropylene market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom Polypropylene Market

- LyondellBasell Industries

- INEOS Grangemouth, SABIC

- ExxonMobil Chemical

- Braskem

- Borealis

- Plastoplan Polymers Ltd.

- Whatmore UK Ltd.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom polypropylene market based on the below-mentioned segments:

United Kingdom Polypropylene Market, By Polymer

- Homopolymer

- Copolymer.

United Kingdom Polypropylene Market, By Application

- Fiber

- Film & Sheet

- Raffia

- Others.

United Kingdom Polypropylene Market, By End Use

- Automotive

- Building & Construction

- Packaging

- Medical

- Electrical & Electronics

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the United Kingdom polypropylene market size?A: United Kingdom polypropylene market is expected to grow from USD 6973.4 million in 2024 to USD 15761.8 million by 2035, growing at a CAGR of 7.7% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing use of the material in various industries such as the packaging, construction, automotive, and healthcare industries.

-

Q: What factors restrain the United Kingdom polypropylene market?A: Constraints include the high energy and production costs, volatility in crude oil and feedstock prices, reliance on imports, and intense competition with low-cost global producers.

-

Q: How is the market segmented by polymer?A: The market is segmented into homopolymer, copolymer.

-

Q: Who are the key players in the United Kingdom polypropylene market?A: Key companies include LyondellBasell Industries, INEOS Grangemouth, SABIC (UK operations), ExxonMobil Chemical (UK supply), Braskem (serving UK market), Borealis (supplying UK), Plastoplan Polymers Ltd. and Whatmore UK Ltd.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?