United Kingdom Plastic Market Size, Share, By Product (Polyethylene (PE), Polypropylene (PP), Polyurethane (PU), Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), Polystyrene (PS), Acrylonitrile Butadiene Styrene, and Others), By Application (Injection Molding, Blow Molding, Roto Molding, Compression Molding, Casting, Themroforming, Extrusion, and Others), By End Use (Packaging, Construction, Electricals & Electronics, Automotive, Medical Devices, Agriculture, Furniture & Bedding, and Others), United Kingdom Plastic Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited Kingdom Plastic Market Insights Forecasts to 2035

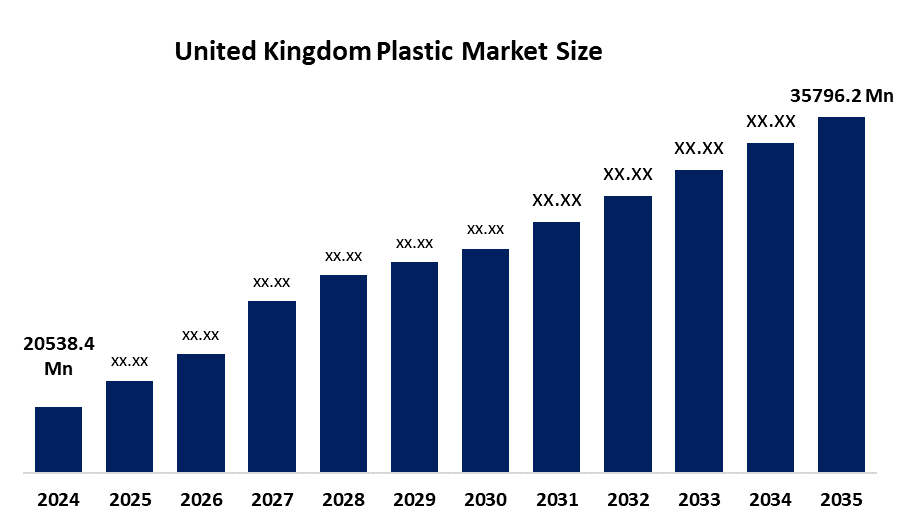

- United Kingdom Plastic Market Size 2024: USD 20538.4 Million

- United Kingdom Plastic Market Size 2035: USD 35796.2 Million

- United Kingdom Plastic Market CAGR 2024: 5.18%

- United Kingdom Plastic Market Segments: Product, Application, and End Use

Get more details on this report -

The plastic market of the United Kingdom is one of the well-established markets that is heavily regulated and is driven by strong demand for plastic products across the packaging industry, automotive industry, construction industry, healthcare industry, and the consumer goods industry itself. The market is also positively affected by the expansion of retail packaging, e-commerce, infrastructure development, and manufacturing industry. Nevertheless, the industry is at a very crucial stage of transformation from a volume-driven manufacturing industry to a sustainable, circular, or high-performance plastic material. The plastic market is also witnessing the rise of recycled plastic, biodegradable plastic, or advanced polymer materials. Besides that, the plastic market is also becoming consolidated or heavily regulated due to environmental regulations or plastic waste reduction strategies.

The UK Plastic Packaging Tax (PPT), introduced on April 1, 2022, applies to plastic packaging containing less than 30% recycled material. The tax rate increased to £223.69 per tonne from April 1, 2025. The policy encourages recycling, sustainability, and innovation, while upcoming assessment changes may further influence packaging manufacturing and material sourcing.

The plastic market of the United Kingdom is moving from its traditional position of steady demand to an innovative and sustainable approach, via an increase in the packaging, healthcare, automotive, and construction sectors of the country. The government’s regulations about waste, as well as plastic, and the increasing recycling targets and eco-friendly materials, are encouraging the market to undertake circular economy activities, despite facing challenges such as government regulations and raw material costs.

Market Dynamics of the United Kingdom Plastic Market

The plastic industry trends in the United Kingdom are driven by the huge demand for plastics from industries such as packaging, healthcare, automotive, construction, and consumer products, which is boosted by the expansion of industries, retail trade, and online business operations. The plastic industry trends in the United Kingdom are boldly impacted by the factors such as sustainability legislation, recycling directives, and the government regulations for reducing plastic waste and adopting circular economy trends. Some of the most critical factors that affect the plastic industry trends in the United Kingdom are investments in manufacturing, innovations, and the demand for the lightweight and durable products that are used in many industries. The increasing population, changing lifestyles, and sustainable products are some of the factors that boost the industry trends.

The restraining factors for the United Kingdom plastic market are environmental legislation, increasing pressures associated with reducing waste, and concerns about the alleged ill effects of using plastics. The UK’s carbon neutrality initiative has placed more pressure on the sustainability, EPR, and recycling compliance fronts, thereby increasing the cost burdens for vendors to ensure compliance.

The future opportunities for United Kingdom market is relate to the creation of lasting and degradable plastics, digital and smart manufacturing forces, market consolidation, and high-performance and specialty polymer products. These opportunities are aided by the government's decarbonization strategies, circular economy strategies, and the increasing demand for sustainable packaging products, lightweight automotive materials, and high-end polymer products for the healthcare industry. In spite of the moderating demand from traditional markets, the core future requirements of the United Kingdom market depend on the ability to move away from volume and towards innovation, quality, increased standards of stricter environmental, recycling requirements, especially related to high-end and modulated manufacturing solutions.

United Kingdom Plastic Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 20538.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.18% |

| 2035 Value Projection: | USD 35796.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Amcor PLC, DS Smith, Berry Global, Coveris Holdings, Klöckner Pentaplast, Sealed Air Corporation, INEOS, Mainetti, Plastipak Packaging Ltd, Alpla UK Limited, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom plastic market share is classified into product, application, and end use.

By Product

The United Kingdom plastic market is divided by product into polyethylene (PE), polypropylene (PP), polyurethane (PU), polyvinyl chloride (PVC), polyethylene terephthalate (PET), polystyrene (PS), acrylonitrile butadiene styrene, and others. Among these, the polyethylene (PE) segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is riven by its widespread use in packaging applications such as bottles, films, and containers. Its leading position is attributed to its versatility, low cost, and durability, making it the preferred material for the packaging and consumer goods sectors.

By Application

The United Kingdom plastic market is divided by application into injection molding, blow molding, roto molding, compression molding, casting, themroforming, extrusion, and others. Among these, the injection molding segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is due to its high-speed production, precision, and versatility in manufacturing complex, durable, and lightweight components for industries like automotive, packaging, and consumer goods.

By End Use

The United Kingdom plastic market is divided by end use into packaging, construction, electrical & electronics, automotive, medical devices, agriculture, furniture & bedding, and others. Among these, the packaging segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is driven by the high demand for food and beverage packaging, rising e-commerce, and the need for lightweight, durable materials.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom plastic market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom Plastic Market

- Amcor PLC

- DS Smith

- Berry Global

- Coveris Holdings

- Klöckner Pentaplast

- Sealed Air Corporation

- INEOS

- Mainetti

- Plastipak Packaging Ltd

- Alpla UK Limited

- Others

Recent Developments in United Kingdom Plastic Market

In November 2024, Symphony Environmental Technologies launched Natural Biodegradable Resin (NbR), incorporating natural minerals to reduce fossil-derived plastics by approximately 20%. The innovation supports sustainability goals and advances biodegradable development within the UK plastics market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom plastic market based on the below-mentioned segments:

United Kingdom Plastic Market, By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Polyurethane (PU)

- Polyvinyl chloride (PVC)

- Polyethylene terephthalate (PET)

- Polystyrene (PS)

- Acrylonitrile butadiene styrene

- Others

United Kingdom Plastic Market, By Application

- Injection Molding

- Blow Molding

- Roto Molding

- Compression Molding

- Casting

- Themroforming

- Extrusion

- Others

United Kingdom Plastic Market, By End Use

- Packaging

- Construction

- Electricals & Electronics

- Automotive

- Medical Devices

- Agriculture

- Furniture & Bedding

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the United Kingdom plastic market size?A: United Kingdom plastic market is expected to grow from USD 20538.4 million in 2024 to USD 35796.2 million by 2035, growing at a CAGR of 5.18% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the huge demand for plastics from industries such as packaging, healthcare, automotive, construction, and consumer products, which is boosted by the expansion of industries, retail trade, and online business operations.

-

Q: What factors restrain the United Kingdom plastic market?A: Constraints includes the environmental legislation, increasing pressures associated with reducing waste, and concerns about the alleged ill effects of using plastics.

-

Q: How is the market segmented by product?A: The market is segmented into polyethylene (PE), polypropylene (PP), polyurethane (PU), polyvinyl chloride (PVC), polyethylene terephthalate (PET), polystyrene (PS), acrylonitrile butadiene styrene, and others.

-

Q: Who are the key players in the United Kingdom plastic market?A: Key companies include Amcor PLC, DS Smith, Berry Global, Coveris Holdings SA, Klöckner Pentaplast, Sealed Air Corporation, INEOS, Mainetti, Plastipak Packaging Ltd, Alpla UK Limited, and Otherrs.

-

Q: What is the United Kingdom plastic market size?A: United Kingdom plastic market is expected to grow from USD 20538.4 million in 2024 to USD 35796.2 million by 2035, growing at a CAGR of 5.18% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the huge demand for plastics from industries such as packaging, healthcare, automotive, construction, and consumer products, which is boosted by the expansion of industries, retail trade, and online business operations.

-

Q: What factors restrain the United Kingdom plastic market?A: Constraints includes the environmental legislation, increasing pressures associated with reducing waste, and concerns about the alleged ill effects of using plastics.

-

Q: How is the market segmented by product?A: The market is segmented into polyethylene (PE), polypropylene (PP), polyurethane (PU), polyvinyl chloride (PVC), polyethylene terephthalate (PET), polystyrene (PS), acrylonitrile butadiene styrene, and others.

-

Q: Who are the key players in the United Kingdom plastic market?A: Key companies include Amcor PLC, DS Smith, Berry Global, Coveris Holdings SA, Klöckner Pentaplast, Sealed Air Corporation, INEOS, Mainetti, Plastipak Packaging Ltd, Alpla UK Limited, and Otherrs.

Need help to buy this report?