United Kingdom Pharmaceuticals Market Size, Share By Disease Indication (Oncology, Diabetes, Infectious, Cardiovascular, Neurology & Psychiatry, Respiratory, Renal, Obesity, Autoimmune, Ophthalmic, Gastrointestinal, Dermatology, Reproductive, & Allergies), By Drug Type (Biologics & Biosimilar, and Small Molecules/Conventional Drugs), By Route of Administration (Oral, Parenteral, Topical, & Inhalation), United Kingdom Pharmaceuticals Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Pharmaceuticals Market Insights Forecasts to 2035

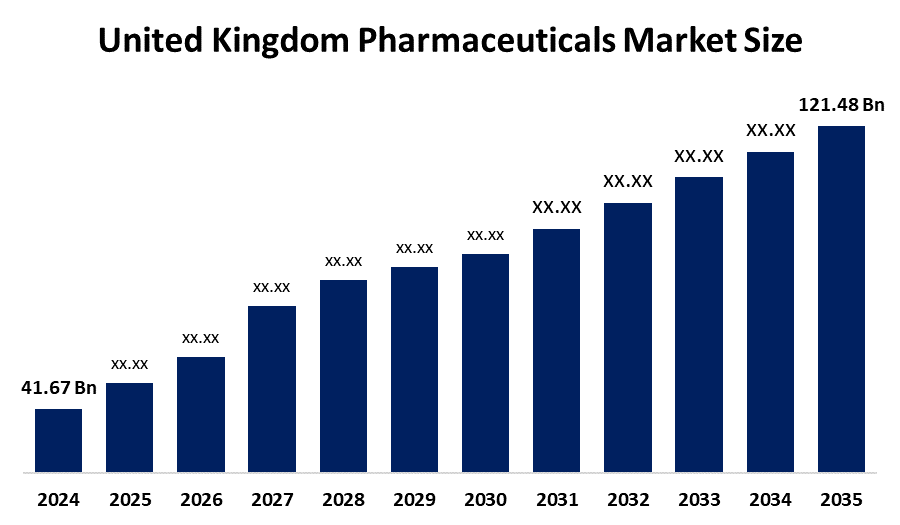

- United Kingdom Pharmaceuticals Market Size 2024: USD 41.67 Bn

- United Kingdom Pharmaceuticals Market Size 2035: USD 121.48 Bn

- United Kingdom Pharmaceuticals Market CAGR 2024: 10.22%

- United Kingdom Pharmaceuticals Market Segments: Diseases Indication, Drug Type, and Route of Administration

Get more details on this report -

The pharmaceutical industry in the UK poses a mature and innovative marketplace in the areas of branded drugs, generics, biologics, and advanced therapies, with a significant inclination towards high-value research and developments in the areas of precision medicines and biologic manufacturing. It also exhibits a high level of demand within the medical sector, strict regulatory guidelines by the MHRA, pricing constraints within the NHS setting, and competition between leading pharmaceutical corporations in the UK and international players. Further, the pharmaceutical industry in the UK portrays a vibrant marketplace along with advanced research, industry, and manufacturing in a well-structured regulatory setting.

In 2025, the UK government continued to implement and review its statutory scheme for branded medicines pricing, ensuring it remains broadly commercially equivalent to the voluntary VPAG scheme as part of efforts to control NHS drug costs and maintain a viable alternative pricing framework for pharmaceutical companies.

The United Kingdom Pharmaceuticals Market Size presents an excellent growth opportunity based on the population's aging factor, increasing prevalence of chronic diseases, biologics, precision medicine, and drug discovery enabled by artificial intelligence. Innovative therapies, opportunities in rare diseases, oncology, and cell and gene therapies are emerging as the life sciences sector shifts its focus towards high-value R&D and advanced manufacturing alongside global research partnerships. Complex cancer treatments, robust clinical trial pipelines, and genomic, real-world evidence, and data analytics are being used to develop targeted therapies, supported by supportive government initiatives for life-sciences innovation despite challenges posed by pricing and cost pressures.

United Kingdom Pharmaceuticals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 41.67 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 10.22% |

| 2035 Value Projection: | USD 121.48 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Drug Type, By Disease Indication |

| Companies covered:: | AstraZeneca, Sanofi, Hoffmann-La Roche, Pfizer, Gilead Sciences, GSK, Amgen, Novo Nordisk, Bristol-Myers Squibb, AbbVie, Eli Lilly, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the United Kingdom Pharmaceuticals Market

The United Kingdom Pharmaceuticals Market Size in the United Kingdom has been influenced by an aging population with increasing instances of diseases, support for life science innovation by the government, and R&D investments. The favorable healthcare infrastructure and advanced testing facilities, along with access to quality patient data, have propelled the enhancement of high-value therapeutic areas, namely biologics, oncology, and cell and gene therapy. In addition, favorable healthcare expenditure, combined with collaboration and partnerships between academia and industry, has allowed the United Kingdom to make strides in moving from being a manufacturer of pharmaceutical drugs to being a global hub for pharmaceutical innovation and breakthroughs.

The United Kingdom Pharmaceuticals Market Size faces restrain like intense government price control, intellectual property issues, fragmented regulations, quality concern, the talent gaps, and the geopolitical tensions, alongside a reliance on imports for key areas, all pressuring domestic innovations and profitability despite of huge market potential.

The outlook for the United Kingdom’s pharmaceutical market is very positive. This is due to its strong innovation ecosystem, public and private life sciences strategies, and the increasing needs of the UK’s healthcare system driven by its aging population. Research in biologics, biosimilar, cell and gene therapies, and AI-assisted innovative drug development, along with improved clinical trial regulations and the linkage of real-world evidence and digital health platforms in the UK’s National Health Service are already unlocking important development and growth opportunities for the UK’s life sciences sector. Moreover, advancements in advanced manufacturing, data analytics and genomics, precision medicine, and tight collaborations between the NHS and academia are increasing innovation efficiencies in the UK.

Market Segmentation

The United Kingdom Pharmaceuticals Market share is classified into diseases indication, drug type, and route of administration.

By Disease Indication

The United Kingdom Pharmaceuticals Market Size is divided by disease indication into oncology, diabetes, infectious, cardiovascular, neurology & psychiatry, respiratory, renal, obesity, autoimmune, ophthalmic, gastrointestinal, dermatology, reproductive, & allergies. Among these, the oncology segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is driven by the rising prevalence of cancer, significant R&D investment in new therapies, and increasing regulatory approvals, making it the largest area for drug sales and pipeline focus.

By Drug Type

The United Kingdom Pharmaceuticals Market Size is divided by drug type into biologics & biosimilar, and small molecules/conventional drugs. Among these, the biologics & biosimilar segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because of the high cost (both innovator and biosimilar) and complex manufacturing contribute significantly to market revenue, even if small molecules make up a larger volume of prescriptions.

By Route of Administration

The United Kingdom Pharmaceuticals Market Size is divided by route of administration into oral, parenteral, topical, & inhalation. Among these, the oral segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because swallowing a tablet or capsule is generally preferred by patients and does not require a healthcare professional, which improves patient compliance and adherence to medication schedules.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom Pharmaceuticals Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom Pharmaceuticals Market

- AstraZeneca

- Sanofi

- Hoffmann-La Roche

- Pfizer

- Gilead Sciences

- GSK

- Amgen

- Novo Nordisk

- Bristol-Myers Squibb

- AbbVie, Eli Lilly

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom Pharmaceuticals Market Size based on the below-mentioned segments:

United Kingdom Pharmaceuticals Market, By Disease Indication

- Oncology, Diabetes

- Infectious, Cardiovascular

- Neurology & Psychiatry

- Respiratory

- Renal

- Obesity

- Autoimmune

- Ophthalmic

- Gastrointestinal

- Dermatology

- Reproductive & Allergies

United Kingdom Pharmaceuticals Market, By Drug Type

- Biologics & Biosimilar

- Small Molecules/Conventional Drugs.

United Kingdom Pharmaceuticals Market, By Route of Administration

- Oral

- Parenteral

- Topical

- Inhalation

Frequently Asked Questions (FAQ)

-

What is the United Kingdom pharmaceuticals market size?United Kingdom pharmaceuticals market is expected to grow from USD 41.67 billion in 2024 to USD 121.48 billion by 2035, growing at a CAGR of 10.22% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by an aging population with increasing instances of diseases, support for life science innovation by the government, and R&D investments. an aging population with increasing instances of diseases, support for life science innovation by the government, and R&D investments.

-

What factors restrain the United Kingdom pharmaceuticals market?Constraints include the intense government price control, intellectual property issues, fragmented regulations, quality concern, the talent gaps, and the geopolitical tensions.

-

How is the market segmented by drug type?The market is segmented into biologics & biosimilar, and small molecules/conventional drugs.

-

Who are the key players in the United Kingdom pharmaceuticals market?Key companies include AstraZeneca, Sanofi, Hoffmann-La Roche, Pfizer, Gilead Sciences, GSK, Amgen, Novo Nordisk, Bristol-Myers Squibb, AbbVie, Eli Lilly, and others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?