United Kingdom Payment Market Size, Share, By Mode of Payment (Debit Card, Credit Card, Account-To-Account, Digital Wallet, Cash, and More), and By End-User Industry (Retail, Entertainment, Hospitality, Healthcare, Other), United Kingdom Payment Market Insights, Industry Trend, Forecasts to 2035

Industry: Electronics, ICT & MediaUnited Kingdom Payment Market Insights Forecasts to 2035

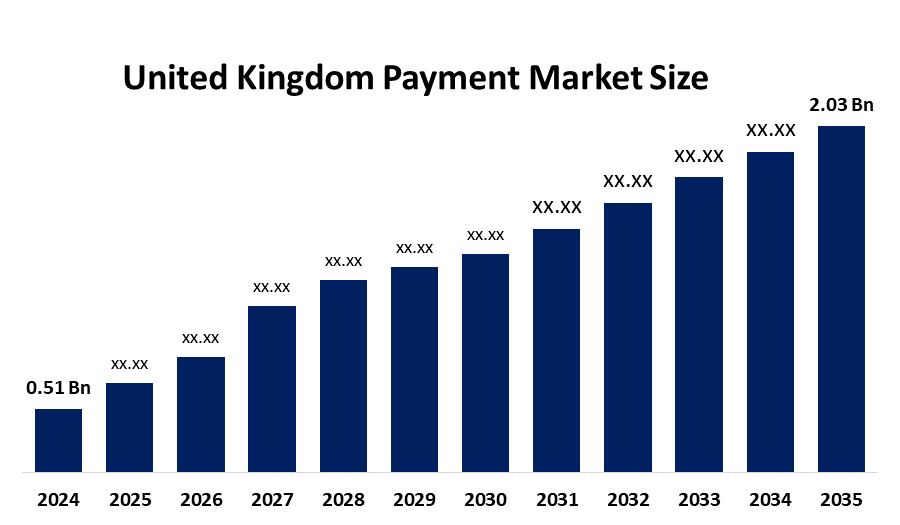

- United Kingdom Payment Market Size 2024: USD 0.51 Billion

- United Kingdom Payment Market Size 2035: USD 2.03 Billion

- United Kingdom Payment Market CAGR 2024: 13.38%

- United Kingdom Payment Market Segments: Mode of Payment and End User Industry

Get more details on this report -

The payment market in the United Kingdom is a constantly evolving and dynamic market that includes card payments, digital wallets, account-to-account payments, mobile payments, and open banking solutions. The market is undergoing a shift from traditional cash and card payment systems to real-time, API-based, and fintech-integrated payment systems. This payment market is driven by the demand for e-commerce, retail, banking, and subscription-based services, and is also influenced by regulatory requirements, pricing challenges, and competition between traditional banks and fintech companies. The payment market in the United Kingdom is a blend of financial acumen and technological advancements in a supportive regulatory environment, fueled by digitalization, consumer preference for cashless payments, and government-backed open banking initiatives.

Commercial Variable Recurring Payments (cVRPs) are gaining momentum in the UK payments market as a flexible account-to-account alternative to Direct Debits. Backed by the UK government and supported by the Financial Conduct Authority, the UK Payments Initiative plans to launch the first live commercial VRP transactions in Q1 2026.

The United Kingdom payment industry provides excellent future prospects due to the accelerated digital evolution, online payments growth, and a rising demand for cashless payments, along with innovations like open banking APIs, artificial intelligence, real-time payments, and embedded finance. The United Kingdom payment industry is experiencing new opportunities in account-to-account payments, digital wallets, subscription payments, and international payment platforms, with a definitive move towards high-value financial ecosystems and partnerships with fintech. The major areas of growth in the United Kingdom payment market are real-time retail payments, online payments, and the secure authentication solutions for banks and merchants. The adoption of payments in e-commerce, financial services, and digital marketplaces is facilitated by data analytics, fraud protection solutions, and open banking initiatives, making the United Kingdom a prominent destination for payments innovation.

Market Dynamics of the United Kingdom Payment Market

The United Kingdom payment industry is driven by the increasing pace of digitalization, the rising trend of cashless payments, the government’s strong support for open banking, and ongoing investments in financial infrastructure. Unending innovation in R&D, the trend towards high-value fintech solutions, and the adoption of real-time and mobile payments are propelling the industry from traditional banking systems to a world leader in innovative digital payment solutions. The rising adoption of contactless cards, digital wallets, and secure authentication methods is revolutionizing business and consumer transactions. The rising disposable income, e-commerce transactions, and business investments are fueling the demand for AI-powered fraud detection and embedded finance.

The United Kingdom payment industry is challenged by factors such as strong price competition among banks and fintech companies, changing regulatory requirements, data protection and cyber threats, and risks associated with digital fraud.

The future of the United Kingdom payments industry looks bright, the fast-paced fintech innovation, the positive government-backed open banking initiatives, and the growing need for secure and seamless digital payments. AI-powered fraud protection, real-time account-to-account payments, cloud-based processing platforms, and embedded finance offerings are opening up new avenues for growth. Moreover, developments in data analytics, API connectivity, cybersecurity best practices, and digital infrastructure are improving the speed, compliance, and efficiency of payments in the United Kingdom’s growing digital payments landscape.

United Kingdom Payment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 0.51 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 13.38% |

| 2035 Value Projection: | USD 2.03 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Mode of Payment, By End-User Industry |

| Companies covered:: | HSBC, Barclays, Lloyds Banking Group, NatWest Group, Revolut, Worldpay, PayPal UK, Adyen, Square UK, Visa UK, Mastercard UK, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom payment market share is classified into mode of payment and end user industry.

By Mode of Payment

The United Kingdom payment market is divided by mode of payment into debit card, credit card, account-to-account, digital wallet, cash, and more. Among these, the debit card segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because the debit cards are the default choice for consumers, representing roughly 85% of total card transaction volume.

By End User Industry

The United Kingdom payment market is divided by end user industry into retail, entertainment, hospitality, healthcare, and other. Among these, the retail segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because the retailers are heavily investing in self-checkout systems and contactless technology to improve efficiency and reduce operational costs.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom payment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom Payment Market

- HSBC

- Barclays

- Lloyds Banking Group

- NatWest Group

- Revolut

- Worldpay

- PayPal UK

- Adyen

- Square UK

- Visa UK

- Mastercard UK

- Others

Recent Developments in United Kingdom Payment Market

In June 2025, Visa Inc. launched Visa A2A in the UK, introducing a “pay by bank” solution enabling instant account-to-account payments with card-like consumer protections. The service targets bills, subscriptions, and e-commerce transactions, strengthening the UK digital payments landscape.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom payment market based on the below-mentioned segments

United Kingdom Payment Market, By Mode of Payment

- Debit Card

- Credit Card

- Account-To-Account

- Digital Wallet, Cash

- More

United Kingdom Payment Market, By End User Industry

- Retail

- Entertainment

- Hospitality

- Healthcare

- Other

Frequently Asked Questions (FAQ)

-

Q: What is the United Kingdom payment market size?A: United Kingdom Payment Market is expected to grow from USD 0.51 billion in 2024 to USD 2.03 billion by 2035, growing at a CAGR of 13.38% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing pace of digitalization, the rising trend of cashless payments, the government’s strong support for open banking, and ongoing investments in financial infrastructure.

-

Q: What factors restrain the United Kingdom payment market?A: Constraints include the strong price competition among banks and fintech companies, changing regulatory requirements, data protection and cyber threats, and risks associated with digital fraud.

-

Q: How is the market segmented by mode of payment?A: The market is segmented into debit card, credit card, account-to-account, digital wallet, cash, and more.

-

Q: Who are the key players in the United Kingdom Payment market?A: Key companies include HSBC, Barclays, Lloyds Banking Group, NatWest Group, Revolut, Wise, Worldpay, PayPal UK, Stripe, Adyen, Checkout.com, Square UK (Block), Visa UK, Mastercard UK, and Others.

Need help to buy this report?