United Kingdom Neobanking Market Size, Share, By Account Type (Business Account and Savings Account), By Application (Enterprises, Personal, and Others), United Kingdom Neobanking Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialUnited Kingdom Neobanking Market Insights Forecasts to 2035

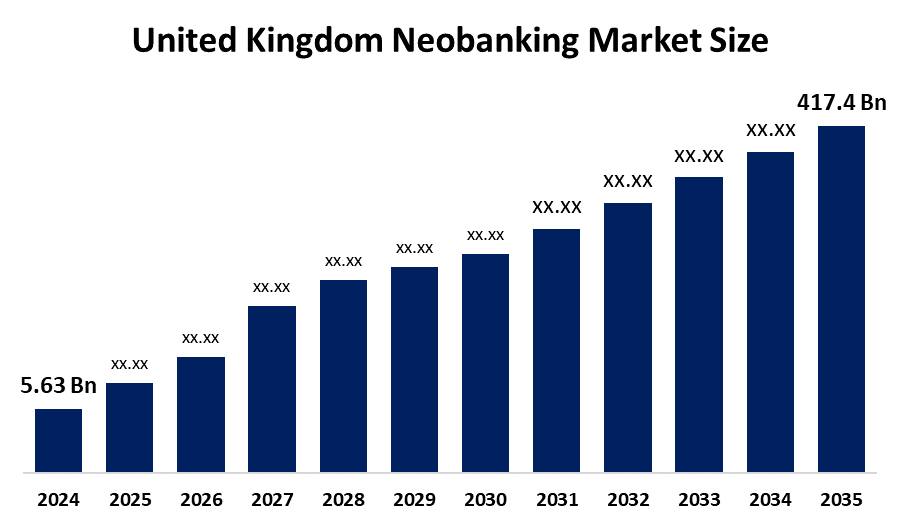

- United Kingdom Neobanking Market Size 2024: USD 5.63 Billion

- United Kingdom Neobanking Market Size 2035: USD 417.4 Billion

- United Kingdom Neobanking Market CAGR 2024: 47.91%

- United Kingdom Neobanking Market Segments: Account Type and Application

Get more details on this report -

The neobanking market in the United Kingdom has emerged as a fast-growing industry that includes digital-only banks, mobile banking applications, payment systems and financial platforms which use artificial intelligence. The industry is moving away from its conventional banking operations to provide customers with technology-based personalized financial solutions that use data analytics. High-tech consumers, small and medium-sized enterprises and city residents drive market demand which combines with financial conduct authority oversight and price competition and the intense market battle between local companies and international fintech businesses. The UK neobanking market exists because digital technologies and financial inclusion projects and government-supported fintech innovations create an environment with advanced technological systems and effective financial regulation and economic frameworks.

The UK government launched the National Payments Vision (NPV) to modernise the country’s payments ecosystem. The strategy focuses on promoting account-to-account (A2A) payments as a standard method for e-commerce, enhancing efficiency, security, and innovation across banks, fintechs, merchants, and neobanking platforms.

The neobanking market in the United Kingdom presents major growth potential because customers increasingly use digital services and require effortless financial solutions, businesses develop new banking technologies through AI, cloud banking platforms, open banking APIs and data analytics systems. The current market trends create opportunities for personalized banking solutions, automatic financial management tools and integrated fintech systems which focus on software development and customer needs and international fintech partnerships. The main development areas of the organization focus on digital banking services for small and medium enterprises and urban customers and people who lack access to banking services which receive support from domestic fintech innovations and their ability to expand through platform development.

United Kingdom Neobanking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.63 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 47.91% |

| 2035 Value Projection: | USD 417.4 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Account Type, By Application |

| Companies covered:: | Monzo, Starling Bank, Wise, Atom Bank, Monese, Tide, Pockit, Zopa, OakNorth Bank, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Market Dynamics of the United Kingdom Neobanking Market

The United Kingdom neobanking market is driven by digital technologies which users increasingly adopt while users with advanced technical skills expect to receive quick and specific banking solutions. The market transformation from traditional banking services to a global center of advanced software-based financial solutions occurs through AI development and cloud banking platforms and open banking APIs and real-time data analytics. The rising demand for digital wallets and automated lending services and personalized banking solutions is driven by urban growth and increasing disposable incomes and the adoption of fintech services. The UK is evolving from a conventional banking provider to a global leader in neobanking innovation, attracting significant investment and strategic international partnerships.

The United Kingdom neobanking market experiences multiple challenges through its competition with traditional banks and fintech companies together with its need to follow strict regulatory requirements established by the FCA and its battle against cybersecurity threats and data privacy issues and its struggle to gain customer confidence in virtual banks.

The United Kingdom neobanking market shows promising growth potential because of upcoming technological changes and favorable fintech regulations and increasing customer demand for digital financial services which offer customized experiences. The industry is expanding because of AI banking solutions, cloud platforms, open banking systems, real-time data processing and faster compliance verification. The United Kingdom neobanking industry is experiencing growth because its security measures, data analysis capabilities, machine learning systems and API-based networks are improving service dependability and system capacity and legal adherence and business productivity.

Market Segmentation

The United Kingdom neobanking market share is classified into account type and application.

By Account Type

The United Kingdom neobanking market is divided by account type into business account and savings account. Among these, the business account segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is driven by high demand from SMEs for streamlined financial services, including real-time cash-flow tracking, lower-cost international payments, and integration with accounting software, which traditional banks struggle to offer with the same agility.

By Application

The United Kingdom neobanking market is divided by application into enterprises, personal, and others. Among these, the enterprises segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to high demand for streamlined financial services among Small and Medium-sized Enterprises (SMEs). These platforms are preferred for their superior expense tracking, invoicing, and swift payment processing.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom neobanking market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom Neobanking Market

- Monzo

- Starling Bank

- Wise

- Atom Bank

- Monese

- Tide

- Pockit

- Zopa

- OakNorth Bank

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom neobanking market based on the below-mentioned segments

United Kingdom Neobanking Market, By Account Type

- Business Account

- Savings Account.

United Kingdom Neobanking Market, By Application

- Enterprises

- Personal

- Others.

Frequently Asked Questions (FAQ)

-

Q: What is the United Kingdom neobanking market size?A: United Kingdom neobanking market is expected to grow from USD 5.63 billion in 2024 to USD 417.4 billion by 2035, growing at a CAGR of 47.91% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by digital technologies which users increasingly adopt while users with advanced technical skills expect to receive quick and specific banking solutions.

-

Q: What factors restrain the United Kingdom neobanking market?A: Constraints include the competition with traditional banks and fintech companies together with its need to follow strict regulatory requirements established by the FCA and its battle against cybersecurity threats and data privacy issues and its struggle to gain customer confidence in virtual banks

-

Q: How is the market segmented by account type?A: The market is segmented into business account and savings account.

-

Q: Who are the key players in the United Kingdom neobanking market?A: Key companies include Monzo, Starling Bank, Wise, Atom Bank, Monese, Tide, Pockit, Zopa, OakNorth Bank, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

-

Q: What is the United Kingdom neobanking market size?A: United Kingdom neobanking market is expected to grow from USD 5.63 billion in 2024 to USD 417.4 billion by 2035, growing at a CAGR of 47.91% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by digital technologies which users increasingly adopt while users with advanced technical skills expect to receive quick and specific banking solutions.

-

Q: What factors restrain the United Kingdom neobanking market?A: Constraints include the competition with traditional banks and fintech companies together with its need to follow strict regulatory requirements established by the FCA and its battle against cybersecurity threats and data privacy issues and its struggle to gain customer confidence in virtual banks

-

Q: How is the market segmented by account type?A: The market is segmented into business account and savings account.

-

Q: Who are the key players in the United Kingdom neobanking market?A: Key companies include Monzo, Starling Bank, Wise, Atom Bank, Monese, Tide, Pockit, Zopa, OakNorth Bank, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?