United Kingdom Microarray Market Size, Share By Type (DNA Microarray, Protein Microarray, and Others), By Application (Research Applications, Drug Discovery, Disease Diagnostics, and Others Applications), By End Use (Research and Academic Institutes, Pharmaceutical and Biotechnology Companies, Diagnostic Laboratories, and Others), United Kingdom Microarray Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited Kingdom Microarray Market Insights Forecasts to 2035

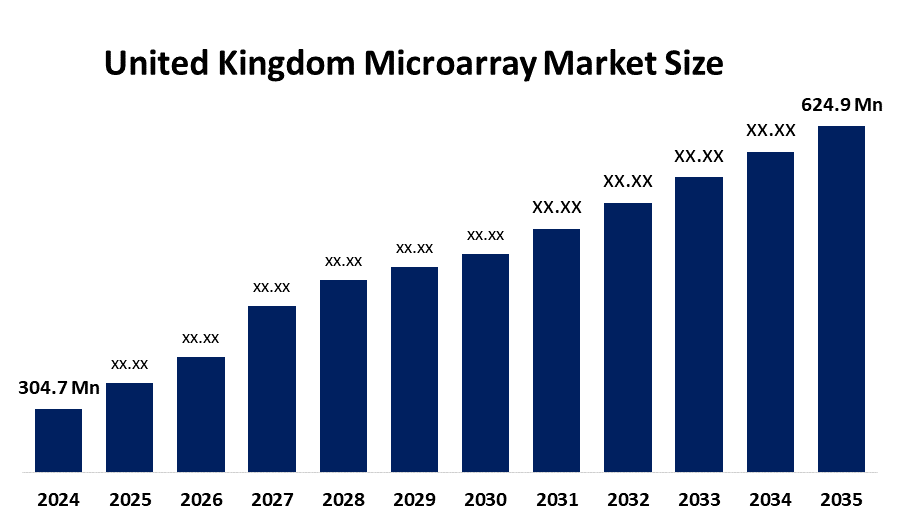

- United Kingdom Microarray Market Size 2024: USD 304.7 Million

- United Kingdom Microarray Market Size 2035: USD 624.9 Million

- United Kingdom Microarray Market CAGR 2024: 6.75%

- United Kingdom Microarray Market Segments: Type, Application, and End Use

Get more details on this report -

The microarray market within the United Kingdom is a part of the burgeoning Life Sciences and Diagnostics Technology Industry. It encompasses the DNA microarray, RNA microarray, and protein microarray technologies and contributes to clinical diagnostics, pharmaceutical research, biotechnology development, and research within the United Kingdom. It is one of the vital technology for NHS, pharmaceutical, and academic sectors for disease detection, drug discovery, and genomic research. This is because of the burgeoning requirement for personal medicine, expansion of molecular diagnostics, genomic and proteomics research, and high government backing for the development of cutting-edge research facilities within the United Kingdom.

The NHS Genomic Medicine Service (GMS) is a major driver of the UK diagnostic microarray market, using SNP arrays to investigate developmental delay, autism, and prenatal anomalies. Launched to ensure equitable access across England, it supports widespread adoption of genomic testing and strengthens microarray utilization in clinical diagnostics.

The United Kingdom has definite opportunities in the microarray market driven by an increasing demand for genomic and proteomics-based research, clinical diagnostics, and the potential for pharmaceutical and biopharmaceutical development. There are opportunities in clinical diagnostics in hospital labs, as well as in drug discovery and development, biomarkers, and personalized medicine applications. The United Kingdom microarrays market opportunity is driven by the Government’s life sciences strategy, genomic research programs within the NHS, and growing partnerships between public sector research and diagnostic technology companies, despite the challenges posed by funding and skilled workforce availability.

Market Dynamics of the United Kingdom Microarray Market

The UK microarray marketplace is driven by strong government support for life science research, genomic medicine initiatives, NHS laboratory modernization programs, and increased public and private partnerships focused on addressing the rising need for advanced diagnostic testing. The move toward centralized, automatic, and integrated laboratory services continues to transform the manner in which genomic testing is approached in hospitals, pharmaceutical industries, and research organizations. Increased emphasis on high-throughput microarray technologies, integration of bioinformatics, and improved quality assurance solutions is resulting in more precise testing, increased efficiency in the laboratories, and a technologically advanced and mature market for microarray solutions in the United Kingdom.

The United Kingdom microarray market faces restraints such as high costs associated with advanced microarray platforms, data analysis software, and maintenance requirements. Limited availability of skilled professionals in genomics and bioinformatics, along with budget limitations within NHS and academic research institutions, can restrict widespread adoption.

The continuous development in the genomic technologies, coupled with the strong government support for life sciences and an increasing need for the accurate molecular diagnostics and research tools, paints a bright future outlook for microarrays in the United Kingdom. The automated high-throughput microarray platforms, advanced integration of bioinformatics, and digital systems for laboratories are presenting tremendous opportunities for growth. Increasing pharmaceutical and the biopharmaceutical research, coupled with growing clinical diagnostics applications, enables better testing accuracy and laboratory efficiency, the challenges posed by an aging population, increasing disease burden, and an increasing need for personalized medicine and drug development have hastened the application of microarray technologies across the healthcare and research sectors of the United Kingdom.

United Kingdom Microarray Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 304.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.75% |

| 2035 Value Projection: | USD 624.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Oxford Gene Technology (OGT), Illumina, Thermo Fisher Scientific, Agilent Technologies, PerkinElmer, Merck KGaA, GE Healthcare, Bio-Rad Laboratories, Qiagen, Molecular Devices, Arrayit Corporation, Microarrays Inc., Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom microarray market share is classified into type, application, and end use.

By Type

The United Kingdom microarray market is divided by type into DNA microarray, protein microarray, and others. Among these, the DNA microarray segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is driven by extensive applications in genomics research, molecular diagnostics, and pharmaceutical drug development.

By Application

The United Kingdom microarray market is divided by application into research applications, drug discovery, disease diagnostics, and others applications. Among these, the research applications segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because it plays a crucial role in molecular biology, cancer research, and understanding complex diseases, which heavily relies on identifying activated or silenced genes.

By End Use

The United Kingdom microarray market is divided by end use into research and academic institutes, pharmaceutical and biotechnology companies, diagnostic laboratories, and others. Among these, the research and academic institutes segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because these institutes are at the forefront of fundamental scientific research, heavily utilizing microarrays for gene function analysis and understanding complex disease mechanisms.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom microarray market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom Microarray Market

- Oxford Gene Technology (OGT)

- Illumina

- Thermo Fisher Scientific

- Agilent Technologies

- PerkinElmer

- Merck KGaA

- GE Healthcare

- Bio-Rad Laboratories

- Qiagen, Molecular Devices

- Arrayit Corporation

- Microarrays Inc.

- Others

Recent Developments in United Kingdom Microarray Market

In December 2024, LinkZill launched the TruArra Std 4K high-throughput oligonucleotide microarray chips, designed for research and diagnostic applications, enhancing genomic analysis capabilities and supporting the growing microarray market in the UK.

In August 2023, Thermo Fisher Scientific launched the CytoScan HD Accel chromosomal microarray, designed to improve productivity in cytogenetic research laboratories. The innovation supports faster genomic analysis, strengthening overall capabilities across the UK microarray market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom microarray market based on the below-mentioned segments

United Kingdom Microarray Market, By Type

- DNA Microarray

- Protein Microarray

- Others

United Kingdom Microarray Market, By Application

- Research Applications

- Drug Discovery

- Disease Diagnostics

- Others Applications

United Kingdom Microarray Market, By End Use

- Research and Academic Institutes

- Pharmaceutical and Biotechnology Companies

- Diagnostic Laboratories

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the United Kingdom microarray market size?A: United Kingdom microarray market is expected to grow from USD 304.7 million in 2024 to USD 624.9 million by 2035, growing at a CAGR of 6.75% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the strong government support for life science research, genomic medicine initiatives, NHS laboratory modernization programs, and increased public and private partnerships focused on addressing the rising need for advanced diagnostic testing.

-

Q: What factors restrain the United Kingdom microarray market?A: Constraints include high costs associated with advanced microarray platforms, data analysis software, and maintenance requirements.

-

Q: How is the market segmented by type?A: The market is segmented into DNA microarray, protein microarray, and others

-

Q: Who are the key players in the United Kingdom microarray market?A: Key companies include Oxford Gene Technology (OGT), Illumina, Thermo Fisher Scientific, Agilent Technologies, PerkinElmer, Merck KGaA, GE Healthcare, Bio-Rad Laboratories, Qiagen, Molecular Devices, Arrayit Corporation, Microarrays Inc., and Others.

Need help to buy this report?