United Kingdom Luxury Goods Market Size, Share, By Type (Clothing and Apparel, Footwear, Eyewear, Leather Goods, Watches, and Beauty and Personal Care), By End Use (Men, Women, and Unisex), By Distribution Channel (Single Brand Stores, Multi Brand Stores, and Online Stores), and United Kingdom Luxury Goods Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsUnited Kingdom Luxury Goods Market Insights Forecasts to 2035

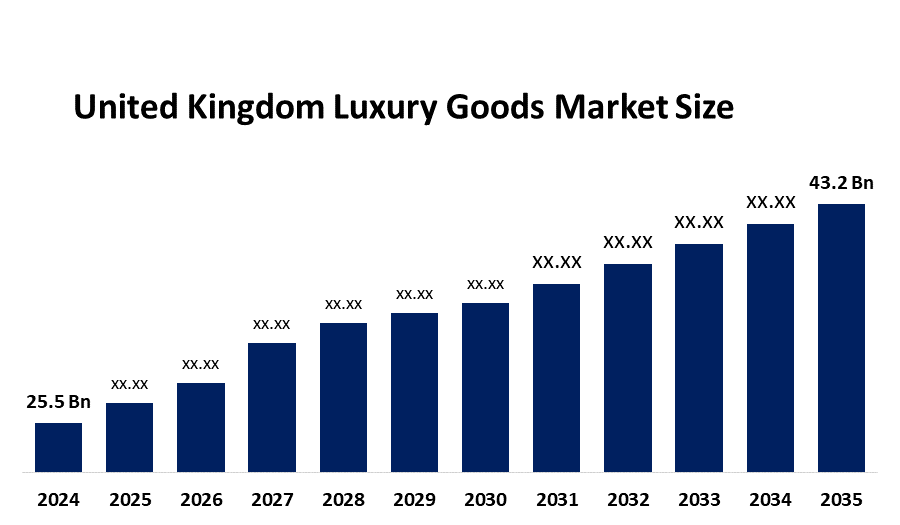

- United Kingdom Luxury Goods Market Size 2024: USD 25.5 Billion

- United Kingdom Luxury Goods Market Size 2035: USD 43.2 Billion

- United Kingdom Luxury Goods Market CAGR: 4.91%

- United Kingdom Luxury Goods Market Segments: Type, By End Use, and Distribution Channel

Get more details on this report -

The United Kingdom luxury goods market continues to grow as consumers increasingly value premium products, craftsmanship, and brand heritage. Despite financial headwinds and post-Brexit changes, the industry continues to play an important role in the UK economy, sustaining over 450,000 employments and valued at over EURO 81 billion yearly. UK luxury brands are expanding omnichannel strategies, integrating physical boutiques with digital sales and immersive customer experiences to cater to both domestic and international buyers.

Trade and export assistance through the UKTI International Action Plan is one of the government's initiatives to support the retail and luxury industries. It assists luxury firms in breaking through supply chain or market access obstacles and gaining access to international markets. Government interest in fostering high-value industries is shown by broader retail assistance initiatives, even as luxury industry associations persist in advocating for incentives like tax adjustments (such as restoring VAT-free shopping for tourists) to increase competitiveness.

As firms use AI, augmented reality, virtual showrooms, and blockchain technologies to improve personalization, customer engagement, and product transparency, technological innovation is changing the luxury market. Digital product passports, virtual consultations, and augmented reality try-ons are a few examples of innovations that enhance the luxury buying experience and authenticity verification.

Market Dynamics of the United Kingdom Luxury Goods Market:

The United Kingdom luxury goods market is driven by strong consumer demand for premium, high-quality, and branded products, supported by rising disposable incomes, urbanization, and the country’s status as a global fashion and luxury hub. Sales of luxury clothing, accessories, watches, and cosmetics are greatly increased by the rise in foreign travel, especially in places like London. Market growth is also being accelerated by rising brand awareness, the impact of social media, celebrities, and fashion influencers, as well as the quick development of omnichannel and e-commerce platforms.

Despite these positive drivers, the market faces certain restraints. Accessibility for a wider range of consumers is restricted by high product prices, particularly in times of economic instability and inflationary pressure. Market stability is further threatened by shifting exchange rates, interruptions in the supply chain, and growing operating expenses. Furthermore, if left unchecked, growing worries about ethical sourcing, sustainability, and fake goods can harm a brand's reputation.

However, the market presents substantial growth opportunities. Growth in online luxury retail, rising demand for luxury items made ethically and sustainably, and developments in digital technologies like AI-driven personalization and virtual try-ons are creating new opportunities for brands. Long-term market growth in the UK is anticipated to be supported by expansion into unisex collections, resale and circular luxury models, and growing customer categories.

United Kingdom Luxury Goods Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 25.5 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.91% |

| 2035 Value Projection: | USD 43.2 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By End Use |

| Companies covered:: | LVMH Moet Hennessy Louis Vuitton SE, Compagnie Financiere Richemont SA, Burberry Group plc, Kering S.A, Chanel Limited, Hermes International SCA, Swatch Group AG, Asprey London Limited, Smythson, Radley London, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom luxury goods market share is classified into type, by end use, and distribution channel.

By Type:

On the basis of type, the United Kingdom luxury goods market is categorized into clothing and apparel, footwear, eyewear, leather goods, watches, and beauty and personal care. Among these, the clothing and apparel segment held the largest market share in 2024 and is expected to grow at a remarkable rate over the forecast period. High customer demand for high-end designer clothing, the existence of well-known British luxury fashion firms, and the enduring appeal of luxury ready-to-wear collections are the main drivers of this supremacy.

By End Use:

Based on end use, the United Kingdom luxury goods market is divided into men, women, and unisex. Among these, the women segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. Women's increased spending on luxury clothing, handbags, shoes, and cosmetics is the main factor for this domination. Strong influence from fashion trends, social media, and celebrity endorsements continues to boost demand for women-focused luxury collections.

By Distribution Channel:

The United Kingdom luxury goods market is classified by distribution channel into single brand stores, multi brand stores, and online stores. Among these, the online Store segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The quick transition to digital luxury shopping, rising internet usage, and the ease of perusing and buying high-end goods online are the main drivers of this expansion. Luxury brands are heavily investing in e-commerce platforms, virtual showrooms, and personalized digital experiences to attract tech-savvy and younger consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom luxury goods market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the United Kingdom Luxury Goods Market:

- LVMH Moet Hennessy Louis Vuitton SE

- Compagnie Financiere Richemont SA

- Burberry Group plc

- Kering S.A

- Chanel Limited

- Hermes International SCA

- Swatch Group AG

- Asprey London Limited

- Smythson

- Radley London

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom luxury goods market based on the following segments:

United Kingdom Luxury Goods Market, By Type

- Clothing and Apparel

- Footwear

- Eyewear

- Leather Goods

- Watches

- Beauty and Personal Care

United Kingdom Luxury Goods Market, By End Use

- Men

- Women

- Unisex

United Kingdom Luxury Goods Market, By Distribution Channel

- Single Brand Stores

- Multi Brand Stores

- Online Stores

Frequently Asked Questions (FAQ)

-

1.What is the expected growth outlook of the United Kingdom luxury goods market?The United Kingdom luxury goods market is expected to grow steadily from USD 25.5 billion in 2024 to USD 43.2 billion by 2035, registering a CAGR of 4.91% during the forecast period. Growth is supported by strong brand heritage, rising demand for premium products, and expanding digital retail channels.

-

2.What are the key factors driving the United Kingdom luxury goods market?Major growth drivers include increasing disposable income, rising brand consciousness, growth in international tourism, and strong demand for premium apparel, accessories, and beauty products. The rapid expansion of e-commerce and omnichannel retail strategies further accelerates market growth.

-

3.What are the major opportunities in the United Kingdom luxury goods market?Key opportunities include growth in sustainable and ethical luxury products, expansion of resale and circular luxury models, adoption of AI-driven personalization, and increased demand from younger and unisex consumer segments.

-

4.Who are the major players in the United Kingdom luxury goods market?Leading companies include LVMH, Richemont, Burberry, Kering, Chanel, Hermès, Swatch Group, Asprey London, Smythson, and Radley London, among others.

Need help to buy this report?