United Kingdom Liquefied Petroleum Gas Market Size, Share, By Application (Residential, Commercial, Chemical, Industrial, Autogas, Refinery, and Others), By Source (Refinery, Associated Gas, and Non-Associated Gas), By Transportation (Ship, Railways, Intermodal ISO Tank Containers, Pipelines, Reticulated Gas System, Large Road Tankers, Bobtail Tankers, and Bike Carts), and United Kingdom Liquefied Petroleum Gas Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerUnited Kingdom Liquefied Petroleum Gas Market Size Insights Forecasts to 2035

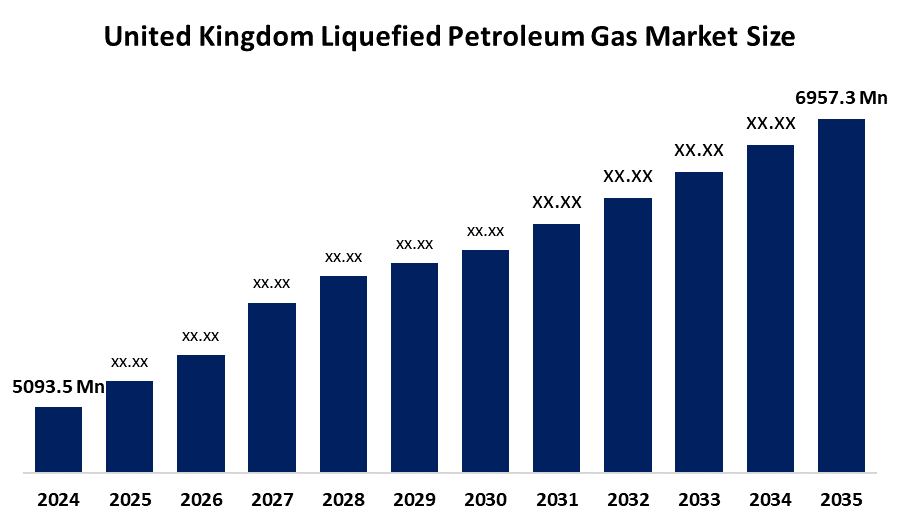

- United Kingdom Liquefied Petroleum Gas Market Size 2024: USD 5093.5 Mn

- United Kingdom Liquefied Petroleum Gas Market Size 2035: USD 6957.3 Mn

- United Kingdom Liquefied Petroleum Gas Market CAGR: 2.88%

- United Kingdom Liquefied Petroleum Gas Market Segments: Application, Source, and Transportation

Get more details on this report -

The UK LPG market remains an important energy segment, particularly for off-grid homes, rural businesses, and industrial applications, with significant investment underway to support cleaner fuel solutions and energy security. The industry is actively moving toward renewable LPG (BioLPG), which is compatible with current LPG infrastructure and can cut carbon emissions by as much as 90% when compared to conventional LPG.

The goal of government and business initiatives is to align LPG with the UK's net-zero ambitions. Reports highlighting the significance of renewable liquid gases in decarbonization support industry commitments to achieve a 100% conversion to BioLPG by 2040.

The sector's capacity and sustainability are strengthened by technological developments like enhanced supply chain innovations, diverse feedstock paths (such waste gasification), and renewable fuel production techniques. When taken as a whole, these advancements strengthen LPG's position as a low-carbon, transitional energy source in the context of larger UK clean energy initiatives.

Market Dynamics of the United Kingdom Liquefied Petroleum Gas Market:

Strong demand from off-grid residential and commercial customers, especially in rural regions with limited access to the natural gas grid, is the main driver of the UK LPG industry. LPG is a desirable transitional fuel due to its great energy efficiency and lower carbon emissions when compared to coal and heating oil. Demand is also supported by expansion in industries like construction, hospitality, agriculture, and industrial production. Furthermore, expanding the use of BioLPG, a renewable substitute, supports long-term market prospects and is consistent with the UK's net-zero goals.

Market growth is restrained by the price volatility of crude oil and natural gas, as LPG prices are closely linked to global energy markets. Rising penetration of electric heating systems and heat pumps, supported by government incentives, also poses competition. Furthermore, expansion may be constrained, especially for smaller providers, by strict safety rules, storage needs, and high logistics expenses.

Significant opportunities exist in the expansion of BioLPG and renewable LPG blends, especially for decarbonising off-grid heating. Additional growth opportunities include industrial fuel switching, smart tank monitoring, and infrastructure improvements. The UK LPG market is becoming more robust and scalable as a result of ongoing market consolidation and acquisitions that allow suppliers to increase their geographic reach and operational effectiveness.

Market Segmentation

The United Kingdom liquefied petroleum gas market share is classified into application, source, and transportation.

By Application:

On the basis of the application, the United Kingdom liquefied petroleum gas market is categorized into residential, commercial, chemical, industrial, autogas, refinery, and other. Among these, the residential segment held the largest market share in 2024 and is expected to grow at a remarkable rate over the forecast period. This domination is because off-grid rural homes with limited access to the natural gas network heavily rely on LPG for cooking, space heating, and hot water. LPG's extensive use in homes is further supported by its affordability, convenience of storage, and reduced carbon emissions as compared to coal and heating oil.

By Source:

Based on the source, the United Kingdom liquefied petroleum gas market is divided into refinery, associated gas, and non-associated gas. Among these, the refinery segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. The UK's well-established refining infrastructure, which produces LPG as a by-product during crude oil refining processes, is mostly to blame for this dominance. To meet the demand from residential, commercial, and industrial uses, refineries provide a steady and reliable supply of LPG.

By Transportation:

The United Kingdom liquefied petroleum gas market is classified by transportation into ship, railways, intermodal iso tank containers, pipelines, reticulated gas system, large road tankers, bobtail tankers, and bike carts. Among these, the large road tankers segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. This dominance is fueled by the UK's enormous road network, flexibility, and cost-effectiveness, which allow for the dependable transportation of bulk LPG to commercial, industrial, and residential clients, especially in rural and off-grid locations.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom liquefied petroleum gas market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the United Kingdom Liquefied Petroleum Gas Market:

- Shell PLC

- BP plc (BP Gas)

- TotalEnergies Gas & Power Ltd

- Calor Gas

- Flogas Britain

- Energas

- CamGas

- JGas

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the market based on the following segments:

United Kingdom Liquefied Petroleum Gas Market, By Application

- Residential

- Commercial

- Chemical

- Industrial

- Autogas

- Refinery

- Others

United Kingdom Liquefied Petroleum Gas Market, By Source

- Refinery

- Associated Gas

- Non-Associated Gas

United Kingdom Liquefied Petroleum Gas Market, By Transportation

- Ship

- Railways

- Intermodal ISO Tank Containers

- Pipelines

- Reticulated Gas System

- Large Road Tankers

- Bobtail Tankers

- Bike Carts

Frequently Asked Questions (FAQ)

-

1. What is the market size of the UK LPG market in 2024 and 2035?The UK LPG market was valued at USD 5,093.5 million in 2024 and is projected to reach USD 6,957.3 million by 2035.

-

2. What is the expected growth rate of the UK LPG market?The market is expected to grow at a CAGR of 2.88% during the forecast period 2025–2035.

-

3. What are the key drivers of the UK LPG market?Key drivers include strong off-grid energy demand, lower carbon emissions compared to coal and oil, industrial usage, and growing adoption of BioLPG.

-

4. What are the major restraints affecting market growth?Price volatility of crude oil, competition from electric heating and heat pumps, and strict safety and storage regulations act as key restraints.

-

5. What opportunities exist in the UK LPG market?Opportunities include BioLPG expansion, industrial fuel switching, smart tank monitoring, infrastructure upgrades, and market consolidation.

Need help to buy this report?