United Kingdom Lighting Market Size, Share, By Type (CFL, Fluorescent Lighting, Halogen, HID, Incandescent, and LED Lighting), By Application (Indoor Lighting, Outdoor Lighting, and Smart Lighting), By End Use (Commercial, Industrial, and Residential), United Kingdom Lighting Market Insights, Industry Trend, Forecasts to 2035.

Industry: Semiconductors & ElectronicsUnited Kingdom Lighting Market Insights Forecasts to 2035

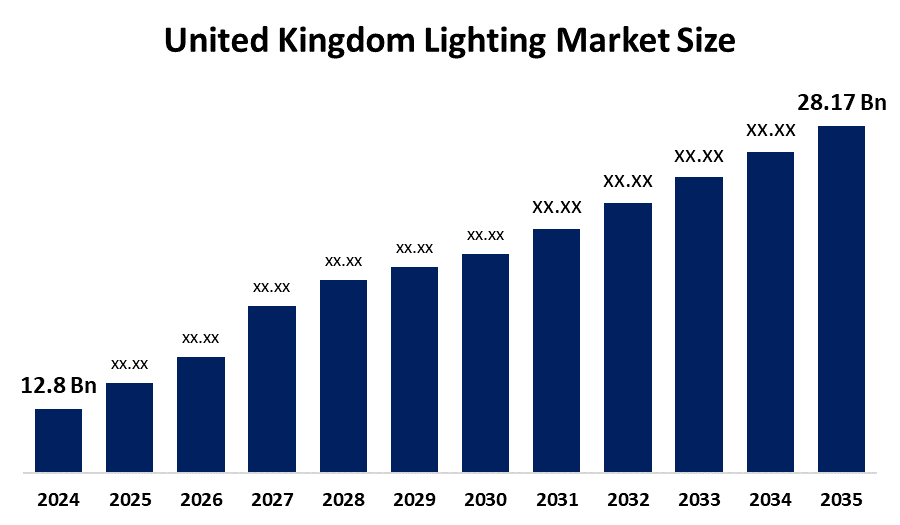

- United Kingdom Lighting Market Size 2024: USD 12.8 Billion

- United Kingdom Lighting Market Size 2035: USD 28.17 Billion

- United Kingdom Lighting Market CAGR 2024: 7.43%

- United Kingdom Lighting Market Segments: Type, Application, and End Use

Get more details on this report -

The United Kingdom Lighting Market Is Mature Yet Steadily Developing, Catering To Residential, Commercial, Industrial, And The Public Infrastructure Illumination Needs. There is increasingly strong governmental focus on the energy conservation, carbon neutrality targets, and smart city development accelerates the adoption of intelligent and connected lighting solutions. Besides, the market exhibits inelastic replacement demand governed by upgrade cycles of infrastructure, urban development, and efficiency standards set by regulators. Strong procurement control of public authorities, commercial enterprises, and municipal bodies, along with strict environmental and safety legislation, ensures that competition remains at a moderate level among established manufacturers of light sources and specialized lighting solution providers.

The lighting market of the United Kingdom offers prospects for a sustained growth rate with the increase of energy efficiency schemes, progress of smart city programs, and development of sustainable and low-carbon infrastructures. With the increasing trend of advanced lighting technologies, LED lighting systems and other smart lighting technologies are becoming feasible due to their increased energy-saving potential, longer lifespan, and lower lifecycle cost. This trend has opened doors for upgrading existing lighting infrastructures of residential, commercial buildings, and public spaces with the integration of lighting and IoT technology. In addition, the lighting industry is seeing good prospects of adopting adaptive and intelligent lighting systems that offer several advantages such as improved urban safety, reduced energy demand, and increased resistance to environmental and operational challenges.

United Kingdom Lighting Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12.8 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.43% |

| 2035 Value Projection: | USD 28.17 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type By Application |

| Companies covered:: | AppsSignify (Philips Lighting), LEDVANCE GmbH (MLS Co Ltd), Thorn Lighting Ltd (Zumtobel Group), FW Thorpe plc (Thorlux Lighting), Dialight plc, Aurora Lighting Group, Whitecroft Lighting, Luceco plc, Dextra Lighting Ltd, Crompton Lamps Limited, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the United Kingdom Lighting Market

The UK lighting market is driven by the influence of constant investment in energy-saving facilities, the concept of Smart Cities, and government initiatives towards the implementation of net-zero carbon emission projects, promoting sustainable urbanization. The ongoing process of changing traditional lighting systems, addition of new commercial and domestic infrastructure, and rapid advancement of smart and connected lights have accelerated investments in technically advanced LED lights. Rising investments in the development of eco-friendly lights, coupled with their integration with IoT-based control systems, have led to the gradual transformation of traditional illumination-based suppliers into technically advanced lighting solution suppliers. This has encouraged many indigenous as well as external manufacturers, despite the implementation of stringent guidelines, pricing, and moderate competition.

he United Kingdom lighting market faces restraints such as strict regulatory requirements related to energy efficiency, environmental sustainability, and product safety standards, which increase compliance and certification costs for manufacturers. Price sensitivity in public sector and large-scale commercial procurement, along with relatively long replacement cycles for installed lighting infrastructure, limits rapid market expansion.

The outlook or future of the United Kingdom lighting market looks promising as the government and other bodies are focusing greatly on the use of energy efficiency standards while promoting other strategies as well as infrastructure towards the development of a sustainable city environment. Therefore, the use of smart lighting solutions combined with other opportunities in the development of sustainable sources of energy as well as electric vehicle charging infrastructure development indicates a favorable outlook for the advancement of sustainable growth opportunities in the use of advanced lighting solutions in the United Kingdom market. Thus, the outlook for the lighting market in the United Kingdom looks promising as it combines advanced technological solutions while operating in a highly regulated market environment that promotes sustainability.

Market Segmentation

The United Kingdom lighting market share is classified into type, application, and end use.

By Type

The United Kingdom lighting market is divided by type into CFL, fluorescent lighting, halogen, hid, incandescent, and led lighting. Among these, the steel Lighting segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because the LEDs produce more light with less energy compared to CFL, incandescent, and halogen bulbs.

By Application

The United Kingdom lighting market is divided by application into indoor lighting, outdoor lighting, and smart lighting. Among these, the indoor lighting segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because the large-scale relighting programs in offices, warehouses, and retail spaces, driven by net-zero pledges and energy cost reductions, fuel this segment.

By End Use

The United Kingdom lighting market is divided by end use into commercial, industrial, and residential. Among these, the residential segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because the consumers are increasingly replacing traditional, inefficient, and halogen lighting with modern, energy-efficient LED solutions, contributing to a high volume of sales in the residential sector.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom lighting market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom Lighting Market

- AppsSignify (Philips Lighting)

- LEDVANCE GmbH (MLS Co Ltd)

- Thorn Lighting Ltd (Zumtobel Group)

- FW Thorpe plc (Thorlux Lighting)

- Dialight plc

- Aurora Lighting Group

- Whitecroft Lighting

- Luceco plc

- Dextra Lighting Ltd

- Crompton Lamps Limited

- Others

Recent Developments in United Kingdom Lighting Market

In January 2026, Aurora Lighting launched an upgraded R6 fire-rated downlight range, featuring improved installation efficiency, enhanced CRI90 lighting performance, extended 50,000-hour lifespan, and reliable design, supporting evolving residential requirements in UK lighting market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Sperical Insights has segmented the United Kingdom lighting market based on the below-mentioned segments:

United Kingdom Lighting Market, By Type

- CFL

- Fluorescent Lighting

- Halogen

- HID

- Incandescent

- LED Lighting.

United Kingdom Lighting Market, By Application

- Indoor Lighting

- Outdoor Lighting

- Smart Lighting

United Kingdom Lighting Market, By Application

- Commercial

- Industrial

- Residential.

Frequently Asked Questions (FAQ)

-

Q: What is the United Kingdom lighting market size?A: United Kingdom lighting market is expected to grow from USD 12.8 billion in 2024 to USD 28.17 billion by 2035, growing at a CAGR of 7.43% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by constant investment in energy-saving facilities, the concept of Smart Cities, and government initiatives towards the implementation of net-zero carbon emission projects, promoting sustainable urbanization.

-

Q: What factors restrain the United Kingdom lighting market?A: Constraints include strict regulatory requirements related to energy efficiency, environmental sustainability, and product safety standards, which increase compliance and certification costs for manufacturers.

-

Q: Who are the key players in the United Kingdom lighting market?A: Key companies include AppsSignify (Philips Lighting), LEDVANCE GmbH (MLS Co Ltd), Thorn Lighting Ltd (Zumtobel Group), FW Thorpe plc (Thorlux Lighting), Dialight plc, Aurora Lighting Group, Whitecroft Lighting, Luceco plc, Dextra Lighting Ltd, Crompton Lamps Limited, and Others.

Need help to buy this report?