United Kingdom Kombucha Market Size, Share, By Product (Conventional Kombucha, Hard Kombucha), By Distribution Channel (On-Trade, Off-Trade), United Kingdom Kombucha Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Kombucha Market Insights Forecasts to 2035

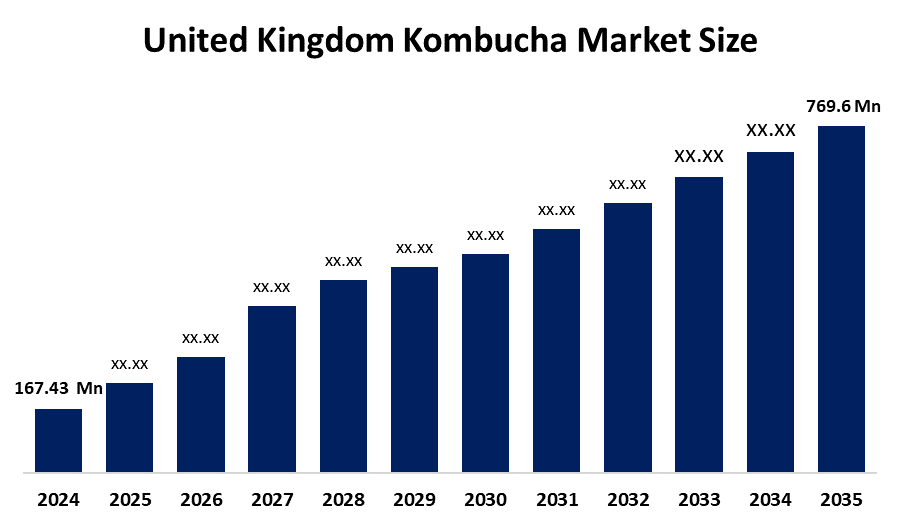

- United Kingdom Kombucha Market Size 2024: USD 167.43 Mn

- United Kingdom Kombucha Market Size 2035: USD 769.6 Mn

- United Kingdom Kombucha Market CAGR 2024: 14.87%

- United Kingdom Kombucha Market Segments: Product and Distribution Channel

Get more details on this report -

The UK market for kombucha is a growing and fiercely competitive sector, ranging from traditional fermented teas to flavored and functional variants, seasonal limited edition products, and premium artisanal versions. This market is already being fueled by the growing awareness of health, the need for sugar-free and alcohol-free drinks, the movement towards premiumization and super premiumization, and the growing interest in health and functional drinks. The strong competition in the market from both artisanal brands and global beverage corporations is changing the face of the market with the development and expansion of supermarkets and the growing interest in the market from the foodservice sector. Furthermore, the market has received clarity through innovations in flavor profiles, functional components, sustainable packaging, and brand narratives.

The United Kingdom Kombucha Market Size is emerging with immense growth due to the increasing health awareness among the population, the demand for low sugar and alcohol-free drinks, and the changing consumption patterns among consumers to include premium, functional, and speciality fermented beverages. Specialty kombucha, botanical, and fruit flavors, and wellness-driven product lines such as those containing high levels of probiotics and adaptogens are major categories and are backed by the presence of proper fermentation rules and procedures, sugar content, labeling, and food safety.

Market Dynamics of the United Kingdom Kombucha Market

The development of the United Kingdom Kombucha Market Size is driven largely by health-minded urban citizens with more disposable income who understand the regulations regarding the labeling and safety of food products. Furthermore, there is an increase in desire among consumers to purchase premium, crafted and functional beverages, thus helping to elevate what was once considered a niche product, to one that now represents the mainstream, innovation-centric beverage category. As such, kombucha has attracted an increasing number of young consumers and has also benefitted from the growth of the middle class with a focus on health and wellness. Hence, there continues to be an increase in the demand by these consumers to acquire seasonal and flavored Kombucha, as well as botanically flavored Kombucha.

The United Kingdom Kombucha Market Size faces restraints such as strict food safety and labelling regulations, sugar-content and alcohol-threshold compliance requirements, intense competition between craft producers and multinational beverage companies, high production costs, limited shelf space in retail, and challenges in maintaining consistent quality and live cultures across distribution channels.

The future of the UK kombucha industry promises to be extremely bright and dynamic, with innovation in products, increasing premiumization, and ever-changing consumer trends associated with health and functionality, such as low sugar and non-alcoholic drinks. Seasonal special editions, functional drinks developed with probiotics, botanics, and adaptogens, and local flavors are emerging as new and exciting avenues. The kombucha industry in the UK is becoming increasingly efficient, compliant, and scalable because of innovation in controlled fermentation technologies, online quality management, cold chain management, and sustainable sourcing practices. Furthermore, the increasing focus on the environmental sustainability and recycled packaging of drinks in the UK provides an impetus to both craft and multinational companies to innovate and launch new products and production capacity to meet the rising demands of the health-conscious consumers.

United Kingdom Kombucha Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 167.43 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 14.87% |

| 2035 Value Projection: | USD 769.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product , |

| Companies covered:: | GO Kombucha, Pret A Manger, Remedy Drinks, MOMO Kombucha, L.A Brewery, Happy Kombucha, Lobros, One Living, Equinox Kombucha, HOLOS Kombucha, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom Kombucha Market share is classified into product and distribution channel.

By Product

The United Kingdom Kombucha Market Size is divided by product into conventional kombucha, hard kombucha. Among these, the conventional kombucha segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to its strong association with health, wellness, and as a sugary drink alternative.

By Distribution Channel

The United Kingdom Kombucha Market Size is divided by distribution channel into on-trade, off-trade. Among these, the infection segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to high accessibility, convenience for at-home consumption, variety, and strong retail presence in chains like Tesco.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom Kombucha Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom Kombucha Market

- GO Kombucha

- Pret A Manger

- Remedy Drinks

- MOMO Kombucha

- L.A Brewery

- Happy Kombucha

- Lobros

- One Living

- Equinox Kombucha

- HOLOS Kombucha

- Others

Recent Developments in United Kingdom Kombucha Market

In March 2025, Lipton Kombucha launched in the UK, introduced by Britvic, bringing a mainstream tea brand into the kombucha category with Strawberry Mint, Raspberry, and Mango Passionfruit flavours, targeting health-conscious consumers’ nationwide rollout.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom Kombucha Market Size based on the below-mentioned segments:

United Kingdom Kombucha Market, By Product

- Conventional Kombucha

- Hard Kombucha.

United Kingdom Kombucha Market, By Distribution Channel

- On-Trade

- Off-Trade.

Frequently Asked Questions (FAQ)

-

What is the United Kingdom kombucha market size?United Kingdom kombucha market is expected to grow from USD 167.43 million in 2024 to USD 769.6 million by 2035, growing at a CAGR of 14.87% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven health-minded urban citizens with more disposable income who understand the regulations regarding the labeling and safety of food products.

-

What factors restrain the United Kingdom kombucha market?Constraints include the strict food safety and labelling regulations, sugar-content and alcohol-threshold compliance requirements, intense competition between craft producers and multinational beverage companies.

-

How is the market segmented by product?The market is segmented into conventional kombucha, hard kombucha.

-

Who are the key players in the United Kingdom kombucha market?Key companies include GO Kombucha, Pret A Manger, Remedy Drinks, MOMO Kombucha, L.A Brewery, Happy Kombucha, lobros, One Living, Equinox Kombucha, HOLOS Kombucha, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?