United Kingdom Hospitality Mattress Market Size, Share, By Type (Innerspring, Foam, and Hybrid), By End Use (Hotels & Resorts, Vacation Rental, and Hostels), United Kingdom Hospitality Mattress Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited Kingdom Hospitality Mattress Market Insights Forecasts to 2035

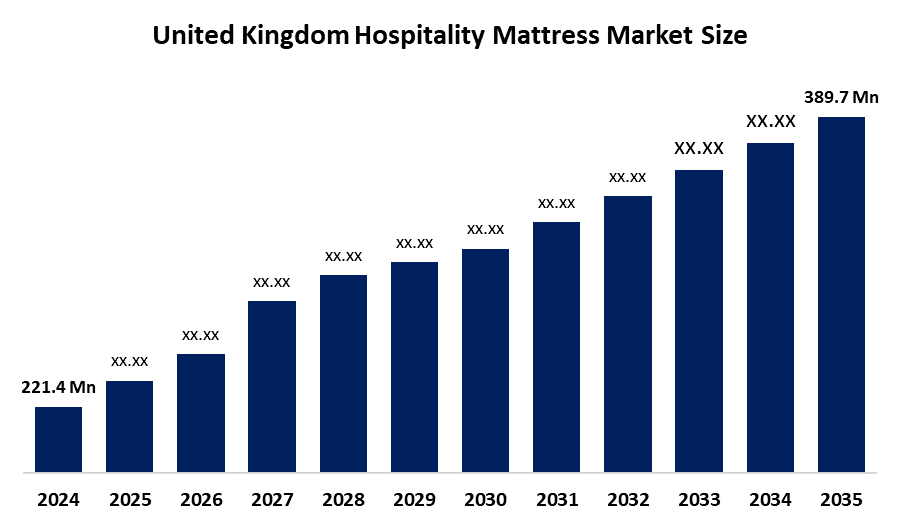

- United Kingdom Hospitality Mattress Market Size 2024: USD 221.4 Mn

- United Kingdom Hospitality Mattress Market Size 2035: USD 389.7 Mn

- United Kingdom Hospitality Mattress Market CAGR 2024: 5.27%

- United Kingdom Hospitality Mattress Market Segments: Type and End Use

Get more details on this report -

The United Kingdom Hospitality Mattress Market Size represents a large and dynamically changing market, and it revolves around luxury, eco-friendly, and customized mattresses for the hospitality industry. The industry is undergoing a shift from mass production and standardized mattresses to value-added mattresses with enhanced focus on comfort, sustainability, and wellness. Factors influencing the market in the UK hospitality industry include rising disposable incomes, enhanced focus by the hospitality industry on upgrading the expectations of its clientele, improving the focus on the importance of sleep, and the growing use of the internet for purchasing by the hospitality industry, apart from sustainable and eco-friendly materials in the mattress industry.

The United Kingdom Hospitality Mattress Market Size Strong growth is offered by rising urbanization, an increase in disposable incomes, evolving expectations of guests, the focus on wellness and sleep quality, and, therefore, a demand for premium, eco-friendly, and bespoke mattresses in the United Kingdom Hospitality Mattress Market. As the market shifts to high-value, differentiated, and environmentally responsible products, emphasis is being placed on the use of organic, recycled materials with low emissions, certification, advanced ergonomic design, and sustainable packaging. Growth is further fueled by the rapid expansion of e-commerce and digital procurement by hotels, online brand marketing, and customization for guest comfort, in addition to integration into the décor of luxury and boutique hotels. Regulatory support for sustainability coupled with domestic and international competition between mattress suppliers is driving innovation, brand building, and market expansion across the UK hospitality sector.

United Kingdom Hospitality Mattress Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 221.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.27% |

| 2035 Value Projection: | USD 389.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type ,By End Use |

| Companies covered:: | Therapedic International, Brooklyn Bedding, LLC, Tempur Sealy International, Inc., Corsicana Mattress Company, King Koil Licensing Company, Inc., Whitestone Home Furnishings, LLC (Saatva), Hilding Anders International AB, Serta Simmons Bedding, LLC, KINGSDOWN, INC., Restonic Mattress Corporation., Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the United Kingdom Hospitality Mattress Market

The United Kingdom Hospitality Mattress Market Size in the United Kingdom is fueled by the growing and experience-centric hospitality industry, growing disposable income, the presence of very adept manufacturing within the domestic economy of the United Kingdom, as well as favorable regulations in the United Kingdom focusing on sustainability and quality. High quality, eco-friendly, and wellness-centric mattresses have been experiencing growing demand because of the changing expectations of the guest along with the focus on quality of sleep and being a part of luxurious and boutique hotel design. At present, the hospitality mattress industry within the United Kingdom is overcoming traditional volume production and is moving towards being the design-centric, ergonomic, and sustainable mattresses hub because of the use of digital procurement and the growing use of the internet for marketing.

The United Kingdom Hospitality Mattress Market Size faces restraints such as intense price competition, rising raw material and manufacturing costs, quality and safety compliance challenges, and fragmented supplier standards. In addition, brand differentiation gaps, intellectual property concerns, dependence on international sourcing, trade barriers, and regulatory complexities continue to affect profitability and long-term innovation, despite strong domestic and global market potential.

The United Kingdom Hospitality Mattress Market Size is showing great promise for future growth as innovation continues to drive growth along with increasing guest expectations and regulatory support around sustainability and premium level services. New avenues of growth are being created with luxury, green and wellness oriented products, and an increase in ergonomic mattress options and custom bedding. Smart manufacturing techniques to maximize production efficiency, the use of new design technology (digital), artificial intelligence optimization e-commerce and digital sourcing, and sustainable packaging solutions will all contribute to increasing production efficiency, product differentiation, and access to all areas of the UK hospitality market. The increasing demand for custom-made, hygienic, and aesthetically designed mattresses will increase overall market potential, establish brand loyalty, and attract investors.

Market Segmentation

The United Kingdom Hospitality Mattress Market share is classified into type and end use.

By Type

The United Kingdom Hospitality Mattress Market Size is divided by type into innerspring, foam, and hybrid. Among these, the foam segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because the foam conforms to different body types and sleeping positions, enhancing guest satisfaction and leading to positive reviews.

By End Use

The United Kingdom Hospitality Mattress Market Size is divided by end use into hotels & resorts, vacation rental, and hostels. Among these, the Convenience Stores & Gift Centres segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is driven by large-scale procurement, continuous refurbishment cycles, and a strong focus on guest comfort as a key competitive factor, especially with luxury properties prioritizing premium experiences, though hostels are growing due to budget travel trends.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom Hospitality Mattress Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the United Kingdom Hospitality Mattress Market

- Therapedic International

- Brooklyn Bedding, LLC

- Tempur Sealy International, Inc.

- Corsicana Mattress Company

- King Koil Licensing Company, Inc.

- Whitestone Home Furnishings, LLC (Saatva)

- Hilding Anders International AB

- Serta Simmons Bedding, LLC

- KINGSDOWN, INC.

- Restonic Mattress Corporation.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom Hospitality Mattress Market Size based on the following segments:

United Kingdom Hospitality Mattress Market, By Type

- Innerspring

- Foam

- Hybrid.

United Kingdom Hospitality Mattress Market, By End Use

- Hotels & Resorts

- Vacation Rental

- Hostels.

Frequently Asked Questions (FAQ)

-

What is the United Kingdom hospitality mattress market size?United Kingdom hospitality mattress market is expected to grow from USD 221.4 million in 2024 to USD 389.7 million by 2035, growing at a CAGR of 5.27% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by growing and experience-centric hospitality industry, growing disposable income, the presence of very adept manufacturing within the domestic economy.

-

What factors restrain the United Kingdom hospitality mattress market?Constraints include the intense price competition, rising raw material and manufacturing costs, quality and safety compliance challenges, and fragmented supplier standards.

-

How is the market segmented by type?The market is segmented into innerspring, foam, and hybrid.

-

Who are the key players in the United Kingdom hospitality mattress market?Key companies include Therapedic International, Brooklyn Bedding, LLC, Tempur Sealy International, Inc., Corsicana Mattress Company, King Koil Licensing Company, Inc., Whitestone Home Furnishings, LLC (Saatva), Hilding Anders International AB, Serta Simmons Bedding, LLC, KINGSDOWN, INC., Restonic Mattress Corporation., and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?