United Kingdom Gambling Market Size, Share, By Type (Sports Betting, Casinos, iSlot, iTable, iDealer, Poker, Bingo, And Others), By Device (Desktop, Mobile, And Others), And United Kingdom Gambling Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsUnited Kingdom Gambling Market Insights Forecasts to 2035

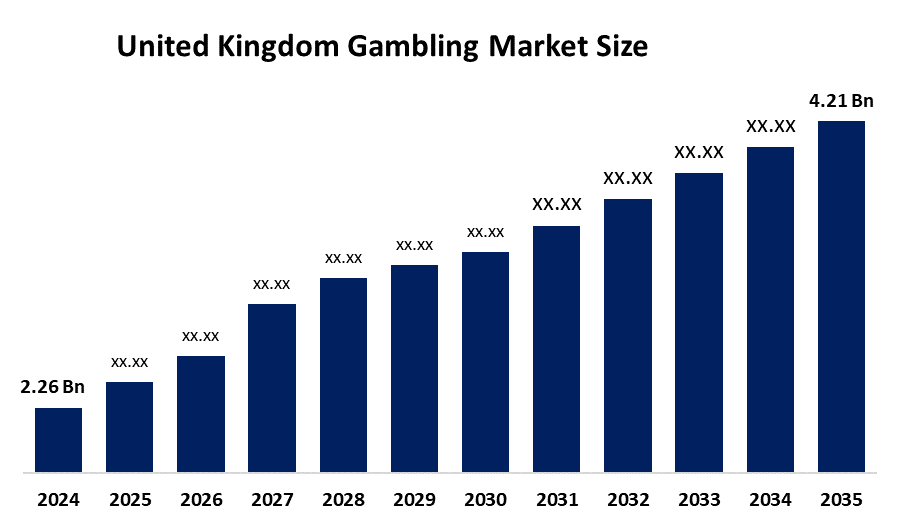

- United Kingdom Gambling Market Size 2024: USD 2.26 Billion

- United Kingdom Gambling Market Size 2035: USD 4.21 Billion

- United Kingdom Gambling Market CAGR 2024: 5.82%

- United Kingdom Gambling Market Segments: Type, and Device

Get more details on this report -

The United Kingdom gambling market includes all forms of gaming and betting that occur via the Internet. Types of gambling are sports betting, casino games and other forms of wagering using an Internet-connected device. A gambling site enables anyone with internet access to place a monetary wager on the results of a sporting event, play casino games and take part in other real-money competitions. The gambling sector has been developed using the latest in real-time betting technology, including mobile applications and digital payment options, heavily regulated with respect to responsible gambling and anti-money laundering by international regulatory agencies.

As technology advances, United Kingdom’s gambling providers are now using mobile internet access, AI-powered analytics, real-time odds calculation, customized user interfaces, identification of fraud, and digital secure payment solutions for improved gambling's accessibility, enhanced the enjoyment of gambling, increased gambling's efficiency, optimized operators' use of machine learning for risk assessment and player profiling developed real-time betting features to improve the player experience and increase the security of the gambling platform through AI analysis.

Market Dynamics of the United Kingdom Gambling Market

The United Kingdom gambling market is driven by the increasing number of users having connected devices, accepted regulation that allows to legally participate in gaming, enabling foreign operators to enter the market, high levels of internet and smartphone accessibility, ease of access to betting services, increasing degrees of activity and revenue-generating potential for operators, along with strong governmental backing.

The United Kingdom gambling market is restrained by the illegal operators and sites offering illegal betting opportunities, significant risk to consumers and prevents state governments from collecting tax revenue, illegal operators also continue to operate a high percentage of gambling, and challenges for regulators regarding enforcement and compliance.

The future of United Kingdom gambling market is bright and promising, with versatile opportunities emerging from the formalizing and educating consumers will create an opportunity for licenced operators to take market share from the unregulated sector, as well as to implement more gaming through increased funding for gambling efforts through formalised safeguards and more effective enforcement. As United Kingdom continues to develop, it will allow for e-sports betting, live in-game wagering, and localised content development based on the population's demographic data. There will also be additional opportunities for new payment options and localised promotional offers the market growth.

United Kingdom Gambling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.26 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.82% |

| 2035 Value Projection: | USD 4.21 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Device |

| Companies covered:: | Flutter Entertainment, Entain Plc, Bet365, Evoke plc, Kindred Group, Playtech, Gamesys Group, The Rank Group, Tombola, Betfred, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom gambling market share is classified into type and device.

By Type

The United Kingdom gambling market is divided by type into sports betting, casinos, iSlot, iTable, iDealer, Poker, Bingo, and Others. Among these, the sports betting segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Widespread sports fan base, its broad appeal, frequent events, ease of digital adoption, and strong mobile and digital integration all contribute to the sports betting segment's largest share and higher spending on gambling when compared to other type

By Device

The United Kingdom gambling market is divided by device into desktop, mobile, and others. Among these, the mobile segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The mobile segment dominates because of high smartphone penetration, offering fast registration, live betting, push notifications, and seamless payments via PIX, easily accessible, lower data costs, and widespread network availability.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom gambling market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom Gambling Market

- Flutter Entertainment

- Entain Plc

- Bet365

- Evoke plc

- Kindred Group

- Playtech

- Gamesys Group

- The Rank Group

- Tombola

- Betfred

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom gambling market based on the below-mentioned segments:

United Kingdom Gambling Market, By Type

- Sports Betting

- Casinos

- iSlot

- iTable

- iDealer

- Poker

- Bingo

- Others

United Kingdom Gambling Market, By Device

- Desktop

- Mobile

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the United Kingdom gambling market size?A: United Kingdom gambling market is expected to grow from USD 2.26 billion in 2024 to USD 4.21 billion by 2035, growing at a CAGR of 5.82% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the combination of a large digitally-connected population, growing regulatory framework that provides legal certainty, attracts international operators, and supports formal monetization of betting demand, high internet and smartphone penetration, easily access betting services, and increasing overall activity and revenue potential with strong government support.

-

Q: What factors restrain the United Kingdom gambling market?A: Constraints include the persistent illegal gambling segment, many wagers occur through unlicensed operators and illegal sites, posing risks for consumers and diverting tax revenue away from the government, illegal operators still dominate a large portion of activity, presenting enforcement and compliance challenges.

-

Q: How is the market segmented by device?A: The market is segmented into mobile, desktop, and others.

-

Q: Who are the key players in the United Kingdom gambling market?A: Key companies include Flutter Entertainment, Entain Plc, Bet365, Evoke plc (formerly 888 Holdings), Kindred Group (Unibet/32Red), Playtech, Gamesys Group, The Rank Group, Tombola, Betfred, and Others.

Need help to buy this report?