United Kingdom Food Safety Testing Market Size, Share, By Test (Allergen Testing, Chemical & Nutritional Testing, Microbiological Testing, And Others), By Technology (Traditional, Rapid, Convenience Based, PCR, Immunoassay, And Chromatography & Spectrometry), By Application (Meat, Poultry, & Seafood Products, Processed Food, Beverages, And Others), And United Kingdom Food Safety Testing Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesUnited Kingdom Food Safety Testing Market Insights Forecasts to 2035

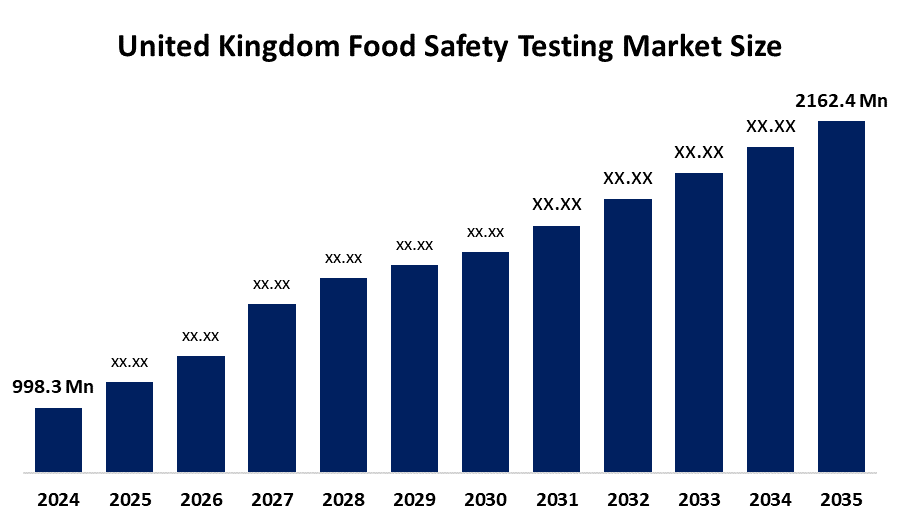

- United Kingdom Food Safety Testing Market Size 2024: USD 998.3 Million

- United Kingdom Food Safety Testing Market Size 2035: USD 2162.4 Million

- United Kingdom Food Safety Testing Market CAGR 2024: 7.28%

- United Kingdom Food Safety Testing Market Segments: Test, Technology, and Application

Get more details on this report -

United Kingdom food safety testing market is an entire market comprised of many different elements that create a food safety testing ecosystem, includes laboratories, service providers, technologies, and government regulatory bodies that conduct scientific analysis of food products for the presence of contaminants, pathogens, chemical residues, allergens, nutritional content and various other food safety parameters. The ultimate goals of food safety testing are to verify compliance with national food safety standards, protect consumer health, and provide assurance of quality throughout the food supply chain from farm-to-fork.

The food safety testing in United Kingdom are backed by government support, including the United Kingdom’s multi-year strategic plan to strengthen food security and the food supply chain in United Kingdom and also create a food service industry that is developed and full of technology. The goals of this initiative, which started in 2023, include improving the productivity of agricultural production systems and the safety and quality of the food supply systems by 2035. These goals will be accomplished through the application of biotechnology, improvements in and through research infrastructure, improved regulatory functions of the food supply chain, and indirectly enhance the need for testing food through the Food Safety Program.

As technology advances, food safety testing providers are now using modernized methods, including rapid diagnostic testing, automation, artificial intelligence-assisted spectroscopy, and new technology have increased the accuracy and efficiency of lab-based tests. The use of PCR testing has been expanded to cover more tests with the aid of sophisticated equipment such as high performance spectrometers and advanced AI-enhanced imaging systems that can provide much faster results from microbiological and contamination analysis. The use of these technologies has resulted in a significant increase in precision as they reduce costs and provide on-site or real-time screening capabilities critical to the success of fast-track supply chains.

Market Dynamics of the United Kingdom Food Safety Testing Market:

The United Kingdom food safety testing market is driven by the strengthened regulatory oversight, increased consumer awareness and concern regarding food safety, increased enforcement of food safety laws, and mandatory inspections, the amount of testing needed will rise dramatically through the entire supply chain, consumers concern about contaminants, allergens, and nutritional accuracy, consumers brand trust on product purchase, technological innovation and government support further drives the market.

The United Kingdom food safety testing market is restrained by the penetration of advanced food safety tests into less developed regions, high cost and complexity to develop advanced tests, people lack awareness of food safety issues slow, widespread adoption of testing services, and both cost and knowledge barriers.

The future of United Kingdom food safety testing market is bright and promising, with versatile opportunities emerging from the digital testing methods, including new technologies has helped businesses create mobile labs for use in the food industry, which provide on-site testing in a shorter amount of time, with lower costs; essentially providing a convenient and efficient method for conducting food safety testing. As an added benefit, many businesses are now using digital traceability systems and blockchain technology to improve their food supply chains by providing improved access to and visibility of supplies within the supply chain. As such, many rural areas, as well as smaller producers, are taking advantage of these new technologies by using them to create new avenues for growth through providing low-cost, scalable testing processes.

United Kingdom Food Safety Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 998.3 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 7.28% |

| 2035 Value Projection: | USD 2162.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Test, By Technology |

| Companies covered:: | SGS UK, Eurofins Food Testing UK, Intertek Group, ALS Laboratories (UK) Ltd, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom food safety testing market share is classified into test, service, and application.

By Test

The United Kingdom food safety testing market is divided by test into allergen testing, chemical & nutritional testing, microbiological testing, and others. Among these, the microbiological testing segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Rising consumer demand, strict government regulations, rapid urbanization leading to processed food consumption, and widespread foodborne illness concerns among consumers all contribute to the microbiological testing segment's largest share and higher spending on food safety testing when compared to other tests.

By Technology

The United Kingdom food safety testing market is divided by technology into traditional, rapid, convenience based, PCR, immunoassay, and chromatography & spectrometry. Among these, the traditional segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The traditional segment dominates because of established regulatory acceptance, consumer demand for traditional use, well-validated protocols, and widespread use in manufacturing and by regulators for compliance sustains traditional methods.

By Application:

The United Kingdom food safety testing market is divided by application into meat, poultry, & seafood products, processed food, beverages, and others. Among these, the meat, poultry, & seafood products segment held the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. High consumer awareness and demand, high risk of contamination, strict government regulations, urbanization and increase in disposable income all contribute to the meat, poultry, & seafood products segment's largest share and higher spending on food safety testing when compared to other application.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom food safety testing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom Food Safety Testing Market

- SGS UK

- Eurofins Food Testing UK

- Intertek Group

- ALS Laboratories (UK) Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom food safety testing market based on the below-mentioned segments:

United Kingdom Food Safety Testing Market, By Test

- Allergen Testing

- Chemical & Nutritional Testing

- Microbiological Testing

- Others

United Kingdom Food Safety Testing Market, By Technology

- Traditional

- Rapid

- Convenience Based

- PCR

- Immunoassay

- Chromatography & Spectrometry

United Kingdom Food Safety Testing Market, By Application

- Meat, Poultry & Seafood Products

- Processed Food

- Beverages

- Other

Frequently Asked Questions (FAQ)

-

Q: What is the United Kingdom food safety testing market size?A: United Kingdom food testing market is expected to grow from USD 998.3 million in 2024 to USD 2162.4 million by 2035, growing at a CAGR of 7.28% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the strengthened regulatory oversight, rising consumer awareness of food safety, stricter enforcement of food safety laws, mandatory inspections have substantially increased the volume of testing required across the supply chain, consumers are increasingly concerned about contaminants, allergens, and nutritional accuracy, ensurance of product quality and maintain brand trust.

-

Q: What factors restrain the United Kingdom food safety testing market?A: Constraints include the high cost and complexity of advanced testing technologies, uneven awareness and understanding of food safety issues, slow widespread adoption of testing services, and cost and knowledge barriers dampen market penetration, especially in less developed regions

-

Q: How is the market segmented by test?A: The market is segmented into allergen testing, chemical & nutritional testing, microbiological testing, and others.

-

Q: Who are the key players in the United Kingdom food safety testing market?A: Key companies include SGS UK, Eurofins Food Testing UK, Intertek Group, ALS Laboratories (UK) Ltd, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?