United Kingdom Fiber Optic Connectors Market Size, Share, By Product (SC Connector, LC Connector, FC Connector, ST Connector, MTP Connector, and Others), By Application (Telecom, Oil and Gas, Military & Aerospace, BFSI, Medical, Railway, and Others), and United Kingdom Fiber Optic Connectors Market Insights, Industry Trend, Forecasts to 2035.

Industry: Semiconductors & ElectronicsUnited Kingdom Fiber Optic Connectors Market Insights Forecasts to 2035

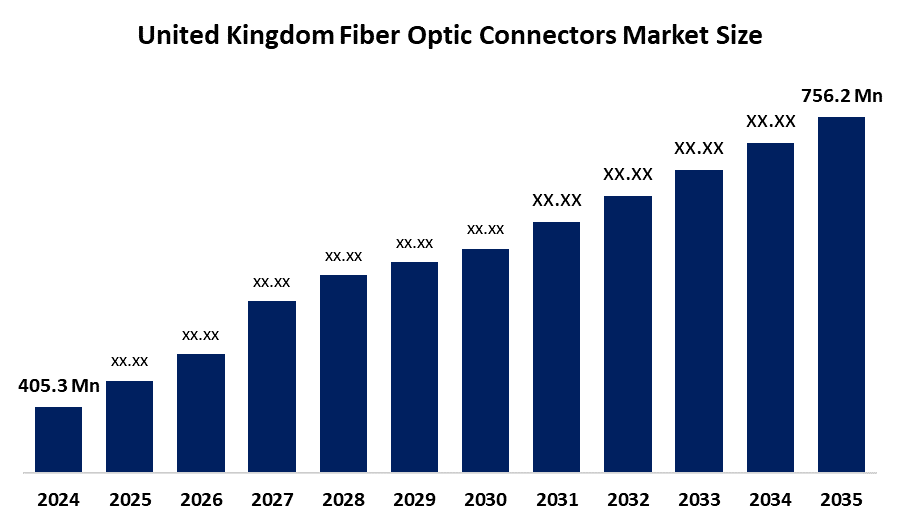

- United Kingdom Fiber Optic Connectors Market Size 2024: USD 405.3 Mn

- United Kingdom Fiber Optic Connectors Market Size 2035: USD 756.2 Mn

- United Kingdom Fiber Optic Connectors Market CAGR: 5.83%

- United Kingdom Fiber Optic Connectors Market Segments: Product and Application

Get more details on this report -

The market for fiber optic connectors in the UK is growing in tandem with the fast expansion of digital infrastructure due to rising demand for data center connectivity, 5G networks, and high-speed internet. Fiber-to-the-home (FTTH) and gigabit broadband deployment are major national goals, with full-fibre adoption continuously increasing and gigabit-capable broadband reaching over 84% of English premises.

Government initiatives play a central role in accelerating infrastructure build-out. To expand coverage to commercially problematic areas, Building Digital UK (BDUK) collaborates with private companies to facilitate the development of fiber. With funding for deployments in underserved and rural areas, the UK government's £5 billion Project Gigabit initiative seeks to provide gigabit internet to at least 85% of locations by 2025 and over 99% by 2030.

The market is also changing as a result of technological developments. Performance, reliability, and scalability in fiber networks are being driven by advancements in transmission technologies (such as passive optical networks and higher bandwidth solutions), high-density connector innovations, and 5G and next-generation broadband upgrades. These developments are opening up opportunities for connector manufacturers to provide cutting-edge, effective connectivity solutions.

United Kingdom Fiber Optic Connectors Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 405.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.83% |

| 2035 Value Projection: | USD 756.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 137 |

| Segments covered: | By Product,By Application |

| Companies covered:: | Ridgemount Technologies Tech Optics Ltd Amphenol Ltd RS Components Ltd PEI-Genesis FibreFab Limited Emtelle UK Ltd HellermannTyton (UK) TE Connectivity Corning Incorporated 3M Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the United Kingdom Fiber Optic Connectors Market:

The primary driver of market growth is the rapid expansion of high-speed broadband, 5G networks, and data center infrastructure across the UK. Increasing adoption of fiber-to-the-home (FTTH) and upgrades to legacy copper networks are boosting demand for reliable and high-performance fiber optic connectors. Growth in cloud computing, IoT, and enterprise networking, along with rising data traffic, further supports market expansion. Additionally, government initiatives aimed at improving digital connectivity and nationwide gigabit broadband coverage are accelerating fiber deployment.

Despite strong demand, the market faces restraints such as the high initial cost of fiber optic infrastructure and connectors compared to traditional cabling solutions. Installation complexity and the need for skilled technicians can increase deployment time and costs. Moreover, price competition and fluctuating raw material costs may impact profit margins for manufacturers and suppliers.

The development of 5G backhaul networks, smart city initiatives, and rising investments in hyperscale data centers present significant prospects. Strong development potential is presented by the growing use of high-density connectors like MTP/MPO and improvements in connector design for increased bandwidth and reduced signal loss. It is anticipated that further digital revolution across industries would improve UK market prospects even more.

Market Segmentation

The United Kingdom fiber optic connectors market share is classified into product and application.

By Product:

Based on the product, the United Kingdom fiber optic connectors market is divided into SC, LC, FC, ST, MTP, and other connectors. Among these, the LC segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. LC connectors are the favored option in data centers, FTTH deployments, and high-speed telecom networks due to their small size, high port density, and excellent performance. The UK's expanding deployment of cloud data centers, 5G infrastructure, and full-fiber internet is hastening the switch to LC connectors from more cumbersome legacy options like SC and ST.

By Application:

The United Kingdom fiber optic connectors market is classified by application into telecom, oil and gas, military & aerospace, BFSI, medical, railway, and others. Among these, the telecom segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The fast growth of full-fiber broadband, the construction of 5G networks, and rising data traffic in the UK are the main factors driving the telecom segment's dominance. The demand for dependable and high-performing fiber optic connectors has greatly increased due to telecom operators' large-scale investments in data centers, network densification, and high-speed backbone equipment.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom fiber optic connectors market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the United Kingdom Fiber Optic Connectors Market:

- Ridgemount Technologies

- Tech Optics Ltd

- Amphenol Ltd

- RS Components Ltd

- PEI-Genesis

- FibreFab Limited

- Emtelle UK Ltd

- HellermannTyton (UK)

- TE Connectivity

- Corning Incorporated

- 3M

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom fiber optic connectors market based on the following segments:

United Kingdom Fiber Optic Connectors Market, By Product

- SC Connector

- LC Connector

- FC Connector

- ST Connector

- MTP Connector

- Others

United Kingdom Fiber Optic Connectors Market, By Application

- Telecom

- Oil and Gas

- Military & Aerospace

- BFSI

- Medical

- Railway

- Others

Frequently Asked Questions (FAQ)

-

1. What is the expected market size of the United Kingdom fiber optic connectors market by 2035?The market is projected to reach USD 756.2 million by 2035, growing from USD 405.3 million in 2024.

-

2. What is the CAGR of the United Kingdom fiber optic connectors market during the forecast period?The market is expected to grow at a CAGR of 5.83% during the forecast period 2025–2035.

-

3. What are the key growth drivers of the market?Major drivers include expansion of FTTH networks, 5G deployment, rising data center investments, cloud computing adoption, and government-led digital connectivity initiatives.

-

4. What challenges restrain market growth?High initial installation costs, complexity of fiber deployment, requirement for skilled labor, and price pressure on manufacturers are key restraints.

-

5. What opportunities exist in the UK fiber optic connectors market?Opportunities include growth in hyperscale data centers, smart city projects, 5G backhaul networks, and increasing adoption of high-density connectors such as MTP/MPO.

-

6. Which companies dominate the fiber optic connectors market in the United Kingdom?TE Connectivity, Corning Incorporated, HellermannTyton (UK), Amphenol Ltd, RS Components Ltd, PEI-Genesis, and Emtelle UK Ltd are a few of the important businesses.

Need help to buy this report?