United Kingdom Factoring Services Market Size, Share, By Type (Recourse, Non-Recourse), By Category (Domestic, International), By Financial Institution (Banks, NBFIs), United Kingdom Factoring Services Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialUnited Kingdom Factoring Services Market Insights Forecasts to 2035

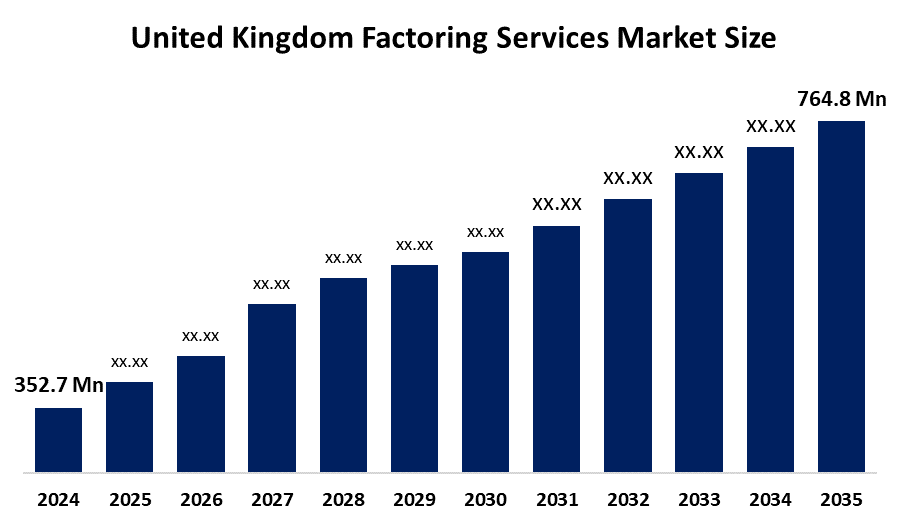

- United Kingdom Factoring Services Market Size 2024: USD 352.7 Bn

- United Kingdom Factoring Services Market Size 2035: USD 764.8 Bn

- United Kingdom Factoring Services Market CAGR 2024: 7.29%

- United Kingdom Factoring Services Market Segments: Type, Category and Financial Institutions

Get more details on this report -

The UK Factoring Services Market covers a wide and growing sector in the financial services sector, including services such as invoice factoring, accounts receivable financing, and supply chain finance. The market has been experiencing a change from conventional, human-based operations to technology-enabled, digital platforms, led by the growing requirement among SMEs, quicker access to funds, and use of technology, also known as fin tech, services. This industry also entails fierce competition among traditional banking organizations, other independent financial services providers, and newly established technological services providers, as well as government policies emphasizing financial clarity and sound lending techniques. Moreover, this industry combines conventional financial expertise with innovative digital technology, facilitating effective management of cash flow and facilitating business development.

The UK government’s financial services growth & competitiveness strategy aims to strengthen the country as a leading global financial center by promoting fin tech, AI adoption, and smart data use. These government-led initiatives improve SME access to finance, directly benefiting factoring services by enhancing digital processes, risk assessment, and efficient cash flow management across businesses.

The United Kingdom Factoring Market Size presents a promising growth opportunity in view of growing SME demand for working capital finance, increasing use of digital platforms for billing and payment, and technological advances such as AI-based risk assessments and credit scoring. The growth opportunities are emerging in developing innovative financing solutions and rapid cash management systems leveraging fin tech technologies and a transformation towards AI and real-time customizable factoring solutions. The growth areas in the United Kingdom factoring industry are invoice factoring solutions, supply chain finance solutions, reverse factoring solutions, and integrated platforms. The growth of these areas is driven by government policies related to SME finance and a transformation in the banking and finance sector.

Market Dynamics of the United Kingdom Factoring Services Market

The United Kingdom Factoring Services Market Size is driven by the rising number of SMEs in the UK, the rising demand for working capital financing services, the increased support from the UK government, and the use of digital and fetch-based innovations in the industry that is changing it from the conventional financing mechanism to a technology-driven and efficient and flexible financing platform. The rising number of small and medium-sized businesses and their business turnover and interest in faster cash flow management has increased the demand for invoice factoring services, supply chain financing services, and reverse factoring services in the UK. The increased use of AI-based and automatic credit evaluation and real-time data and analytics facilities is helping in improved associated risks and customized financing facilities in the UK’s industry.

The United Kingdom Factoring Services Market Size faces restraints such as intense competition among banks and independent finance providers, pricing pressures, regulatory compliance requirements, limited fin tech adoption in some SMEs, reliance on credit data accuracy, and economic uncertainties including Brexit-related trade impacts. These factors challenge providers’ profitability and innovation potential despite the market’s strong growth opportunities.

The future of factoring services in the United Kingdom market holds a promising and bright outlook since the growth of the segment is underpinning innovation, friendly government policies, and increasing SME demand for working capital solutions. New opportunities continue to emerge with digital invoicing, AI-enabled credit assessment, real-time cash flow management, and automated risk analytics. Fintech platforms, big data insights, cloud-based finance solutions, and fully integrated payment systems ensure prime operational efficiency, regulatory compliance, and access to business in the UK-wide factoring ecosystem. Moreover, adoption of technology-driven finance, surging SME activity, and demand for faster, flexible, and customized funding solutions are driving up the market potential and positioning the UK as the leading hub for innovative factoring services.

United Kingdom Factoring Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 352.7 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 7.29 |

| 2035 Value Projection: | USD 764.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Type, By Category |

| Companies covered:: | Bibby Financial Services Kriya eCapital Factoring Close Brothers Invoice Finance IGF Commercial Finance Skipton Business Finance Time Finance, Aldermore Bank Nucleus Commercial Finance Previse Pulse Cashflow Finance Team Factors Others Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom factoring services market share is classified into type, category and financial institutions.

By Type

The United Kingdom Factoring Services Market Size is divided by type into recourse, non-recourse. Among these, the recourse segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because the recourse factoring is cheaper for businesses because the factoring company takes on less risk.

By Category

The United Kingdom Factoring Services Market is divided by category into domestic, international. Among these, the domestic segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because the domestic transactions are less complicated in terms of paperwork, legal requirements, and regulatory compliance compared to cross-border or international factoring.

By Financial Institutions

The United Kingdom Factoring Services Market is divided by financial institutions into Banks, NBFIs. Among these, the banks dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is due to their established infrastructure, strong market reputation, access to low-cost capital, and robust regulatory framework.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom Factoring Services Market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the United Kingdom Factoring Services Market

- Bibby Financial Services

- Kaiya

- capital Factoring

- Close Brothers Invoice Finance

- IGF Commercial Finance

- Skipton Business Finance

- Time Finance, Aldermore Bank

- Nucleus Commercial Finance

- Previse

- Pulse Cash flow Finance

- Team Factors

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom factoring services market based on the following segments:

United Kingdom Factoring Services Market, By Type

- Recourse

- Non-recourse

United Kingdom Factoring Services Market, By Category

- Domestic

- International.

United Kingdom Factoring Services Market, By Financial Institutions

- Banks

- NBFIs

Frequently Asked Questions (FAQ)

-

What is the United Kingdom factoring services market size?United Kingdom factoring services market is expected to grow from USD 352.7 billion in 2024 to USD 764.8 billion by 2035, growing at a CAGR of 7.29% during the forecast period 2025-2035

-

What are the key growth drivers of the market?Market growth is driven by rising number of SMEs in the UK, the rising demand for working capital financing services, the increased support from the UK government, and the use of digital and fintech-based innovations in the industry

-

What factors restrain the United Kingdom factoring services market?Constraints include the intense competition among banks and independent finance providers, pricing pressures, regulatory compliance requirements

-

How is the market segmented by type?The market is segmented into recourse, non-recourse

-

Who are the key players in the United Kingdom factoring services market?Key companies include Bibby Financial Services, Kriya, eCapital Factoring, Close Brothers Invoice Finance, IGF Commercial Finance, Skipton Business Finance, Time Finance, Aldermore Bank, Nucleus Commercial Finance, Previse, Pulse Cashflow Finance, Team Factors, and Others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs

Need help to buy this report?