United Kingdom ESG Investing Market Size, Share, By Type (Impact Investing, Sustainable Funds, Green Bonds, ESG Integration, and Others), By Investor Types (Corporate, Institutional, and Retail), By Application (Integrated ESG, Environmental, and Social), and United Kingdom ESG Investing Market Insights, Industry Trend, Forecasts to 2035.

Industry: Banking & FinancialUnited Kingdom ESG Investing Market Insights Forecasts to 2035

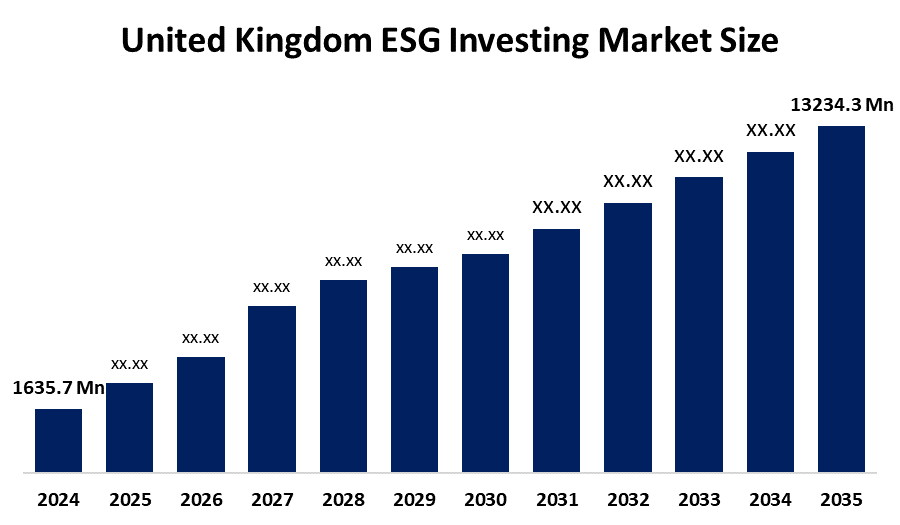

- United Kingdom ESG Investing Market Size 2024: USD 1635.7 Mn

- United Kingdom ESG Investing Market Size 2035: USD 13234.3 Mn

- United Kingdom ESG Investing Market CAGR: 20.93%

- United Kingdom ESG Investing Market Segments: Type, Investor Types, and Application

Get more details on this report -

The United Kingdom ESG investing market is witnessing robust growth, supported by increasing awareness of sustainable finance and long-term value creation. To control climate risks, enhance corporate accountability, and match investments with moral and social objectives, investors in the UK are increasingly incorporating environmental, social, and governance (ESG) considerations into portfolio development. Due to the increased availability of ESG-focused mutual funds, ETFs, and green financial products, retail participation is also increasing, but institutional investors, pension funds, and asset managers are driving adoption.

Government initiatives play a pivotal role in market development. To promote clarity and uniformity in sustainable investments, the UK government is developing the UK Green Taxonomy and enacting required climate-related financial disclosures that are in line with the Task Force on Climate-related Financial Disclosures (TCFD) framework. Investor trust and market confidence are being bolstered by policies that support the nation's net-zero by 2050 goal, green financing tactics, and the issue of sovereign green bonds.

ESG investing is being further transformed by technological breakthroughs. Improved ESG data collection, risk assessment, and impact measurement are made possible by the use of AI, big data analytics, and machine learning. In the UK market, digital platforms and fintech solutions are improving reporting accuracy, lowering the risk of greenwashing, and empowering investors to make better-informed, data-driven ESG investment choices.

United Kingdom ESG Investing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1635.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 20.93% |

| 2035 Value Projection: | USD 13234.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 154 |

| Segments covered: | By Type,By Investor Types,By Application |

| Companies covered:: | Generation Investment Management Impax Environmental Markets Royal London Asset Management (RLAM) Bridges Fund Management Legal & General Investment Management (LGIM) Robeco (including sustainable ETFs and funds) Schroders Jupiter Asset Management HSBC Global Asset Management Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the United Kingdom ESG Investing Market:

The UK's growing legal environment that encourages ethical and transparent investing is one of the main forces behind ESG investment. The UK's pledge to achieve net-zero carbon emissions by 2050 and mandatory climate-related financial disclosures in line with TCFD principles are driving asset managers and enterprises to include ESG considerations in investment strategies. The market is expanding more quickly as institutional and individual investors become more conscious of the risks associated with corporate governance, social responsibility, and climate change. Wider use of ESG-focused funds is also being aided by long-term risk mitigation, enhanced portfolio resilience, and rising demand for sustainable finance solutions.

Despite rapid growth, the market faces challenges such as a lack of standardized ESG metrics, data inconsistency, and concerns around greenwashing. Divergent ESG ratings among providers can undermine investor confidence and cause uncertainty. Adoption may also be hampered by ESG assets' short-term performance volatility and increased compliance expenses, especially for smaller asset managers.

The growth of green bonds, impact investment, and ESG-integrated tactics presents significant prospects. Strong growth potential is anticipated across the UK ESG investment ecosystem thanks to technological advancements in data analytics and AI-driven ESG assessment tools, growing retail engagement, and government-backed sustainability programs.

Market Segmentation

The United Kingdom ESG investing market share is classified into type, investor types, and application.

By Type:

On the basis of the type, the United Kingdom ESG investing market is categorized into impact investing, sustainable funds, green bonds, ESG integration, and others. Among these, the segment held the largest market share in 2024 and is expected to grow at a remarkable rate during the predicted period. The extensive use of ESG integration by asset managers, pension funds, and institutional investors who increasingly incorporate ESG considerations into conventional investment research and portfolio construction rather than allocating to stand-alone ESG products is the reason for its popularity.

By Investor Types:

Based on the investor types, the United Kingdom ESG investing market is divided into corporate, institutional, and retail. Among these, the institutional segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. Large asset managers, insurance firms, sovereign funds, and pension funds, all of which were early adopters of ESG principles in portfolio management, have a significant role in this leadership. Institutional investors are encouraged to systematically include ESG factors into investing decisions due to regulatory pressure, fiduciary obligation, and long-term risk management requirements.

By Application:

The United Kingdom ESG investing market is classified by application into Integrated ESG, environmental, and social. Among these, the integrated segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. Large asset managers, insurance firms, sovereign funds, and pension funds, all of which were early adopters of ESG principles in portfolio management, have a significant role in this leadership. Institutional investors are encouraged to systematically include ESG factors into investing decisions due to regulatory pressure, fiduciary obligation, and long-term risk management requirements.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom ESG investing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the United Kingdom ESG Investing Market:

- Generation Investment Management

- Impax Environmental Markets

- Royal London Asset Management (RLAM)

- Bridges Fund Management

- Legal & General Investment Management (LGIM)

- Robeco (including sustainable ETFs and funds)

- Schroders

- Jupiter Asset Management

- HSBC Global Asset Management

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom ESG investing market based on the following segments:

United Kingdom ESG Investing Market, By Type

- Impact Investing

- Sustainable Funds

- Green Bonds

- ESG Integration

- Others

United Kingdom ESG Investing Market, By Investor Types

- Corporate

- Institutional

- Retail

United Kingdom ESG Investing Market, By Application

- Integrated ESG

- Environmental

- Social

Frequently Asked Questions (FAQ)

-

1. What is ESG investing?ESG investing refers to investment strategies that incorporate Environmental, Social, and Governance factors into financial decision-making to achieve sustainable long-term returns while managing non-financial risks.

-

2. What is the current and projected size of the UK ESG investing market?The market was valued at USD 1,635.7 million in 2024 and is projected to reach USD 13,234.3 million by 2035, growing at a CAGR of 20.93% during the forecast period.

-

3. What are the key factors driving UK ESG investing market growth?Major growth drivers include mandatory climate-related disclosures, the UK’s net-zero by 2050 commitment, rising institutional and retail investor awareness, increasing green bond issuance, and growing demand for sustainable finance products.

-

4. What challenges does the UK ESG investing market face?Key challenges include inconsistent ESG data standards, varying ESG ratings, greenwashing concerns, and higher compliance and reporting costs for smaller asset managers.

-

5. How is technology influencing ESG investing in the UK?Technologies such as AI, machine learning, and big data analytics are improving ESG scoring, impact measurement, transparency, and risk assessment, supporting better investment decisions.

Need help to buy this report?