United Kingdom E-Commerce Parcel Delivery Market Size, Share, By Type (Instant Delivery, Same-Day Delivery, Two-Day Delivery), By Industry (Apparel and Accessories, Consumer Packaged Goods, Consumer Electronics, Manufacturing and Construction, Healthcare, and Others), United Kingdom E-Commerce Parcel Delivery Market Insights, Industry Trend, Forecasts to 2035.

Industry: Information & TechnologyUnited Kingdom E-Commerce Parcel Delivery Market Insights Forecasts to 2035

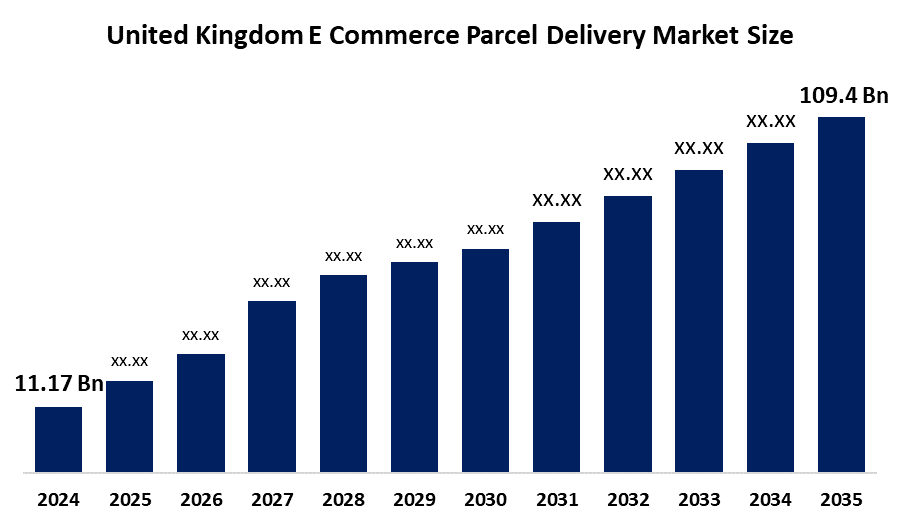

- United Kingdom E-Commerce Parcel Delivery Market Size 2024: USD 11.17 Bn

- United Kingdom E-Commerce Parcel Delivery Market Size 2035: USD 109.4 Bn

- United Kingdom E-Commerce Parcel Delivery Market CAGR 2024: 23.05%

- United Kingdom E-Commerce Parcel Delivery Market Segments: Type and Industry

Get more details on this report -

The UK e commerce parcel delivery market is among the most rapidly growing markets due to the fast growth of e commerce, the rise in the preference for home delivery, and the increase in cross border trade. The market has developed from the traditional postal delivery model to an automated logistics network enabled by real time tracking, AI route optimization, warehouse automation, electric delivery vehicles, and last-mile delivery solutions. The growth in the market is also fueled by the changing consumer behaviour regarding same day and next day delivery, subscription commerce, and the rise of small online businesses.

The UK e-commerce parcel delivery market has vast growth potential due to the growing online shopping trend, the need for the fast and flexible delivery solutions, and for the increasing number of cross-border e-commerce transactions. The increasing influence of the online marketplaces, direct to consumer brands, and subscription-based on the shopping models is driving parcel volumes in the UK. In addition, the creation of automated sorting systems, real-time tracking systems, electric delivery vans, parcel lockers, and AI-powered route optimization systems is enhancing efficiency. The increasing demand for same day and next day delivery solutions, as well as the creation of sustainable logistics infrastructure and last-mile delivery solutions, is increasing the growth potential of the UK e commerce parcel delivery market.

Market Dynamics of the United Kingdom E-Commerce Parcel Delivery Market

The UK e commerce parcel delivery market is driven by a strong online retail market, the increasing preference of consumers for fast and convenient home delivery, and the rising investment in innovative logistics infrastructure. The strong collaboration of leading courier firms, online marketplaces, retailers, warehouse managers, and technology firms has ensured that the industry is now an essential component of the digital economy, as opposed to being reliant on the traditional postal network. The increasing adoption of mobile shopping, same day and next day delivery, and click and collect services is propelling parcel volumes in the UK. Moreover, the increasing adoption by younger, tech savvy consumers and the rising number of small and medium-sized online retailers is further driving the UK e commerce parcel delivery market.

The UK e commerce parcel delivery market faces restraints including high operational and infrastructure costs associated with warehousing, automated sorting systems, last-mile delivery networks, and fleet management, along with significant investment requirements for technology integration, sustainability initiatives, fuel, labor, and digital tracking platforms.

The future for the UK e-commerce parcel delivery market is very encouraging, which is driven by the continued growth of online shopping, the demands of consumers for faster delivery, and the continued investment in logistics technology. The UK parcel delivery market is becoming more reliable, scalable, and efficient with the help of modern warehouse automation, smart locker technology, electric delivery vans, real-time parcel tracking, and artificial intelligence route optimization. With the increased adoption of same-day delivery, cross-border e-commerce, subscription-based shopping, and omnichannel retailing models, the parcel delivery volumes are also expected to rise steadily. The adoption of sustainable practices, digital supply chain platforms, and data-driven logistics solutions will further boost adoption in the United Kingdom.

United Kingdom E-Commerce Parcel Delivery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11.17 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 23.05% |

| 2035 Value Projection: | USD 109.4 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type,By Industry |

| Companies covered:: | Royal Mail,DPD Group,Evri,DHL,FedEx,Yodel,Whistl And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom e-commerce parcel delivery market share is classified into type and industry.

By Type

The United Kingdom e-commerce parcel delivery market is divided by type into instant delivery, same day delivery, two day delivery. Among these, the same day delivery segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because the concentration of the population in major UK cities like London, Manchester, Birmingham enables cost-effective same day logistics.

By Industry

The United Kingdom e-commerce parcel delivery market is divided by industry into apparel and accessories, consumer packaged goods, consumer electronics, manufacturing and construction, healthcare, and others. Among these, the apparel and accessories segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because the clothing items are generally cheap and easy to ship, allowing carriers to handle them at competitive rates.

Competitive Analysis

The report offers the appropriate analysis of the key organisations companies involved within the United Kingdom e-commerce parcel delivery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom E-Commerce Parcel Delivery Market

- Royal Mail

- DPD Group

- Evri

- DHL

- FedEx

- United Parcel Service

- Yodel

- Whistl

- Hermes

- The Delivery Group

- Others

Recent Developments in United Kingdom E-Commerce Parcel Delivery Market

In February 2025, DHL eCommerce opened a 25,000 m² state-of-the-art parcel hub near Coventry Airport, UK, capable of processing over one million parcels daily. The automated facility, rated BREEAM Excellent, strengthens the United Kingdoms growing e-commerce parcel delivery infrastructure.

In November 2024, DHL Express launched a £37 million service centre in Gatwick, United Kingdom, powered entirely by renewable energy. The advanced facility enhances parcel handling capacity and supports the rapid growth of the UK e commerce parcel delivery market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom e-commerce parcel delivery market based on the below-mentioned segments:

United Kingdom E-Commerce Parcel Delivery Market, By Type

- Instant Delivery

- Same Day Delivery

- Two Day Delivery

United Kingdom E-Commerce Parcel Delivery Market, By Industry

- Apparel and Accessories

- Consumer Packaged Goods

- Consumer Electronics

- Manufacturing and Construction

- Healthcare

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the United Kingdom e-commerce parcel delivery market size?A: United Kingdom e-commerce parcel delivery market is expected to grow from USD 11.17 billion in 2024 to USD 109.4 billion by 2035, growing at a CAGR of 23.05% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by strong online retail market, the increasing preference of consumers for fast and convenient home delivery, and the rising investment in innovative logistics infrastructure.

-

Q: What factors restrain the United Kingdom e-commerce parcel delivery market?A: Constraints include high operational and infrastructure costs associated with warehousing, automated sorting systems, last-mile delivery networks, and fleet management.

-

Q: How is the market segmented by type?A: The market is segmented into instant delivery, same-day delivery, two-day delivery.

-

Q: Who are the key players in the United Kingdom e-commerce parcel delivery market?A: Key companies include Royal Mail, DPD Group, Evri, DHL, FedEx, United Parcel Service (UPS), Yodel, Whistl, Hermes (Evri predecessor), The Delivery Group, and others.

Need help to buy this report?