United Kingdom Draught Beer Market Size, Share, By Type (Keg Beer, Cask Beer), By Category (Super Premium, Premium, and Regular), End Use (Commercial, Home), and United Kingdom Draught Beer Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Draught Beer Market Size Insights Forecasts To 2035

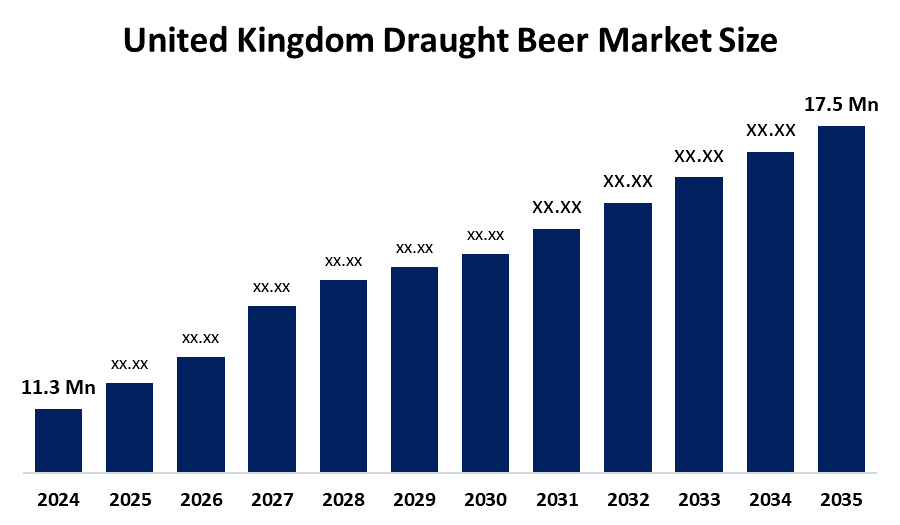

- United Kingdom Draught Beer Market Size 2024: USD 11.3 Mn

- United Kingdom Draught Beer Market Size 2035: USD 17.5 Mn

- United Kingdom Draught Beer Market Size CAGR: 4.06%

- United Kingdom Draught Beer Market Size Segments: Type, Category, and End Use

Get more details on this report -

The on-trade beer segment served by taps in pubs, bars, restaurants, hotels, and entertainment venues is represented by the draught beer market in the United Kingdom. Due to consumer preferences for freshness, social drinking, and premium beer quality, draft beer continues to be a major part of UK drinking culture. Traditional ales, lagers, stouts, and a quickly expanding selection of craft and specialty beers are all part of the market.

The sector is supported in large part by government programs. The draught beer market size has been stabilized and stimulated by initiatives including business rate relief for pubs, alcohol duty revisions intended to boost on-trade sales, and financial schemes to revitalize hospitality and tourism. Local councils and tourism bodies also support pub culture as part of community and economic development.

Beer quality and operating efficiency are both being improved by technological developments. Innovations such as smart keg tracking, temperature-controlled dispensing systems, and digital inventory management help eliminate waste and preserve uniformity. Additionally, sustainable brewing technology and eco-friendly keg systems are boosting the long-term viability of the UK draught beer sector.

Market Dynamics of the United Kingdom Draught Beer Market:

The robust pub and hospitality culture in the UK, where drinking beer on-trade is still a major social activity, is the main driver of the draught beer market. Rising customer preference for freshly poured, premium, and craft draught beers, together with the recovery of pubs, taverns, and restaurants after pandemic interruptions, is encouraging market expansion. Demand is being further increased by the rising popularity of low-alcohol, flavoured, and craft draught beers as well as advancements in cold-chain logistics and tap systems. Major sporting and social events, as well as the expansion of tourism, are important factors in the rise in draught beer consumption.

However, the market size faces several restraints. Pubs' high operating costs, which include electricity, rent, and personnel costs, have put pressure on margins and restricted the number of new on-trade openings. Cost issues are exacerbated by rising beer duties, inflation, and changes in the price of raw materials like barley and hops. Draught beer levels may also be limited by a shift in consumer behavior toward packaged beer formats and at-home consuming.

Despite these challenges, the market presents strong opportunities. New growth opportunities are being created by premiumization trends, the increase of craft and locally brewed draught options, and the rising demand for tap beers with little or no alcohol. Over the projection period, the UK draught beer market is anticipated to be further strengthened by technological improvements in smart dispensing systems, environmental initiatives, and developing experiential drinking culture.

Market Segmentation

The United Kingdom draught beer market share is classified into type, category, and end use.

By Type:

On the basis of type, the United Kingdom draught beer market size is categorized into keg beer and cask beer. Among these, the keg beer segment held the majority market share in 2024 and is predicted to grow at a remarkable rate during the predicted period. The widespread availability of keg beer in pubs, bars, and restaurants, as well as its longer shelf life, consistent quality, and convenience of storage and dispensing in comparison to cask beer, are the main factors contributing to its domination. The increased popularity of lager, craft, and premium imported beers, which are typically served in kegs, is further driving category growth

By Category:

Based on category, the United Kingdom draught beer market size is divided into super premium, premium, and regular. Among these, the regular segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. Regular draught beers are widely available, reasonably priced, and consumed in large quantities in pubs, bars, and other hospitality settings, which contributes to their domination. Regular draught beers are commonly selected for everyday social drinking, sporting events, and high-traffic on-trade sites.

By End Use:

The United Kingdom draught beer market size is classified by end use into commercial and home. Among these, the commercial segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. This domination is primarily owing to the strong presence of pubs, taverns, restaurants, hotels, and entertainment facilities, where draught beer is a core feature. The UK’s well-established pub culture, inclination for social and experiential drinking, and higher consumption volumes in on-trade places continue to promote growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom draught beer market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the United Kingdom Draught Beer Market:

- Heineken N.V.

- Anheuser-Busch InBev

- Molson Coors Brewing Company

- Carlsberg A/S

- Heineken N.V.

- Anheuser-Busch InBev (AB InBev)

- Molson Coors Brewing Company

- Carlsberg A/S

- Diageo Plc

- Asahi Group Holdings Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom draught beer market based on the following segments:

United Kingdom Draught Beer Market, By Beer Type

- Keg Beer

- Cask Beer

United Kingdom Draught Beer Market, By Category

- Super Premium

- Premium

- Regular

United Kingdom Draught Beer Market, By End Use

- Commercial

- Home

Frequently Asked Questions (FAQ)

-

1. What is the expected market size of the United Kingdom draught beer market by 2035?The market is projected to grow from USD 11.3 million in 2024 to USD 17.5 million by 2035.

-

2. What is the forecast CAGR of the United Kingdom draught beer market?The market is expected to expand at a CAGR of 4.06% during the forecast period 2025–2035.

-

3. Which end-use segment leads the UK draught beer market?The commercial segment led the market in 2024, supported by the UK’s strong pub culture, hospitality recovery, and higher on-trade consumption levels.

-

4. What are the key drivers of the UK draught beer market?Key drivers include pub and hospitality culture, rising demand for premium and craft beers, government support for pubs, and technological advancements in dispensing systems.

-

5. Who are the major players in the United Kingdom draught beer market?Major players include Heineken N.V., Anheuser-Busch InBev, Molson Coors Brewing Company, Carlsberg A/S, Diageo Plc, and Asahi Group Holdings Ltd.

Need help to buy this report?