United Kingdom Dental Services Market Size, Share, By Service (Human Resources, Accounting, Medical Supplies Procurement), By End Use (Dental Surgeons, Endodontists, General Dentists, and Others), and United Kingdom Dental Services Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Dental Services Market Insights Forecasts to 2035

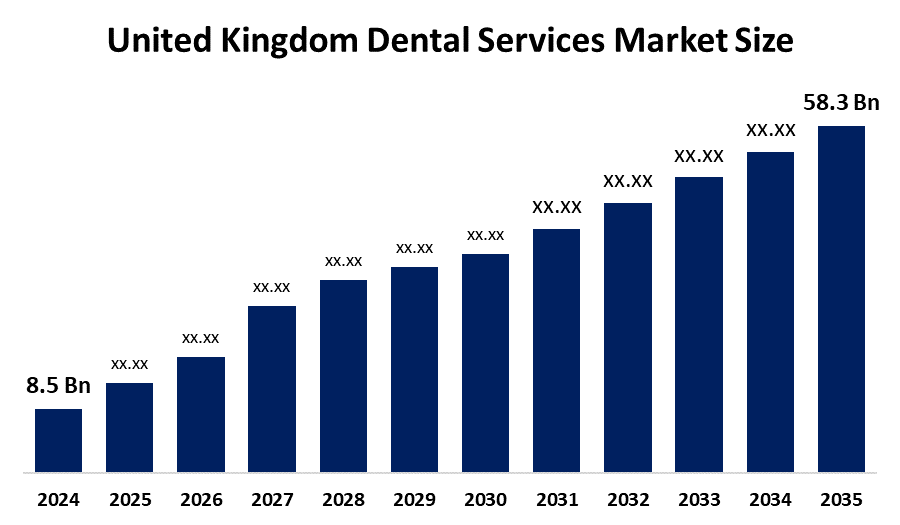

- United Kingdom Dental Services Market Size 2024: USD 8.5 Bn

- United Kingdom Dental Services Market Size 2035: USD 58.3 Bn

- United Kingdom Dental Services Market CAGR: 19.13%

- United Kingdom Dental Services Market Segments: Service and End Use

Get more details on this report -

Increased oral healthcare awareness, an aging population, and increased demand for both preventive and cosmetic dental procedures are all contributing factors to the UK dentistry services market's steady growth. Both private and NHS-funded dental treatments are available in the market; private clinics are becoming more popular as a result of improved treatment options, reduced wait times, and rising consumer demand for aesthetic operations, including orthodontics, implants, and cosmetic restorations.

The UK government plays a key role through the National Health Service NHS which provides subsidized dental care and promotes preventive oral health programs. The demand for dental services is indirectly supported by public initiatives, including sugar reduction plans, smoking cessation programs, and school-based dental health campaigns. The goal of ongoing NHS contract revisions is to increase dentist retention and patient access while bolstering market stability.

The UK's dental care delivery is changing as a result of technological improvements. Intraoral scanners, CADCAM systems, 3D printing, and AI assisted diagnostics are examples of digital dentistry technology that improve treatment accuracy and shorten procedure times. The patient experience, clinical effectiveness, and general quality of dental care services are also being enhanced by the use of tele dentistry, electronic patient records, and minimally invasive procedures.

Market Dynamics of the United Kingdom Dental Services Market:

Growing awareness of oral health and cleanliness, coupled with an aging population and rising rates of dental disorders like cavities, periodontal diseases, and tooth loss, are the main drivers of the UK dental services industry. The market has grown more quickly due to rising demand for cosmetic dentistry operations, such as teeth whitening, orthodontics, and dental implants, especially among younger and working-age populations. Along with technology innovations like digital dentistry, CAD CAM systems, and minimally invasive procedures, the growth of private dental practices is also improving patient results and service quality.

However, the market faces notable restraints. Access to inexpensive dental care is hampered by a lack of NHS dental funding, lengthy wait periods, and a shortage of workers, particularly NHS dentists. Price conscious individuals may be turned off by private dentistry services' high treatment prices, especially for elective and cosmetic operations. Smaller dental practices often face difficulties with operational expenses and regulatory compliance requirements.

The market has significant growth potential in spite of these limitations. Accessibility and patient participation are being enhanced by the growing use of subscription-based dental care plans, tele dentistry technologies, and preventive dentistry. Throughout the projection period, the UK dental services market is anticipated to see profitable growth opportunities due to the rising demand for restorative and aesthetic procedures, investments in digital technologies, and the expansion of private insurance coverage.

United Kingdom Dental Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8.5 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 19.13% |

| 2035 Value Projection: | USD 58.3 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Service, By End Use |

| Companies covered:: | MyDentist,Portman Dental Care,Rodericks Dental Partners,Oasis Dental Care,Smile Together Dental CIC,Smiles Dental,SpaDental Group And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom dental services market share is classified into service and end use.

By Service:

On the basis of the service, the United Kingdom dental services market is categorized into human resources, accounting, and medical supplies procurement. Among these, the medical supplies procurement segment held the largest market share in 2024 and is expected to grow at a remarkable rate over the forecast period. The primary reason for this dominance is the NHS and commercial dental clinics consistent and high demand for dental instruments, consumables, implants, and infection control devices. Consistent procurement activities are also being driven by growing patient traffic, a rise in the use of sophisticated dental procedures, and stringent safety and hygienic regulations.

By End Use:

Based on end use, the United Kingdom dental services market is divided into dental surgeons, endodontists, general dentists, and others. Among these, the general dentists segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. The UK has a large number of general dentists, who serve as the initial point of contact for the majority of people seeking oral treatment, which accounts for their dominance

.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom dental services market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the United Kingdom Dental Services Market:

- MyDentist

- Bupa Dental Bupa Dental Care

- Portman Dental Care

- Rodericks Dental Partners

- Oasis Dental Care

- Smile Together Dental CIC

- Smiles Dental

- SpaDental Group

- Whitecross Dental Care Limited

- Others

Key Target Audience

- Market Players

- Investors

- End users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom dental services market based on the following segments:

United Kingdom Dental Services Market, By Service

- Human Resources

- Accounting

- Medical Supplies Procurement

United Kingdom Dental Services Market, By End Use

- Dental Surgeons

- Endodontists

- General Dentists

- Others

Frequently Asked Questions (FAQ)

-

1. What is the market size of the United Kingdom dental services market in 2024?In 2024, the United Kingdom Dental Services Market is valued at USD 8.5 billion.

-

2. What is the projected market size by 2035?The market is expected to reach USD 58.3 billion by 2035, driven by rising demand for dental care services and technological advancements.

-

3. What is the expected CAGR of the UK dental services market during the forecast period?The market is projected to grow at a CAGR of 19.13% during the forecast period 2025–2035.

-

4. Which factors are driving the growth of the United Kingdom dental services market?Key growth drivers include increasing oral health awareness, an aging population, rising demand for cosmetic and restorative dentistry, expansion of private dental clinics, and advancements in digital dentistry technologies.

-

5. How does government support influence the dental services market in the UK?The UK government, through the NHS, supports the market by providing subsidized dental care, promoting preventive oral health programs, and implementing public health initiatives such as sugar reduction and smoking cessation campaigns.

Need help to buy this report?