United Kingdom Cooktop Market Size, Share, By Type (Electric Cooktops, Gas Cooktops, and Induction Cooktops), By Installation (Built-in, Freestanding), By Application (Residential, Commercial), United Kingdom Cooktop Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited Kingdom Cooktop Market Insights Forecasts to 2035

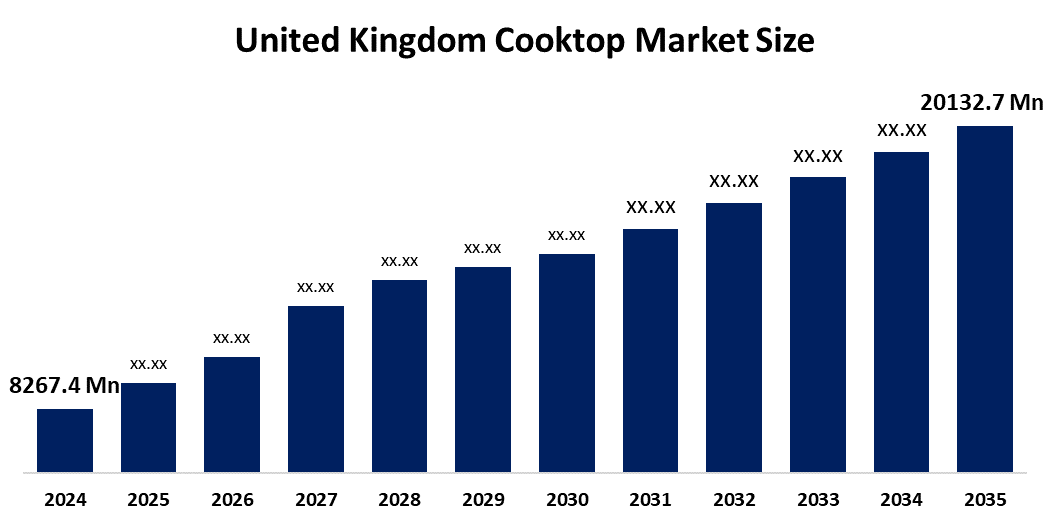

- United Kingdom Cooktop Market Size 2024: USD 8267.4 Million

- United Kingdom Cooktop Market Size 2035: USD 20132.7 Million

- United Kingdom Cooktop Market CAGR 2024: 8.43%

- United Kingdom Cooktop Market Segments: Type, Installation, and Application.

Get more details on this report -

The United Kingdom cooktop market is a rapidly changing and developing the required area of the kitchen appliances market, including the gas, electric, induction, and combined cooktops. The market is moving from traditional heating technologies to the energy-efficient, induction-based, and smart-enabled cooktops due to the urbanization, smaller kitchens, and changing cooking behaviours. There is increase in demand for quick cooking, temperature control, enhanced safety functions, and connectivity with smart home systems is transforming innovation in products. Moreover, the increasing need for energy-efficient products, the preference for low-carbon appliances, the increasing penetration of online retail, and competition from local, global, and private-label brands are fueling the growth of the market in the UK.

The United Kingdom cooktop market is experiencing a steady growth rate due to the increase in adoption of induction and electric cooktops, kitchen renovations with modern designs, and the growing demand for energy-efficient cooking solutions. Here the consumers are increasingly focusing on the safety, temperature control, and faster cooking times. The emerging trends include the smart and connected cooktops, built-in and modular cooktops, and low-emission appliances that support net-zero targets. There is an increasing adoption of technology such as touch interfaces, IoT, and sensors. The development of e-commerce platforms, omnichannel retailing, and high-end products is enhancing market accessibility, and government programs for energy efficiency and home electrification are supporting market growth despite the intense competition and pressure on prices.

United Kingdom Cooktop Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8267.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.43% |

| 2035 Value Projection: | USD 20132.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Installation, By Application |

| Companies covered:: | BSH Hausgerate GmbH, Whirlpool Corporation, Electrolux AB, Haier Smart Home, Smeg S.p.A, Samsung Electromics, Rangemaster, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Market Dynamics of the United Kingdom Cooktop Market

The UK cooktop market is being fueled by rising incomes in households, growing urban apartment living, and the trend towards modern, energy-efficient kitchens. The rising preference for induction and electric cooktops is driven by consumer demands for faster cooking, improved safety, and reduced carbon emissions. The market is transforming from traditional appliance retailing to smart, built-in, and integrated cooktop solutions, fueled by strong growth in online appliance platforms, digital product comparisons, and support services. The government’s focus on home electrification, energy efficiency, and sustainability goals is encouraging innovation, foreign direct investment, and collaborative efforts, making the UK an important player in the global cooktop value chain.

The United Kingdom cooktop market faces challenges including intense price pressure from low-cost imported gas and electric models, rising component, energy, and logistics costs, and strict compliance with UK energy efficiency, safety, and emissions regulations.

The future of the United Kingdom cooktop market looks bright and promising, which is driven by an innovation, the growing need for home-cooked meals, and the changing lifestyle in urban areas. Opportunities are arising in the areas of induction and electric cooktops, smart and connected cooking solutions, and high-end built-in cooktop designs with a focus on safety and energy efficiency. Innovation in digital manufacturing, automation, sensor control, and AI-based cooking assistance is improving the performance and customization of cooktops. At the same time, the growing use of e-commerce, direct-to-consumer sales, and digital marketing is improving market reach and efficiency in the UK cooktop market.

Market Segmentation

The United Kingdom cooktop market share is classified into type, installation, and application.

By Type

The United Kingdom cooktop market is divided by type into electric cooktops, gas cooktops, and induction cooktops. Among these, the electric cooktops segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because the UK is transitioning away from fossil fuels, with recommendations for new homes to use electric induction hobs instead of gas to reduce carbon footprints.

By Installation

The United Kingdom cooktop market is divided by installation into built-in, freestanding. Among these, the built-in segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because the built-in units are ideal for smaller kitchens, which are common in urban UK, as they free up floor space and integrate directly into cabinetry.

By Application

The United Kingdom cooktop market is divided by application into residential, commercial. Among these, the residential segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because of the increasing urbanization and a high volume of home renovations in the UK drive demand for new, built-in appliances.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom cooktop market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom Cooktop Market

- BSH Hausgerate GmbH

- Whirlpool Corporation

- Electrolux AB

- Haier Smart Home

- Smeg S.p.A

- Samsung Electromics

- Rangemaster

- Others

Recent Developments in United Kingdom Cooktop Market

In January 2025, Stoves launched refreshed Richmond and Richmond Deluxe range cookers in the UK, offering induction, dual fuel, and electric options with integrated AirFry technology, delivering healthier cooking and up to 30% faster performance than conventional ovens.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom cooktop market based on the below-mentioned segments:

United Kingdom Cooktop Market, By Type

- Electric Cooktops

- Gas Cooktops

- Induction Cooktops

United Kingdom Cooktop Market, By Installation

- Built-in

- Freestanding

United Kingdom Cooktop Market, By Application

- Residential

- Commercial

Frequently Asked Questions (FAQ)

-

Q: What is the United Kingdom cooktop market size?A: United Kingdom cooktop market is expected to grow from USD 8267.4 million in 2024 to USD 20132.7 million by 2035, growing at a CAGR of 8.43% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by rising incomes in households, growing urban apartment living, and the trend towards modern, energy-efficient kitchens.

-

Q: What factors restrain the United Kingdom cooktop market?A: Constraints include including intense price pressure from low-cost imported gas and electric models, rising component, energy, and logistics costs, and strict compliance with UK energy efficiency, safety, and emissions regulations.

-

Q: How is the market segmented by type?A: The market is segmented into electric cooktops, gas cooktops, and induction cooktops.

-

Q: Who are the key players in the United Kingdom cooktop market?A: Key companies include BSH Hausgerate GmbH, Whirlpool Corporation, Electrolux AB, Haier Smart Home, Smeg S.p.A, Samsung Electromics, Rangemaster, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?