United Kingdom Cement Market Size, Share, By Type (Portland, Blended, and Others), By Application (Residential and Non-Residential), United Kingdom Cement Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited Kingdom Cement Market Size Insights Forecasts to 2035

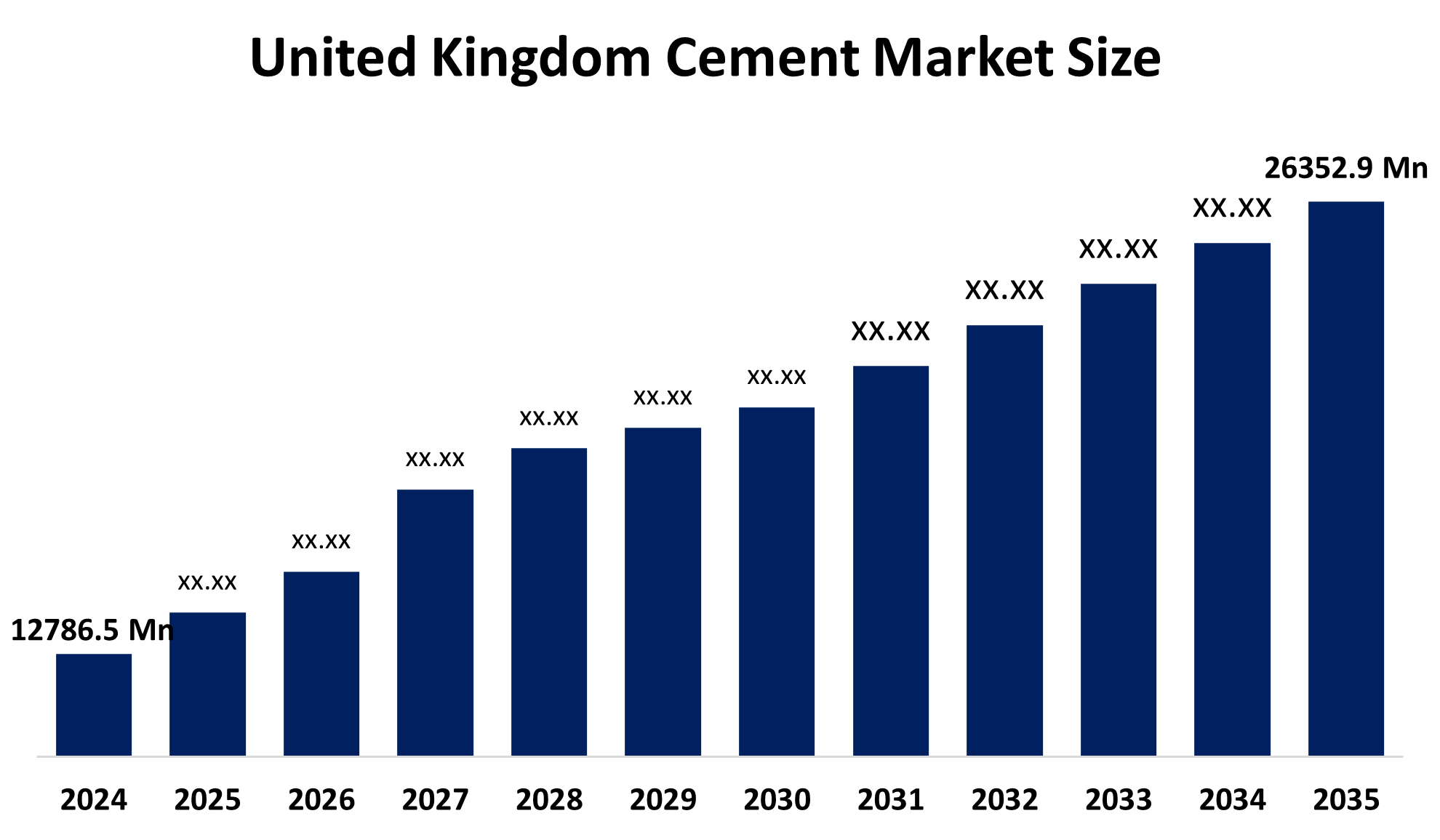

- United Kingdom Cement Market Size 2024: USD 12786.5Mn

- United Kingdom Cement Market Size 2035: USD 26352.9Mn

- United Kingdom Cement Market CAGR 2024: 6.8%

- United Kingdom Cement Market Segments: Type and Application

Get more details on this report -

The United Kingdom Cement Market Size is world’s largest, and is historically driven by massive infrastructure and the real estate booms, consumption of cement for massive infrastructure, urban renewal, and building projects, but it is transitioning from pure volume growth to quality, efficiency, and the low carbon innovations, focusing on the blended cements and the consolidation to address the past overcapacity and the strict environmental goals which is driven by the policy and urbanization. This market is mature, colossal industry undergoing a significant strategic pivot towards sustainable high quality production to align with the national decarbonisation and development goals.

The Network Charging Compensation (NCC) Scheme supports UK energy-intensive industries, including the cement sector, by compensating a portion of electricity network charges. The scheme helps align UK power costs with major European economies, improving competitiveness and reducing the risk of carbon leakage from domestic cement manufacturing.

United Kingdom Cement Market Size goes through a transition from steadier to rapid growth, with more sustainable expansion, driven by the government infrastructure spending for the highways and the green energy, urbanisation and a push towards green sector, despite past overcapacity and a cooling property sector now it is focusing on efficiency, consolidation, and eco-friendly products like the blended cement.

Market Dynamics of the United Kingdom Cement Market:

The United Kingdom Cement Market Size is driven by the massive government backed infrastructure projects like the transport and public utilities, ongoing urbanisation, real estate demand, and the industrial expansion, with growing emphasis on the sustainability, efficiency and the consolidation to manage the overcapacity and meet the environmental targets. The key factor includes fixed investments, GDP growth and the policies supporting the green production through the market and faces challenges from excess capacity. The rising urban population increase demand for the housing, malls, and the other urban amenities. In addition, United Kingdom’s cement market is increasingly shaped by policy driven sustainability efforts and efforts to rationalize a historical oversupplied industry.

The United Kingdom Cement Market Size is restrained by the slowdown in the real-estate sector, persistent over capacity, and increasingly strict environmental regulation. The United Kingdom’s commitment to reducing the carbon neutrality has resulted in stricter environmental regulation and the expansion of the carbon emission trading scheme to include the cement sector too.

United Kingdom Cement Market Size future opportunities lie in the green cement, digital and smart manufacturing, consolidation exports, and the specialized products which are driven by the government decarbonisation goals, new infrastructure and demand for sustainable construction, despite slowing the domestic demand for the property slump, the future success for the cement market means shifting from sheer volume to quality, innovation, and meeting stricter, environmental standards especially in modular standards.

United Kingdom Cement Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12786.5 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.8% |

| 2035 Value Projection: | USD 26352.9 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Cemex UK, Hanson Cement, Tarmac, Holcim UK, Breedon Group, and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom cement market share is classified into type and application.

By Type

The United Kingdom Cement Market Size is divided by type into Portland, blended, and others. Among these, the blended segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to the large-scale infrastructure projects and the government's emphasis on energy efficiency.

By Application

The United Kingdom Cement Market Size is divided by application into residential and non-residential. Among these, the non-residential segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is due to the government which plays a pivotal role, with major initiatives and stimulus packages specifically targeting infrastructure development to spur economic growth and support key industries.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom Cement Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom Cement Market

- Cemex UK

- Hanson Cement

- Tarmac

- Holcim UK

- Breedon Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom Cement Market Size based on the below-mentioned segments:

United Kingdom Cement Market, By Type

- Portland

- Blended

- Others

United Kingdom Cement Market, By Application

- Residential

- Non-Residential

Frequently Asked Questions (FAQ)

-

Q: What is the United Kingdom cement market size?A: United Kingdom cement market is expected to grow from USD 12786.5 million in 2024 to USD 26352.9 million by 2035, growing at a CAGR of 6.8% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the massive government backed infrastructure projects like the transport and public utilities, ongoing urbanisation, real estate demand, and the industrial expansion, with growing emphasis on the sustainability, efficiency and the consolidation to manage the overcapacity and meet the environmental targets.

-

Q: What factors restrain the United Kingdom cement market?A: Constraints includes the slowdown in the real-estate sector, persistent over capacity, and increasingly strict environmental regulation.

-

Q: How is the market segmented by type?A: The market is segmented into Portland, blended, and others.

-

Q: Who are the key players in the United Kingdom cement market?A: Key companies include Cemex UK, Hanson Cement (Heidelberg Materials), Tarmac (CRH plc), Holcim UK, Breedon Group, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?