United Kingdom Cell Line Development Market Size, Share, By Product and Service (Accessories and Consumables, Reagents and Media, Equipment, Bioreactors, Storage Equipment, Automated Systems, Centrifuges, and Others), By Type (Hybridomas, Continuous Cell Lines, Primary Cell Lines, Recombinant Cell Lines), By Application (Tissue Engineering and Regenerative Medicine, Bioproduction, Drug Discovery, Toxicity Testing, and Others), and United Kingdom Cell Line Development Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Cell Line Development Market Insights Forecasts to 2035

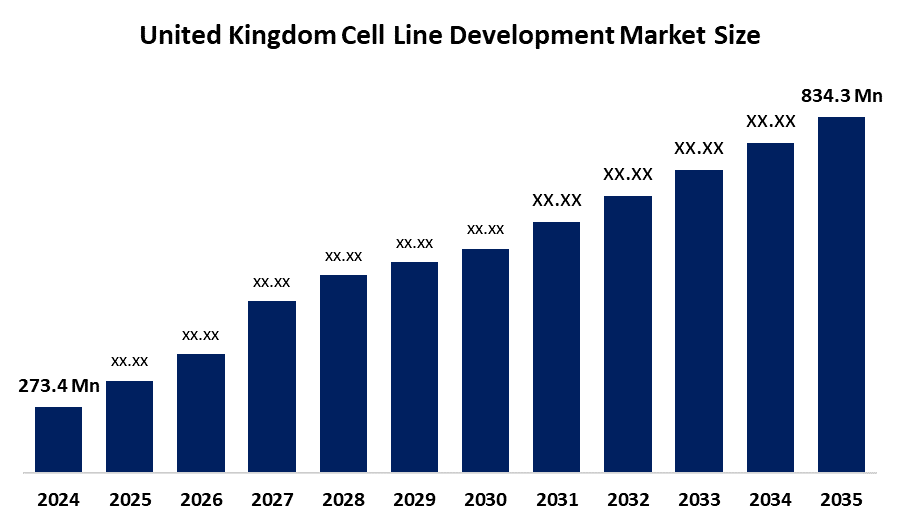

- United Kingdom Cell Line Development Market Size 2024: USD 273.4 Mn

- United Kingdom Cell Line Development Market Size 2035: USD 834.3 Mn

- United Kingdom Cell Line Development Market CAGR: 10.67%

- United Kingdom Cell Line Development Market Segments: Product and Service, Type, and Application

Get more details on this report -

The United Kingdom cell line development market is gaining momentum as the biopharmaceutical and biotechnology sectors expand rapidly. The increased production of biologics, vaccines, biosimilars, and cutting-edge treatments, including cell and gene therapies, is driving a strong demand for high-quality cell lines, according to market data. Growth is supported by strong research activity across pharmaceutical companies, research institutes, and contract development and manufacturing organizations (CDMOs) in the UK, which are increasingly investing in scalable platforms and development services.

The Life Sciences Vision, financial incentives for biotech research, and targeted assistance for advanced therapy medical products (ATMPs) are just a few of the initiatives the UK government has launched to bolster the life sciences ecosystem. The goal of policies promoting infrastructure investment and R&D tax credits is to establish the UK as a global center for biologics and medicinal innovation. Government agencies, research councils, and industry stakeholders collaborate to further improve the sector's capabilities.

Technological advancement is a major market enabler. Innovations in genetic engineering tools, high-throughput screening, automation, and advanced bioprocessing platforms are improving the efficiency, reproducibility, and scalability of cell line development. Clone selection and process workflows are optimized by integrating AI and machine learning, and timeframes are accelerated by automated and high-content systems. The UK market is positioned for future expansion and worldwide competitiveness thanks to these developments.

United Kingdom Cell Line Development Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 273.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 10.67 % |

| 2035 Value Projection: | USD 834.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 154 |

| Companies covered:: | Oxford Biomedica, RoslinCT, Horizon Discovery (Revvity), Sphere Bio, Dolomite Bio, Quell Therapeutics, Amphista Therapeutics, AstraZeneca, GlaxoSmithKline (GSK), Barinthus Biotherapeutics, Ludger Ltd., Adaptimmune, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the United Kingdom Cell Line Development Market:

The biopharmaceutical and biotechnology industries' explosive growth is propelling the UK cell line development market's continuous rise. One of the key drivers is the growing need for biologics, biosimilars, vaccines, and cell and gene therapies, all of which significantly depend on reliable and scalable cell lines. Increased outsourcing to contract development and manufacturing organizations (CDMOs) and robust R&D activity, bolstered by academic institutions and industrial partnerships, are driving market expansion. Furthermore, cell line production is becoming more productive, stable, and efficient because of developments in genetic engineering technologies like CRISPR and recombinant DNA procedures.

Despite these positive factors, the market faces several restraints. Adoption may be hampered by expensive development costs, lengthy development times, and the difficulty of creating stable, high-yield cell lines, especially for small and medium-sized businesses. Strict quality, safety, and compliance regulations can make operations more difficult.

However, there are many opportunities in the market. Customized cell lines are in high demand due to the increased emphasis on personalized medicine and cutting-edge therapies like CAR-T and stem cell-based treatments. Cell line development service providers in the UK should see new growth opportunities as a result of increased investment in biologics manufacturing capacity and government and commercial financing for life sciences innovation.

Market Segmentation

The United Kingdom cell line development market share is classified into product and service, type, and application.

By Product and Service:

On the basis of product and service, the United Kingdom cell line development market is categorized into accessories and consumables, reagents and media, equipment, bioreactors, storage equipment, automated systems, centrifuges, and others. Among these, the reagents and media segment held the largest market share in 2024 and is expected to grow at a remarkable rate over the forecast period. This dominance is attributed to the continuous and high-volume usage of cell culture media, sera, buffers, and reagents throughout cell line development workflows, coupled with rising demand for biologics, biosimilars, and cell and gene therapies.

By Type:

Based on type, the United Kingdom cell line development market is divided into hybridomas, continuous cell lines, primary cell lines, and recombinant cell lines. Among these, the recombinant cell lines segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. The growing need for recombinant proteins, monoclonal antibodies, vaccines, and sophisticated biologics, as well as the extensive use of genetically modified cell lines for high yield, scalability, and reliable product quality, are the main drivers of this expansion.

By Application:

The United Kingdom cell line development market is classified by application into tissue engineering and regenerative medicine, bioproduction, drug discovery, toxicity testing, and others. Among these, the bioproduction segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The production of biologics, monoclonal antibodies, vaccines, and biosimilars is increasing, and outsourcing to contract development and manufacturing organizations (CDMOs) is also contributing to this expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom cell line development market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the United Kingdom Cell Line Development Market:

- Oxford Biomedica

- RoslinCT

- Horizon Discovery (Revvity)

- Sphere Bio

- Dolomite Bio

- Quell Therapeutics

- Amphista Therapeutics

- AstraZeneca

- GlaxoSmithKline (GSK)

- Barinthus Biotherapeutics

- Ludger Ltd.

- Adaptimmune

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035.Spherical Insights has segmented the United Kingdom cell line development market based on the following segments:

United Kingdom Cell Line Development Market, By Product and Service

- Accessories and Consumables

- Reagents and Media

- Equipment

- Bioreactors

- Storage Equipment

- Automated Systems

- Centrifuges,

- Others

United Kingdom Cell Line Development Market, By Type

- Hybridomas

- Continuous Cell Lines

- Primary Cell Lines

- Recombinant Cell Lines

United Kingdom Cell Line Development Market, By Application

- Tissue Engineering and Regenerative Medicine

- Bioproduction

- Drug Discovery

- Toxicity Testing

- Others

Frequently Asked Questions (FAQ)

-

1. What is the projected United Kingdom cell line development market size and growth rate?The market is expected to grow from USD 273.4 million in 2024 to USD 834.3 million by 2035, registering a CAGR of 10.67% during the forecast period 2025 to 2035.

-

2. What factors are driving the growth of the United Kingdom cell line development market?Key drivers include the rising demand for biologics, biosimilars, vaccines, and cell & gene therapies, strong biopharmaceutical R&D activity, increasing outsourcing to CDMOs, and advancements in genetic engineering technologies.

-

3. How does the UK government support this United Kingdom cell line development market?Government initiatives such as the Life Sciences Vision, R&D tax credits, and support for ATMPs promote innovation, infrastructure development, and global competitiveness.

-

4. What opportunities exist in the United Kingdom cell line development market?Opportunities lie in personalized medicine, CAR-T therapies, stem cell treatments, and increased investment in biologics manufacturing and life sciences innovation across the United Kingdom.

Need help to buy this report?