United Kingdom Carotenoids Market Size, Share, By Source (Natural, Synthetic) By Product (BetaCarotene, Lutein, Lycopene, Astaxanthin, Zeaxanthin, Canthaxanthin, and Others), By Application (Food, Supplements, Feed, Pharmaceuticals, and Cosmetics), United Kingdom Carotenoids Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited Kingdom Carotenoids Market Insights Forecasts to 2035

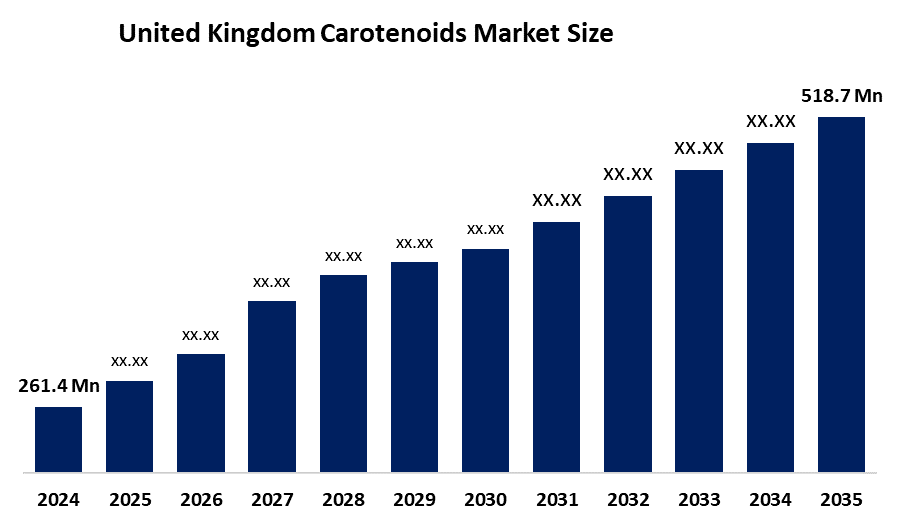

- United Kingdom Carotenoids Market Size 2024: USD 261.4 Mn

- United Kingdom Carotenoids Market Size 2035: USD 518.7 Mn

- United Kingdom Carotenoids Market CAGR 2024: 6.43%

- United Kingdom Carotenoids Market Segments: Source, Product and Application

Get more details on this report -

The UK carotenoids market refers to the commercial ecosystem involved in the production, distribution, and the sale of natural and synthetic carotenoid pigments such as betacarotene, lutein, astaxanthin, and lycopene across the United Kingdom. These compounds are primarily used as natural colorants, nutritional fortifiers, and antioxidants in applications including food and beverages, dietary supplements, animal feed, and personal care cosmetics. There is a shift towards a natural sourcing which is occurring despite the lower cost of the synthetic alternatives. A major switch is observed towards the clean label product, where the manufacturers are eliminating the additives like silicon dioxide in the favor of the natural concentrated juices and also the plant extracts

The UK Carotenoid Market is expected to grow in response to the continued evolution of legislation related to sustainability, technological developments in the production of high-purity and engineered carotenoid products as well as demand from industries using carotenoids. Major end-use applications for carotenoids, Food & Beverage Health & Wellness, Nutraceuticals & Dietary Supplements Animal Feed Health, Colouration & Cosmetics and Personal Care continue to grow due to improving regulatory frameworks that promote environmentally sustainable practices and Traceable Products. Additionally, using bio-based production techniques, enzymatic synthesis and fermentation-based specialty carotenoid products have been established in recent years, enabling the creation of distinct product offerings with improved performance.

Market Dynamics of the United Kingdom Carotenoids Market

The United Kingdom carotenoids market is driven by strong demand across food & beverage, dietary supplements, animal feed, cosmetics, and pharmaceuticals continues to propel the UK’s carotenoids market forward, with government-backed sustainability programmes, clean label regulations, and innovative tax incentives further supporting this growth. Research and Development continues to build new and innovative high-purity and engineered carotenoids to replace traditional natural colorants with valuable functional and specialty products. Enhanced adoption of bio-based and recyclable manufacturing processes coupled with ongoing efforts to enhance stability, bioavailability, and efficiency creates even greater consumer demand. The UK has shifted from being a traditional source of imported carotenoid ingredients to becoming a regional centre of excellence for advanced carotenoid technology and sustainable manufacturing.

The United Kingdom carotenoids market faces restraints including high production and processing costs, volatility in raw material and biomass feedstock prices, and a continued dependence on imports for specialty and high-purity carotenoids. Stringent environmental, food safety, and sustainability regulations, limited domestic large-scale carotenoid manufacturing capacity, and intense global competition.

The outlook for the carotenoids industry in the UK looks very good. There are developments coming out of technological advancements within biotechnology. Companies are benefitting from policies that promote the use of sustainable and clean label ingredients from the government as well as growing industrial demand for the product. There are also many opportunities for growth in the near future through engineered and high purity carotenoids, fermentation and specialty applications for food/drink fortification, nutraceuticals/animal feed/cosmetics and pharmaceuticals. Finally, advances in smart manufacturing, process automation, precision fermentation, and digitized systems for quality control will increase the efficiency of production, regulatory compliance and product consistency. These developments will also continue to strengthen the ecosystem of natural and specialty bioactive compounds in the UK.

United Kingdom Carotenoids Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 261.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.43% |

| 2035 Value Projection: | USD 518.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | BASF SE, DSM-Firmenich, Kemin Industries, Chr. Hansen, LycoreD, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom carotenoids market share is classified into source, product and application.

By Source

The United Kingdom carotenoids market is divided by source into natural, synthetic. Among these, the synthetic segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because it offers high purity, consistent performance, and a longer, more predictable shelf-life compared to natural sources, which are often affected by environmental factors.

By Product

The United Kingdom carotenoids market is divided by product into betacarotene, lutein, lycopene, astaxanthin, zeaxanthin, canthaxanthin, and others. Among these, the betacarotene segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is due to the widespread awareness of its health benefits and the use of it in a food colouring and also as a nutrient.

By Application

The United Kingdom carotenoids market is divided by application into food, supplements, feed, pharmaceuticals, and cosmetics. Among these, the catalyst segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because of the increasing consumer awareness of the antioxidant, immune-boosting, and anti-aging properties of carotenoids has increased their usage in functional foods and fortified products.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom carotenoids market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom Carotenoids Market

- BASF SE

- DSM-Firmenich

- Kemin Industries

- Chr. Hansen

- LycoreD

- Others

Recent Developments in United Kingdom Carotenoids Market

In July 2024, Lycored launched ResilientRed BF, a lycopene-based natural colorant designed for clean-label applications in UHT dairy, plant-based beverages, and meat alternatives, reinforcing innovation and growth within the global carotenoids market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the United Kingdom carotenoids market based on the below-mentioned segments:

United Kingdom Carotenoids Market, By Product

- BetaCarotene

- Lutein

- Lycopene

- Astaxanthin

- Zeaxanthin

- Canthaxanthin

- Others

United Kingdom Carotenoids Market, By Source

- Natural

- Synthetic

United Kingdom Carotenoids Market, By Application

- Food

- Supplements

- Feed

- Pharmaceuticals

- Cosmetics

- Others.

Frequently Asked Questions (FAQ)

-

Q: What is the United Kingdom carotenoids market size?A: United Kingdom carotenoids market is expected to grow from USD 261.4 million in 2024 to USD 518.7 million by 2035, growing at a CAGR of 6.43% during the forecast period 2025-2035.

-

Q: How is the market segmented by product?A: The market is segmented into natural, synthetic.

-

Q: Who are the key players in the United Kingdom carotenoids market?A: Key companies include, BASF SE, DSM-Firmenich, Kemin Industries, Chr. Hansen, LycoreD¸ and Others

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?