United Kingdom Cancer and Tumor Biomarker-Based Assay Market Size, Share, By Cancer Type (Breast, Lung, Colorectal, Prostate, Ovarian, and Others), By Biomarker Type (Genetic, Protein, Epigenetic, and Others), By End Use (Hospitals and Cancer Centers, Diagnostic Laboratories, and Others), and United Kingdom Cancer and Tumor Biomarker-Based Assay Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Cancer and Tumor Biomarker-Based Assay Market Insights Forecasts to 2035

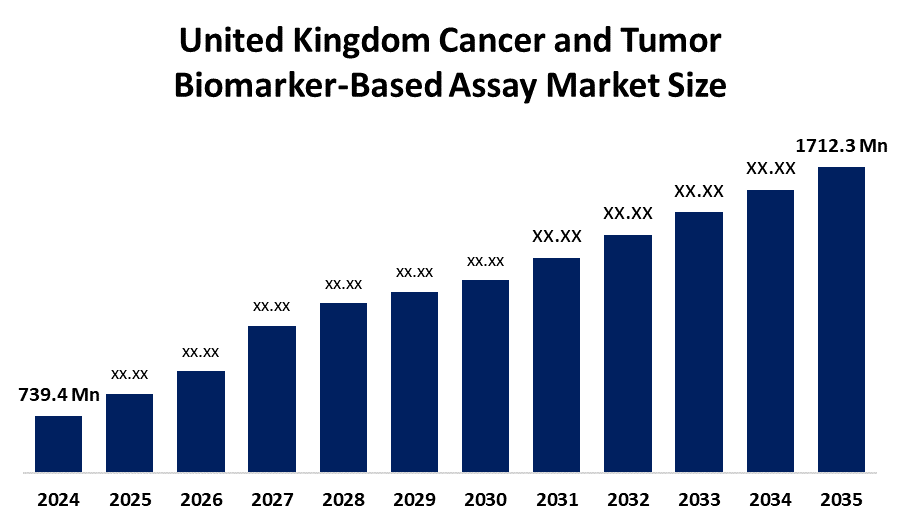

- United Kingdom Cancer and Tumor Biomarker-Based Assay Market Size 2024: USD 739.4 Mn

- United Kingdom Cancer and Tumor Biomarker-Based Assay Market Size 2035: USD 1712.3 Mn

- United Kingdom Cancer and Tumor Biomarker-Based Assay Market CAGR: 7.93%

- United Kingdom Cancer and Tumor Biomarker-Based Assay Market Segments: Cancer Type, Biomarker Type, and End Use.

Get more details on this report -

The growing cancer burden and the growing demand for precise, early-stage diagnostics nationwide are driving the UK's cancer and tumor biomarker-based assay market. Healthcare professionals are depending more and more on biomarker-based assays to enhance diagnosis, prognosis, and treatment monitoring because cancer is still one of the top causes of death in the UK. Biomarker-based testing is becoming an essential part of clinical workflows as oncology care moves toward value-based and outcome-driven models, creating a sustained market demand among hospitals, diagnostic labs, and research institutes.

Government initiatives play a pivotal role. By actively supporting cancer detection and biomarker research through NIHR and UKRI, the UK government and NHS are encouraging innovation and clinical validation of new assays. These initiatives include digital pathology data networks, early diagnosis, and immunotherapy biomarker programs. National genomic medicine initiatives, like the NHS Genomic Medicine Service, facilitate the roll-out of liquid biopsies that expedite diagnosis and direct tailored treatment while standardizing access to genomic profiling.

Next-generation sequencing (NGS), liquid biopsies, AI-assisted diagnostics, and multiplex assay platforms are examples of technological advancements that benefit the market. These technologies enhance sensitivity, shorten turnaround times, and enable comprehensive biomarker panels, thereby increasing clinical utility and bolstering precision oncology.

United Kingdom Cancer and Tumor Biomarker-Based Assay Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 739.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 7.93% |

| 2035 Value Projection: | USD 1712.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 199 |

| Tables, Charts & Figures: | 162 |

| Segments covered: | By Cancer Type,By Biomarker Type,By End Use |

| Companies covered:: | F. Hoffmann-La Roche Ltd Thermo Fisher Scientific Inc. Illumina Inc. QIAGEN N.V. Guardant Health Inc. Exact Sciences Corporation Bio-Rad Laboratories Inc Agilent Technologies Inc. Sysmex Corporation Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the United Kingdom Cancer and Tumor Biomarker-Based Assay Market:

The growing incidence of cancer, the need for prompt and precise diagnosis, and the expanding use of precision medicine are the main factors propelling the UK market for cancer and tumor biomarker-based assays. The widespread use of biomarker-based assays in treatment selection, prognosis, and disease monitoring has significantly improved clinical outcomes, encouraging adoption across hospitals and diagnostic laboratories. Further propelling market expansion are robust government backing, nationwide screening initiatives, and developments in liquid biopsy, next-generation sequencing (NGS), and molecular diagnostics technologies.

However, the market is constrained by several factors, such as the high expense of sophisticated biomarker assays and equipment, which may restrict accessibility, particularly in smaller medical facilities. Variability in assay standardization across laboratories and reimbursement challenges within the UK healthcare system hinder broader adoption. High testing costs and the need for specialized expertise for data interpretation also limit uptake in certain settings.

Expanding liquid biopsy applications, partnering with pharmaceutical companies on companion diagnostics, and using AI and digital analytics to improve clinical utility and result interpretation are all areas with significant potential. The market will continue to grow through the mid-2030s due to national equality initiatives to standardize access across regions and an increase in biomarker testing for clinical trials.

Market Segmentation

The United Kingdom cancer and tumor biomarker-based assay market share is classified into cancer type, biomarker type, and end use.

By Cancer Type:

By cancer type, the United Kingdom cancer and tumor biomarker-based assay market is categorized into breast, lung, colorectal, prostate, ovarian, and others. Among these, the breast segment held the largest market share in 2024 and is expected to grow at a remarkable rate over the forecast period. The high frequency of breast cancer in the UK and effective national screening programs are the main factors driving the segment's dominance.

By Biomarker Type:

Based on biomarker type, the United Kingdom cancer and tumor biomarker-based assay market is divided into genetic, protein, epigenetic, and others. Among these, the genetic segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. Genetic biomarkers are particularly helpful in oncology diagnostics because they are frequently employed for accurate molecular profiling, early cancer identification, and tailored therapy selection. For these reasons, this category leads.

By End Use:

The United Kingdom cancer and tumor biomarker-based assay market is classified by end use into hospitals and cancer centers, diagnostic laboratories, and others. Among these, the hospitals and cancer centers segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The increased adoption of integrated biomarker assays in clinical workflows is due to institutions serving as the main hubs for cancer diagnosis, treatment planning, and monitoring.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom cancer and tumor biomarker-based assay market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the United Kingdom Cancer and Tumor Biomarker-Based Assay Market:

- F. Hoffmann-La Roche Ltd

- Thermo Fisher Scientific Inc.

- Illumina Inc.

- QIAGEN N.V.

- Guardant Health Inc.

- Exact Sciences Corporation

- Bio-Rad Laboratories Inc

- Agilent Technologies Inc.

- Sysmex Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035.Spherical Insights has segmented the United Kingdom cancer and tumor biomarker-based assay market based on the following segments

United Kingdom Cancer and Tumor Biomarker-Based Assay Market, By Cancer Type

- Breast

- Lung

- Colorectal

- Prostate

- Ovarian

- Others

United Kingdom Cancer and Tumor Biomarker-Based Assay Market, By Biomarker Type

- Genetic

- Protein

- Epigenetic

- Others

United Kingdom Cancer and Tumor Biomarker-Based Assay Market, By End Use

- Hospitals and Cancer Centers

- Diagnostic Laboratories

- Others

Frequently Asked Questions (FAQ)

-

1. What is a cancer and tumor biomarker-based assay?A cancer and tumor biomarker-based assay is a diagnostic test used to detect specific biological markers such as genes, proteins, or epigenetic changes associated with cancer. These assays support early diagnosis, treatment selection, prognosis, and disease monitoring.

-

2. What is the market size of the United Kingdom cancer and tumor biomarker-based assay market?The market was valued at USD 739.4 million in 2024 and is projected to reach USD 1,712.3 million by 2035, growing at a CAGR of 7.93% during the forecast period 2025–2035.

-

3. What factors are driving market growth?Key drivers include rising cancer incidence, increasing adoption of precision medicine, government support for genomic testing, and advancements in NGS and liquid biopsy technologies.

-

4. Who are the major players in the market?4. Who are the major players in the market?

Need help to buy this report?