United Kingdom Blood Testing Market Size, Share, By Test Type (Glucose Testing, Lipid Panel Testing, Prostate Specific Antigen Testing, Blood Urea Nitrogen Testing, Thyroid Stimulating Hormone Testing, and Others), By Method (Automated, Manual), By End Use (Hospitals and Clinics, Diagnostic Centers, Remote Testing, and Others), and United Kingdom Blood Testing Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Blood Testing Market Size Insights Forecasts To 2035

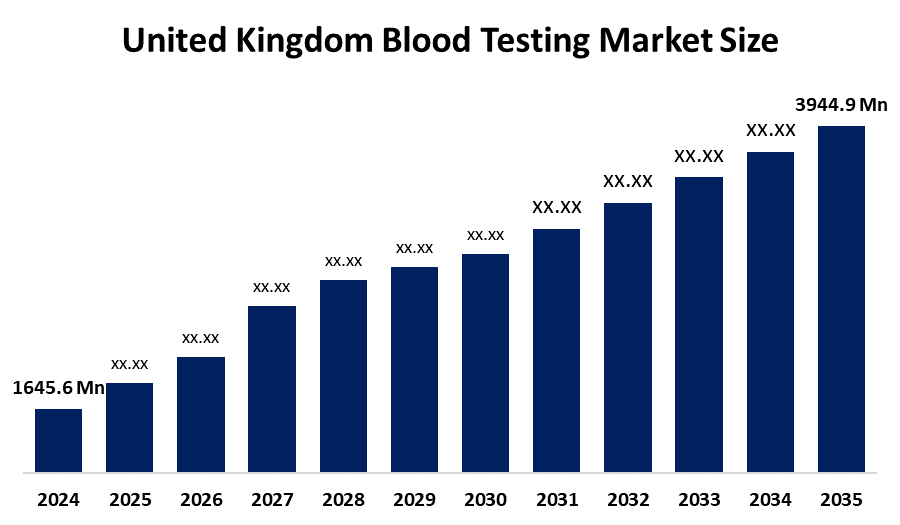

- United Kingdom Blood Testing Market Size 2024: USD 1645.6 Mn

- United Kingdom Blood Testing Market Size 2035: USD 3944.9 Mn

- United Kingdom Blood Testing Market Size CAGR: 8.27%

- United Kingdom Blood Testing Market Size Segments: Test Type, Method, And End Use

Get more details on this report -

The United Kingdom blood testing market size is the ecosystem of services, technology, and products involved in the collection, analysis, and interpretation of blood samples for medical diagnosis, disease monitoring, and preventative healthcare across the UK. To manage chronic disorders, identify infections, screen for cancer, and evaluate general health, blood testing is a fundamental component of clinical decision-making. The market provides both routine and customized assays to NHS hospitals, private clinics, diagnostic labs, and remote or at-home testing providers.

Government programs are essential to the expansion of the market size. Increased funding for pathology and diagnostics has resulted from the UK government's emphasis on early diagnosis and preventative care through the NHS Long Term Plan. The creation of Community Diagnostic Centers (CDCs) is intended to improve patient outcomes, decrease waiting times, and provide access to blood testing outside of hospitals. Furthermore, regulatory frameworks guarantee safety and data protection while promoting innovation.

Widespread adoption of automated and high-throughput analysers, integration of AI and digital pathology systems, and expansion of remote and at-home blood testing kits are enhancing efficiency, accuracy, and patient convenience. Advances in biomarker-based and tailored diagnostics are also enabling earlier disease identification, putting blood testing as a cornerstone of modern UK healthcare.

United Kingdom Blood Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1645.6 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 8.27% |

| 2023 Value Projection: | USD 3944.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Test Type, By Method |

| Companies covered:: | Quest Diagnostics, LabCorp (Laboratory Corporation of America), Sonic Healthcare / Sonic Healthcare UK, SYNLAB UK & Ireland / Synnovis, The Doctors Laboratory (TDL), Medichecks, Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Bio-Rad Laboratories, EKF Diagnostics, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the United Kingdom Blood Testing Market:

The United Kingdom blood testing market size is driven by several strong factors. The increasing incidence of chronic illnesses, including diabetes, heart disease, cancer, and thyroid disorders, which necessitate regular blood testing for diagnosis and monitoring, is a major contributing factor. Additionally, the aging population, greater focus on preventive healthcare, and increased adoption of automated and high-throughput diagnostic technologies across NHS and commercial laboratories are propelling market expansion. Demand is also supported by government programs to increase community diagnostics and update pathology services.

However, there are some limitations on the market. High costs associated with modern diagnostic equipment, maintenance, and qualified manpower shortages can hinder uptake, particularly in smaller laboratories. Regulatory complexity, data protection concerns, and occasional operational challenges within centralized NHS pathology networks may further limit market efficiency and slow service delivery.

Despite these obstacles, there are plenty of chances. Patient access to diagnostics is changing due to the quick expansion of at-home and remote blood testing, which is facilitated by telemedicine and digital health platforms. Strong growth potential is presented by developments in biomarker-based and tailored testing, including early illness identification using blood-based assays. Furthermore, increased private sector participation, public–private collaborations, and investment in AI-enabled diagnostics are likely to generate new avenues for innovation and expansion in the UK blood testing market over the projection period.

Market Segmentation

The United Kingdom blood testing market share is classified into test type, method, and end use.

By Test Type:

On the basis of test type, the United Kingdom blood testing market size is categorized into glucose testing, lipid panel testing, prostate-specific antigen testing, blood urea nitrogen testing, thyroid-stimulating hormone testing, and others. Among these, the glucose testing segment held the majority market share in 2024 and is predicted to grow at a remarkable rate during the predicted period. This dominance is driven by the high prevalence of diabetes and pre-diabetes in the UK, routine monitoring needs, and broad adoption of point-of-care and at-home glucose testing, reinforced by NHS screening programs and increased preventive healthcare awareness.

By Method

Based on the method, the United Kingdom blood testing market size is divided into automated and manual. Among these, the automated segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. The increased use of high-throughput laboratory analyzers, enhanced accuracy and reproducibility, quicker turnaround times, and decreased reliance on manual labour are all responsible for this growth. In addition, the growth of centralized NHS pathology networks, increased test volumes, and advancements in AI-enabled and integrated diagnostic platforms are further shaping the trend toward automated blood testing across the UK.

By End Use:

The United Kingdom blood testing market size is classified by end use into hospitals and clinics, diagnostic centers, remote testing, and others. Among these, the hospitals and clinics segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The large number of routine and specialized blood tests performed in hospital settings, the heavy reliance on NHS hospital laboratories, and the availability of sophisticated diagnostic infrastructure and automated testing systems are the main factors contributing to this dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom blood testing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the United Kingdom Blood Testing Market:

- Quest Diagnostics

- LabCorp (Laboratory Corporation of America)

- Sonic Healthcare / Sonic Healthcare UK

- SYNLAB UK & Ireland / Synnovis

- The Doctors Laboratory (TDL)

- Medichecks

- Abbott Laboratories

- Roche Diagnostics

- Siemens Healthineers

- Bio-Rad Laboratories

- EKF Diagnostics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom blood testing market based on the following segments:

United Kingdom Blood Testing Market, By Test Type

- Glucose Testing

- Lipid Panel Testing

- Prostate Specific Antigen Testing

- Blood Urea Nitrogen Testing

- Thyroid Stimulating Hormone Testing

- Others

United Kingdom Blood Testing Market, By Method

- Automated

- Manual

United Kingdom Blood Testing Market, By End Use

- Hospitals and Clinics

- Diagnostic Centers

- Remote Testing

- Others

Frequently Asked Questions (FAQ)

-

1. What is the market size of the United Kingdom blood testing market?The market was valued at USD 1,645.6 million in 2024 and is projected to reach USD 3,944.9 million by 2035, growing at a CAGR of 8.27% during the forecast period (2025–2035).

-

2. What factors are driving the growth of the UK blood testing market?Key growth drivers include the rising prevalence of chronic diseases, an aging population, increased focus on preventive healthcare, advancements in automated and AI-enabled diagnostics, and strong government initiatives such as Community Diagnostic Centres (CDCs).

-

3. Which test type dominates the UK blood testing market?Glucose testing dominated the market in 2024 due to the high incidence of diabetes and pre-diabetes, routine monitoring requirements, and widespread use of point-of-care and at-home testing solutions.

-

4. What are the key challenges faced by the market?Major challenges include high costs of advanced diagnostic equipment, skilled workforce shortages, regulatory complexities, and operational inefficiencies in centralized pathology networks.

-

5. Who are the major players in the UK blood testing market?Leading companies include Quest Diagnostics, LabCorp, Sonic Healthcare, SYNLAB/Synnovis, The Doctors Laboratory (TDL), Medichecks, Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Bio-Rad Laboratories, and EKF Diagnostics.

Need help to buy this report?