United Kingdom Beef Market Size, Share, By Product Type (Loin, Chuck, Round, Brisket, Rib, and Others), By Cut Type (Ground Beef, Steaks, Roasts, Cubed, and Others), By Distribution Channel (Supermarket and Hypermarket, Retail Store, Wholesaler, E-Commerce), and United Kingdom Beef Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesUnited Kingdom Beef Market Insights Forecasts to 2035

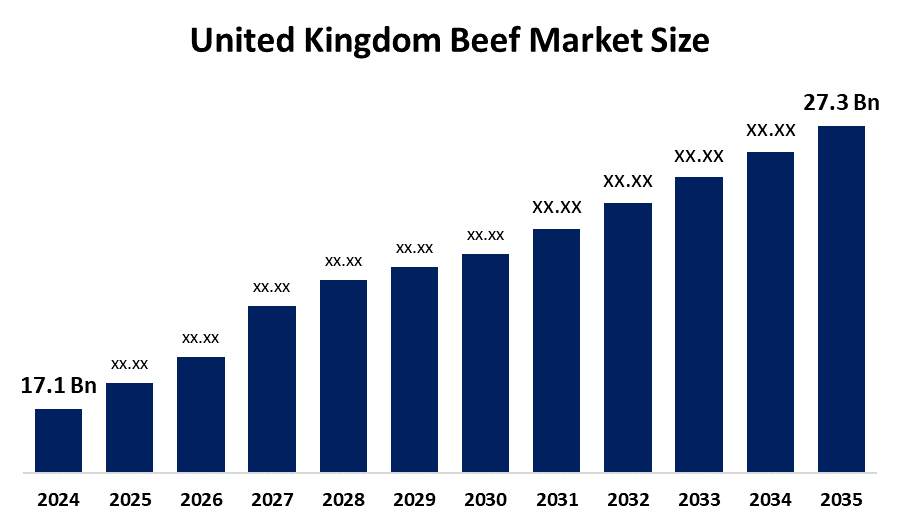

- United Kingdom Beef Market Size 2024: USD 17.1 Bn

- United Kingdom Beef Market Size 2035: USD 27.3 Bn

- United Kingdom Beef Market CAGR: 4.34%

- United Kingdom Beef Market Segments: Product Type, Cut Type, and Distribution Channel

Get more details on this report -

The United Kingdom beef market remains a vital segment of the broader UK meat and protein industry, balancing domestic production with considerable imports to meet national demand. Declining herd sizes and increasing production costs have put pressure on domestic beef production, resulting in a supply gap that the nation is expected to need to close in order to become self-sufficient by 2030. Additionally, the market is driven by value and variety due to the ongoing customer demand for premium beef products across retail and foodservice channels.

Government and industry initiatives are shaping the sector’s future. The National Farmers' Union (NFU) has unveiled a 10-year strategy that would use industry engagement and cooperative policies to improve producer profitability, fortify supply networks, and advance sustainability in beef farming. To further enhance farm-level procedures and animal welfare standards, programs like the Red Tractor Beef & Lamb Standards are also being examined.

On the technology front, UK beef production is increasingly embracing innovation. Data analytics, digital twins, and machine learning are used in projects such as the AI-powered "Beef Twin" program to increase feed efficiency, lower greenhouse gas emissions, and enhance animal health. Meanwhile, to improve product provenance and supply chain transparency, industry partnerships are testing DNA-based tracking solutions.

United Kingdom Beef Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 17.1 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.34% |

| 2035 Value Projection: | USD 27.3 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 239 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type,By Cut Type,By Distribution Channel |

| Companies covered:: | ABP Food Group, Dunbia, Hilton Food Group, Cranswick plc, Tulip Ltd, Kepak Group, Lloyd Maunder,and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the United Kingdom Beef Market:

The United Kingdom beef market is shaped by a combination of supply–demand fundamentals, consumer preferences, economic pressures, and trade patterns. The market is primarily driven by consumer preference for beef products such as ground beef, steaks, and premium cuts, as well as the growing need for high-quality, protein-rich nourishment. Process, packaging, and cold-chain logistics innovations all contribute to improved product quality and shelf life, which increases consumer appeal.

However, the market is constrained by tight domestic supply and high production costs. The UK's domestic beef production is expected to fall as a result of fewer cattle, lower producer profitability, and smaller herd sizes, all of which drive up beef prices and restrict supply. Increased reliance on imports and growing retail prices have resulted from this, which has slowed volume growth and might cause budget-conscious consumers to choose less expensive proteins.

The development of traceability systems that satisfy growing consumer demands for transparency and animal welfare, the expansion of sustainable and ethically produced beef segments, and the use of e-commerce and direct-to-consumer channels present important potential. Producers who use regenerative agricultural techniques and market specialty, premium, and grass-fed beef products are in a good position to take advantage of specialized growth markets.

Market Segmentation

The United Kingdom beef market share is classified into product type, cut type, and distribution channel

By Product Type:

By product type, the United Kingdom beef market is categorized into loin, chuck, round, brisket, rib, and others. Among these, the loin segment held the largest market share in 2024 and is expected to grow at a remarkable rate over the forecast period. Premium and tender beef cuts are highly preferred by consumers, especially for steaks and high-end foodservice applications, which is what is driving this supremacy. The desire for high-quality meat products, the growing popularity of dining out, and rising disposable incomes have all contributed to the expansion.

By Cut Type:

Based on cut type, the United Kingdom beef market is divided into ground beef, steaks, roasts, cubed, and others. Among these, the ground beef segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. The strong performance of this segment is primarily driven by its affordability, versatility, and widespread use in household cooking as well as in foodservice applications such as burgers, ready meals, and quick-service restaurants.

By Distribution Channel:

The United Kingdom beef market is classified by distribution channel into supermarket and hypermarket, retail, wholesaler, and e-commerce. Among these, the supermarket and hypermarket segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The extensive availability of beef products, competitive prices, robust private-label selections, and well-established cold-chain infrastructure across large retail chains are the main drivers of this supremacy.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom beef market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the United Kingdom Beef Market:

- ABP Food Group

- Dunbia

- Hilton Food Group

- Cranswick plc

- Tulip Ltd

- Kepak Group

- Lloyd Maunder

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom beef market based on the following segments:

United Kingdom Beef Market, By Product Type

- Loin

- Chuck

- Round

- Brisket

- Rib

- Others

United Kingdom Beef Market, By Cut Type

- Ground Beef

- Steaks

- Roasts

- Cubed

- Others

United Kingdom Beef Market, By Distribution Channel

- Supermarket and Hypermarket

- Retail Store

- Wholesaler

- E-Commerce

Frequently Asked Questions (FAQ)

-

1. What is the projected market size of the United Kingdom beef market by 2035?The United Kingdom beef market is projected to reach USD 27.3 billion by 2035, growing at a CAGR of 4.34% during the forecast period 2025–2035.

-

2. What are the key growth drivers of the United Kingdom beef market?Key drivers include rising demand for protein-rich diets, preference for premium beef products, advancements in processing and packaging, and growth in organized retail.

-

3. Who are the major players in the United Kingdom beef market?Major companies include ABP Food Group, Dunbia, Hilton Food Group, Cranswick plc, Kepak Group, and Tulip Ltd.

-

4. How does technology support United Kingdom beef market growth?Technological innovations such as AI-driven farm management, DNA traceability, precision feeding systems, and digital supply chain monitoring are improving efficiency, transparency, and productivity across the beef value chain.

Need help to buy this report?